ETF Flows Reveal Smart Investor Allocations in Tech, Defensive, and International Markets

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

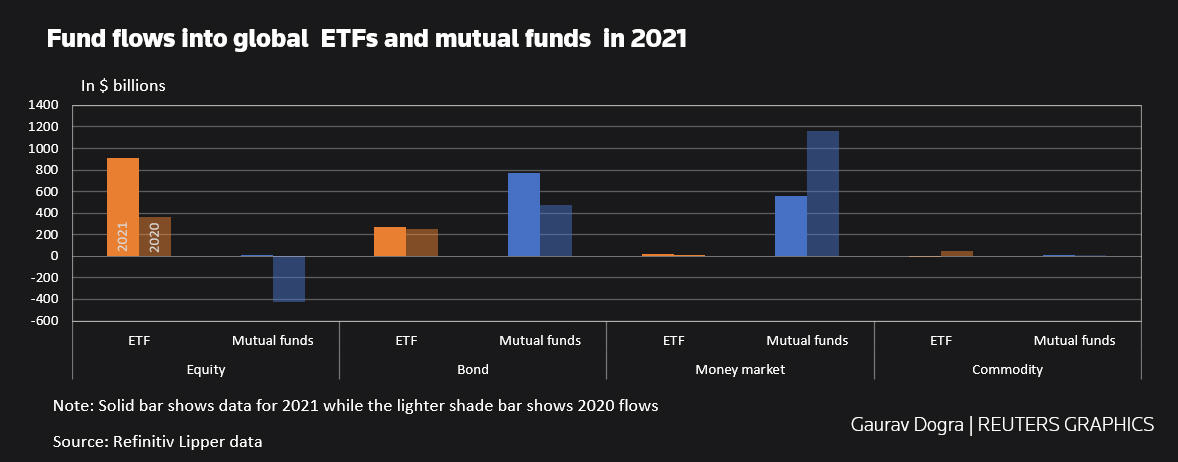

This report is based on a December 2, 2025 YouTube video [4] exploring ETF flow trends and investor capital allocations across mega-cap tech, international, and defensive sectors. Mega-cap tech ETF QQQ (tracking NASDAQ 100) recovered from a -4.24% drop on November 20, 2025, to $621.93 on December 2, with three consecutive positive days and stabilized volume [0]. The defensive Consumer Staples Select Sector SPDR Fund (XLP) also showed steady performance, with positive changes in four of the last five trading days as of December 1 [0]. International equities ETF EFA rose from $91.24 (November 20) to $94.95 (December 2), reflecting investor interest in global markets [0]. A survey of 515 institutional investors found 70% reducing U.S. equity allocations, while 90% and 88% planned to increase/maintain Asia-Pacific and European stocks, respectively [3]. 2025 ETF inflows reached record levels, with global inflows surpassing the U.S. [1], and institutional investors increasingly favoring active ETFs [3].

- Defensive Bull Market Indication: The recovery of growth-focused QQQ alongside steady defensive XLP performance aligns with the video’s “defensive bull market” theme, showing investors balance growth and defensive assets.

- Institutional Portfolio Shift: The significant reallocation from U.S. equities to international markets signals a long-term regional diversification trend.

- ETF Industry Evolution: Record inflows and growing demand for active ETFs reflect increasing adoption of ETFs as core investment vehicles.

- Risks: QQQ’s November volatility highlights mega-cap tech sensitivity to external factors; international exposure carries currency, geopolitical, and regulatory risks; record ETF inflows may lead to fee compression.

- Opportunities: Growth in active ETFs presents manager-driven strategy options; international market expansion offers diversification benefits.

- QQQ: Recovered from $585.67 (Nov 20) to $621.93 (Dec 2), volume stabilized [0].

- XLP: Steady increase from $76.51 (Nov 19) to $78.48 (Dec 2) [0].

- EFA: Rose from $91.24 (Nov 20) to $94.95 (Dec 2) [0].

- Institutional Allocations: 70% reducing U.S. equities; 90% Asia-Pacific, 88% European [3].

- 2025 ETF Inflows: Record global levels surpassing the U.S. [1].

- Active ETFs: Growing institutional demand [3].

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.