NUKK (Nukkleus Inc.) Reddit Buzz: Catalysts & Trading Levels Analysis

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

This analysis is based on a Reddit post [0] and supporting market data [0], highlighting $NUKK (Nukkleus Inc.) in aerospace and defense [0] as a potential trading opportunity. Key catalysts include:

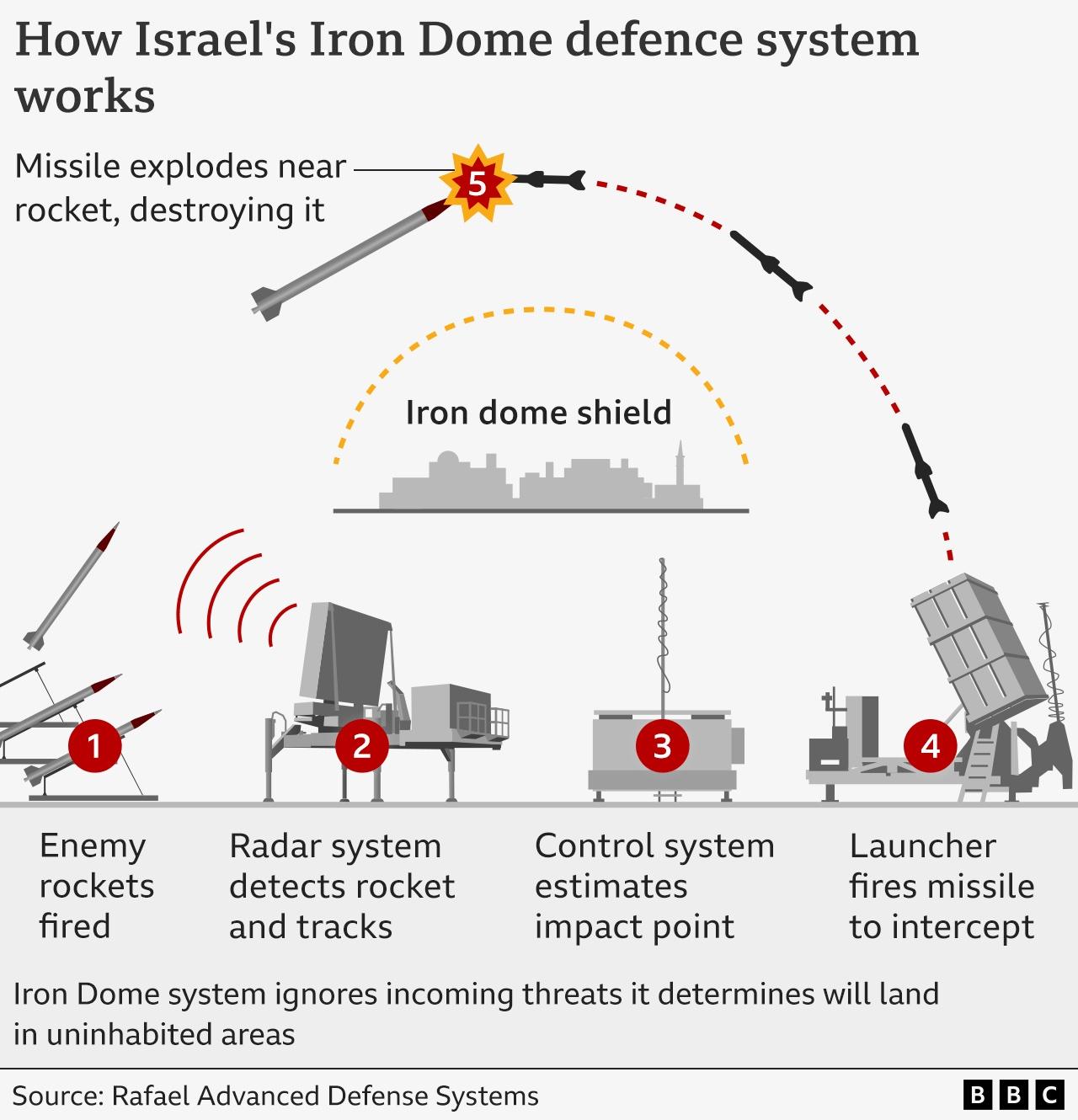

- Dec. 16 Shareholder Vote: Nukkleus seeks to fully acquire Star26 Capital (current 51% stake), whose subsidiary Rimon supplies Iron Dome generators. Iron Dome recently received an $8.7B funding boost [3].

- SPAC IPO Closure: A Nukkleus-sponsored SPAC closed a $172.5M IPO on Nov. 28, 2025, strengthening capital [1].

- Historical Surge: In December 2024, Nukkleus’ 51% Star26 acquisition drove the stock from $1.39 to $67.77 (+4,775%) in 3 days [4], fueling retail speculation of a repeat.

Price analysis shows a post-October bottom at $4.05 [0], with current trading at $6.04—nearing the Reddit-cited $7 breakout threshold. Volume on Dec. 3 was 2.22M shares (slightly below the 2.42M 30-day average) [0], with 20-day volatility of 9.16% [0] indicating high price swings.

- Historical Precedent Drives Sentiment: The 2024 4,775% surge is the primary driver of Reddit buzz, though past performance does not guarantee future results.

- Insider Confidence vs. Current Price: Major shareholder SC Capital II Sponsor LLC purchased 255k shares at $10 on Nov. 28 [5], suggesting long-term confidence despite the current price of $6.04.

- SPAC Capital but Unprofitability: The $172.5M SPAC funds strengthen Nukkleus’ position, but the company remains unprofitable (TTM EPS: -$4.93, P/E: -1.23) [0].

- Sector Tailwinds from Iron Dome: Star26’s Rimon ties to Iron Dome place NUKK in a high-relevance aerospace/defense subsector amid ongoing geopolitical focus.

- Potential approval of the full Star26 acquisition could trigger price momentum.

- SPAC capital supports growth initiatives in the high-demand Iron Dome supply chain.

- Reddit retail interest and technical levels ($7 breakout, $7.50 squeeze trigger) create short-term trading catalysts.

- Extreme volatility (20-day std dev: 9.16% [0]) increases trading risk.

- Unprofitability and negative fundamentals may limit long-term sustainability.

- No guarantee the 2024 price surge will repeat, as market conditions differ.

- Micro-cap status ($100.54M market cap [0]) makes the stock susceptible to manipulative trading.

- Ticker: NUKK (NASDAQ) |Sector: Aerospace and Defense

- Current Price: $6.04 |Market Cap: $100.54M [0]

- Key Catalysts: Dec. 16 Star26 full acquisition vote, $172.5M SPAC IPO, Iron Dome funding boost

- Trading Levels to Watch: Support ($4.05), Resistance ($7), Short Squeeze Trigger ($7.50)

This summary provides informational context for decision-making and is not investment advice.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.