SEC's Atkins Proposes Raising Disclosure Thresholds to Revitalize IPO Market

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

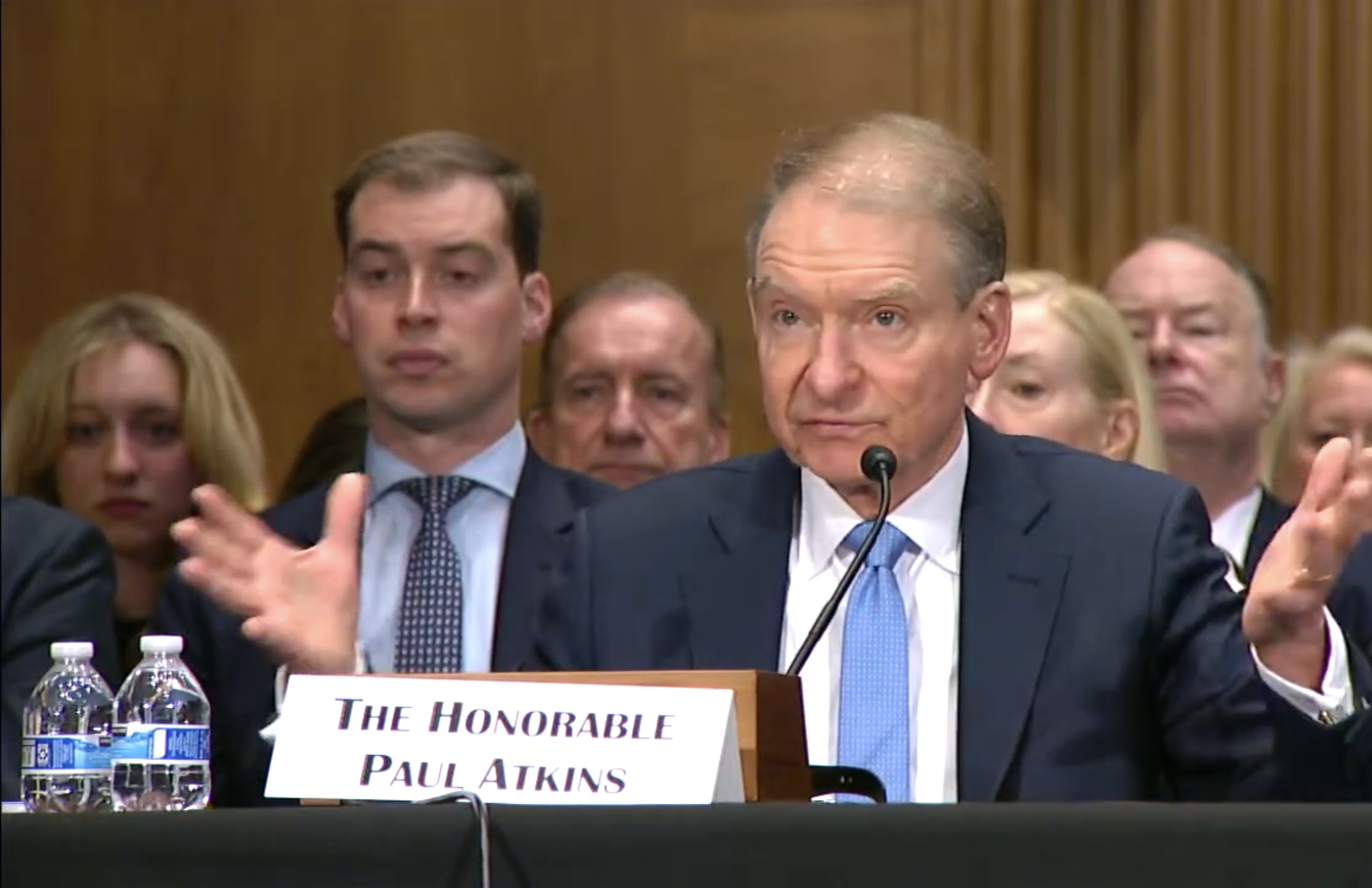

This analysis is based on the Barrons article [1] published on December 2, 2025, which reports that SEC Chairman Paul Atkins proposed raising the size threshold for full disclosure requirements to boost the U.S. IPO market. Detailed in Atkins’ speech at the New York Stock Exchange [2], the proposal addresses the 50% decline in U.S. publicly traded companies since the late 1990s (from ~8,800 to 3,952 by end-2024) [4]. The current threshold of $250 million public float, set in 2005, forces firms of this size to comply with the same disclosure rules as corporations 100 times larger, leading to significant compliance burdens [2].

The proposal would reshape competition: SMBs considering IPOs or recently public would benefit from reduced costs and longer on-ramp periods [2][3]; underwriters and legal/accounting firms face mixed impacts (reduced disclosure-related revenues but potential growth from increased IPO volume) [3]; large public companies remain unaffected; private markets face greater competition for high-growth firms [4].

- Policy Continuity with JOBS Act: The proposal extends the 2012 JOBS Act’s focus on reducing IPO barriers, emphasizing “materiality” to avoid information overload (citing Warren Buffett’s criticism of complex disclosures) [2].

- Broader Reform Agenda: This proposal is part of Atkins’ three-pillar plan (scaled disclosure, depoliticized shareholder meetings, litigation reform) to revitalize IPOs [2][3].

- Private-Public Market Shift: The decline in public companies has strengthened private markets; the proposal could rebalance this by making IPOs more attractive [4].

- Opportunities: Reduced compliance costs for eligible SMBs [2]; increased IPO activity offering investors more diversification [3][4]; enhanced U.S. exchange competitiveness [5].

- Risks: Investor concern over reduced non-material disclosures impacting market confidence [2]; uncertainty in rulemaking speed and threshold magnitude (e.g., $500M vs. $750M) [3]; mixed revenue impacts for underwriters/legal firms [3]; regulatory pushback from investor advocacy groups [2][5].

- Event: SEC Chairman Atkins proposed raising disclosure thresholds for public companies (Dec. 2, 2025) [1][2].

- Current Threshold: $250M public float (2005 reform) [2].

- Rationale: Address regulatory creep and reverse the decline in U.S. publicly traded firms [4].

- Stakeholder Implications:

- Companies: Reduced compliance costs, more attractive IPOs [2][3].

- Investors: Material disclosures guaranteed; non-material information may decrease [2].

- Advisors: Need to adapt to rule changes and increased IPO volume [3].

- Regulators: Must balance capital formation and investor protection [2][5].

- Key Factors: Rulemaking speed, threshold magnitude, investor acceptance, litigation reform progress [2][3][5].

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.