Analysis of Trump’s Tariff-Funded $2k Check Proposal and Its Challenges

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

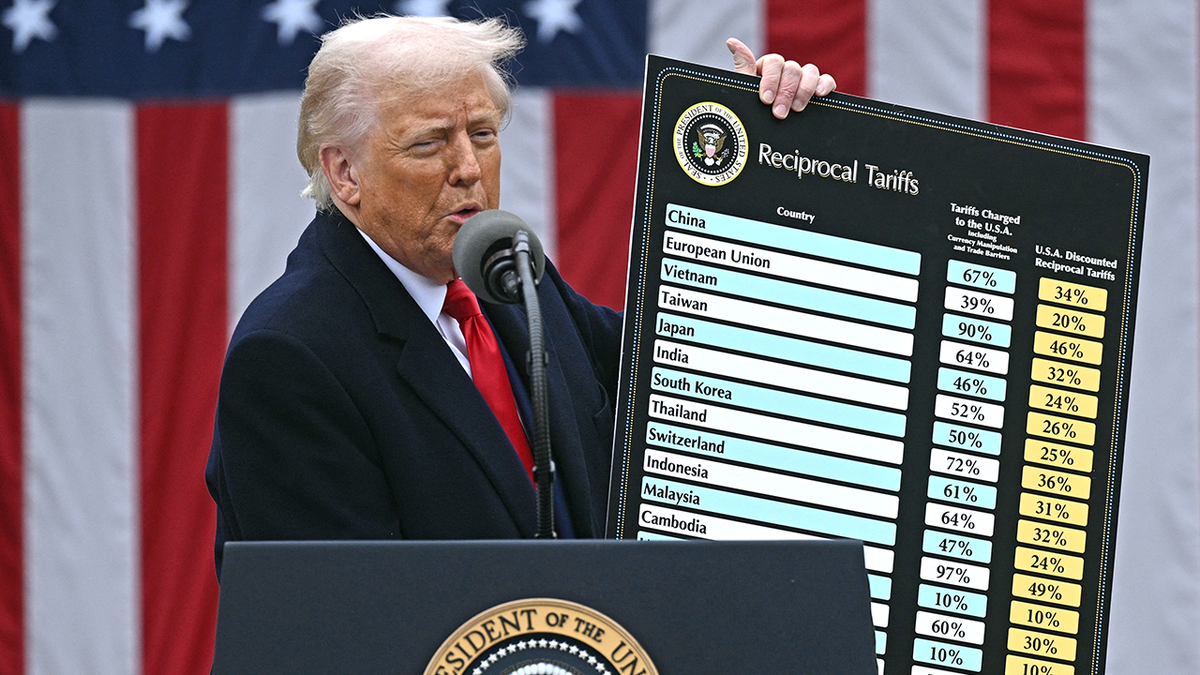

On December 2, 2025, President Donald Trump announced a proposal to distribute $2,000 “tariff dividend” checks to most Americans, funded by tariff revenues, while also claiming tariffs could reduce the national debt and eliminate income taxes [1]. However, the plan faces immediate challenges across political and economic dimensions:

- Proposal Details: Checks are targeted at low-to-middle-income Americans (excluding “high income people”) with a planned distribution in mid-to-late 2026 [2].

- Republican Opposition: Lawmakers like Sen. Bernie Moreno (R-Ohio) reject the proposal, prioritizing tariff revenue allocation toward reducing the $38 trillion national debt instead. Moreno stated the plan “will never pass” Congress [2].

- Fiscal Feasibility Gap: The Tax Foundation (cited by Yahoo News) estimates 2025 tariff revenues at $158.4 billion and 2026 revenues at $207.5 billion. In contrast, the $2,000 check program is projected to cost $279.8–$606.8 billion. Even combining two years of projected revenues ($365.9 billion) falls short of covering the program’s lower cost estimate, leaving no funds for debt reduction or income tax elimination as claimed [2].

- Economic Risks: Fortune estimates Trump’s tariffs could shrink the U.S. economy by nearly 0.4%, reducing long-term tariff revenue potential by over $400 billion. Trump himself previously acknowledged Americans “pay something” for tariffs, as consumer costs rise due to tariff-induced price hikes [3].

- Political Driver and Party Rift: The proposal follows recent Democratic electoral wins where affordability was a key issue, positioning Trump to address consumer pain points. However, this creates a rift within the Republican Party between Trump’s stimulus-focused approach and traditional Republican prioritization of debt reduction [2][3].

- Fiscal Inconsistency: The gap between projected tariff revenues and program costs renders Trump’s core claims (debt reduction, income tax elimination) fiscally unfeasible with the proposed framework. Even a targeted check program would consume a large share of tariff revenues, leaving little for other stated goals [2].

- Consumer Cost Paradox: While the checks are framed as a benefit, the underlying tariffs impose direct costs on American consumers. The estimated 0.4% GDP contraction could reduce household purchasing power beyond the $2,000 check’s value, potentially negating the intended benefit [3].

- Risks:

- Fiscal Strain: A funding gap would require additional borrowing (worsening the national debt) or scaling back the program.

- Economic Contraction: Tariffs could lead to slower job growth and reduced household incomes from the projected 0.4% GDP reduction.

- Legislative Gridlock: Strong Republican opposition in Congress makes the proposal’s passage unlikely [2][3].

- Opportunities:

- Political Resonance: The proposal addresses affordability, a key voter issue, which could resonate with segments of the electorate.

- Policy Precedent: If implemented, it could set a new model for using trade policy revenues for social transfers, though this carries risks of politicizing tariff policy [2].

The analysis synthesizes the following critical non-recommendation insights:

- Trump’s December 2, 2025, proposal aims to distribute $2,000 checks to most Americans using tariff revenues, with additional claims to reduce the national debt and eliminate income taxes [1].

- The plan faces opposition from Republican lawmakers prioritizing debt reduction and skepticism from economists over fiscal feasibility [2][3].

- Projected tariff revenues ($158.4B in 2025, $207.5B in 2026) are insufficient to cover the program’s estimated cost ($279.8–$606.8B) [2].

- Tariffs could shrink the U.S. economy by 0.4%, reducing long-term revenue potential and imposing consumer costs [3].

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.