Weizhi Holdings (01305.HK) Hong Kong Stock Hot Stock Analysis

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

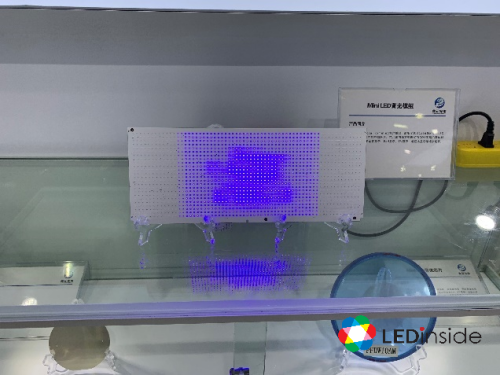

Weizhi Holdings (01305.HK) made it to the Hong Kong Stock Surge List of East Money App on December 3, 2025 [0]. Key driving factors include: 1) Extreme undervaluation: As of December 1, 2025, its total market capitalization was approximately HK$145 million, while its 2024 cash reserves exceeded HK$527 million [1], with the market cap being only one-third of net cash, indicating strong potential for valuation repair; 2) Strong growth in core business: The LED backlight business (accounting for 92.3% of total revenue) saw a 22.6% YoY growth in H1 2025, and its global market share of automotive-grade LED backlight modules reached 15% [1]; 3) Institutional partnership empowerment: The company reached a cooperation with CICC Strategic Emerging Industries Venture Capital, receiving an investment intent of RMB 30-50 million, which will be used for technology R&D and expansion into emerging markets [1].

- Valuation repair is the core short-term logic: The huge gap between the company’s market cap and cash reserves has attracted short-term investors’ attention, which may drive short-term stock price fluctuations [1].

- Long-term value of automotive-grade LED business: The global automotive LED backlight module market is in a high-growth phase, and the company’s 15% market share supports future performance improvement [1].

- Liquidity risk needs vigilance: The company’s stock has thin trading volume; long-term sluggish stock price performance may lead to increased volatility, so market manipulation risks should be noted [1].

- Liquidity risk: Thin trading volume makes the stock price prone to large fluctuations due to capital influences [1].

- Insufficient appeal to long-term investors: The company has never paid dividends, which may make it difficult to attract investors seeking stable returns [1].

- Related-party transaction risk: The acquisition of industrial land held by the spouse of the major shareholder in September 2025 (a related-party transaction) may raise concerns about interest transfer [1].

- Valuation repair opportunity: The huge gap between market cap and net cash provides room for valuation repair [1].

- Growth dividend from LED industry: The continuous growth of the LED backlight industry, especially in the automotive sector, will drive the development of the company’s core business [1].

- Institutional partnership empowerment: The investment intent from CICC Strategic Emerging Industries Venture Capital will provide financial support for the company’s technological innovation and market expansion [1].

Weizhi Holdings (01305.HK) became a hot Hong Kong stock mainly due to extreme undervaluation and business growth expectations. Investors should pay attention to changes in the company’s trading volume, the overall market trend of the LED industry, and company announcements (such as performance releases, capital operation plans, etc.). This analysis is based on public data and market dynamics and does not constitute investment advice.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.