Analysis of Reddit Trading Discussion: Balancing Win Rate and Risk-Reward Ratios

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

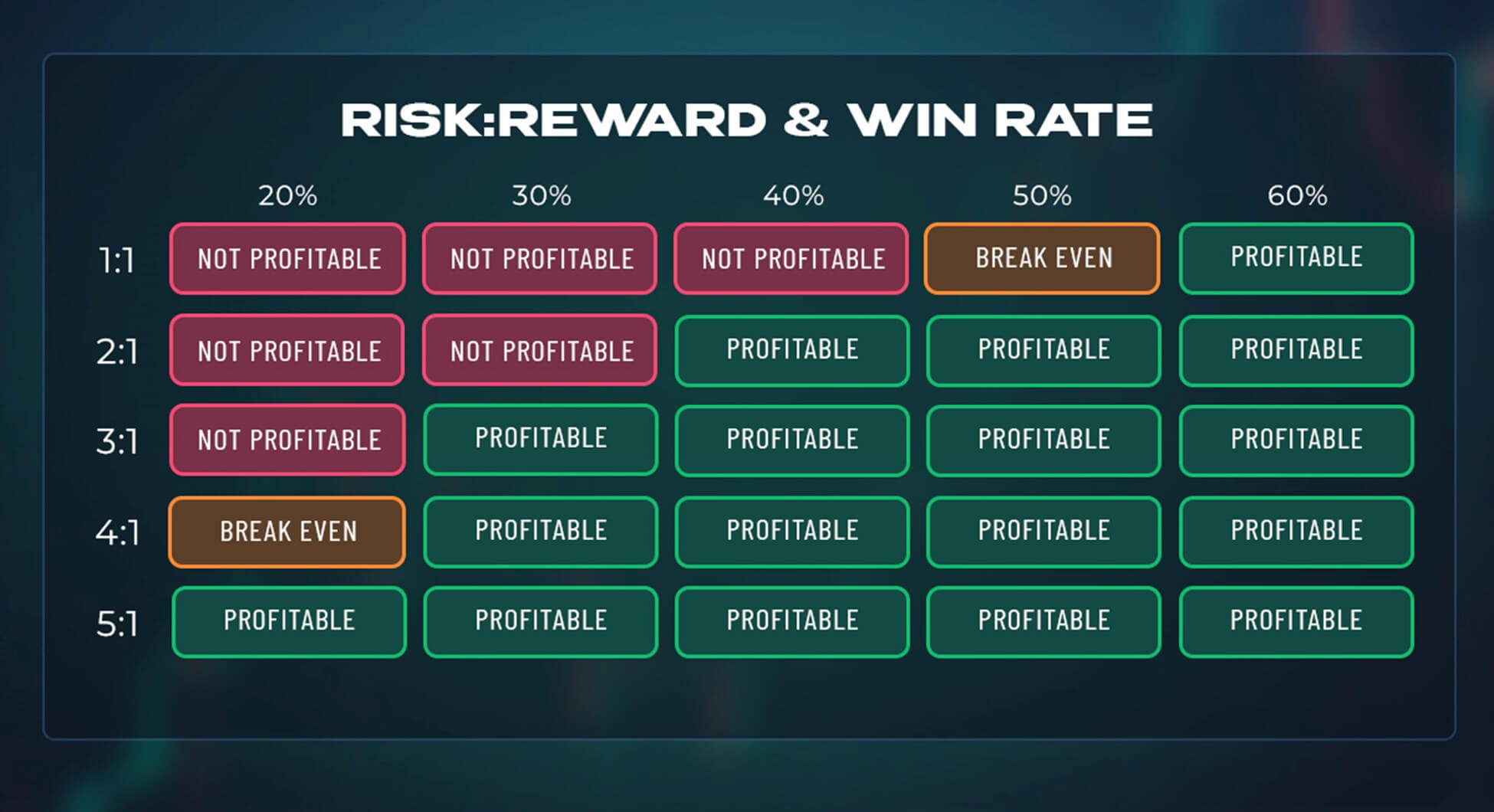

This report examines a 2025-12-02 Reddit thread [0] that asked traders to share insights on balancing high win-rate (e.g., 70%) low R:R strategies and low win-rate (e.g., 30%) high R:R strategies. The discussion revealed five core arguments: (1) high win-rate low R:R strategies are mentally easier due to frequent small wins but less profitable, while low win-rate high R:R strategies offer greater profitability but mental challenges; (2) win rate and R:R emerge from repeatable market behavior, not arbitrary adjustments (tweaking metrics reduces profitability); (3) high win-rate strategies perform best in low volatility (tighter stops), low win-rate strategies in high volatility (wider stops); (4) high R:R reduces the mental toll of losses (small losses relative to wins); and (5) strategies should prioritize expectancy (expected value per trade) and stability across market conditions over isolated metrics.

Investopedia [1] confirms that expectancy—calculated as (win rate × average win) - (loss rate × average loss)—is the critical metric for long-term profitability. For example, a 70% win rate with 1:1 R:R has an expectancy of 0.4, while a 30% win rate with 4:1 R:R has an expectancy of 0.5, showing high R:R can offset low win rates. A Forbes study [2] on crypto traders further supports the psychological impact: volatility and trade outcomes contribute to stress, highlighting the need for strategy fit with emotional tolerance.

- Expectancy bridges quantitative and psychological factors: It combines performance metrics with the behavioral reality that traders must tolerate the strategy’s win/loss frequency and magnitude.

- Volatility dictates strategy effectiveness: Tighter stops (high win rate) work in low volatility, while wider stops (low win rate) avoid premature exits in high volatility, making adaptation critical.

- Arbitrary metric adjustments undermine profitability: Strategies built around market behavior have inherent win rate/R:R profiles; manual tweaks deviate from the “edge” that makes the strategy profitable.

- Risks: Focusing on isolated win rate/R:R (not expectancy) leads to suboptimal long-term performance [1]. Misaligning a strategy with one’s psychological profile increases burnout risk [0][2].

- Opportunities: Educating traders on expectancy and holistic strategy evaluation improves success rates. Adapting strategies to volatility can enhance performance across market conditions.

- Definitions: Win rate (percentage of profitable trades), R:R (profit target/maximum risk per trade), trading expectancy (expected value per trade).

- Trading Edge: A strategy has an edge if its expectancy is positive over a large number of trades.

- No Universal Strategy: Success requires aligning approach with psychological tolerance, market volatility, and focusing on long-term expectancy/stability [0][1].

- Metric Adjustments: Arbitrary changes to win rate/R:R reduce profitability by deviating from market behavior [0].

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.