Analysis of Reddit Discussion on Large Disappearing Order Blocks and Spoofing Concerns

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

This analysis is based on a December 2, 2025 (UTC) Reddit discussion [0] where a user observed large order blocks acting as price caps that disappeared entirely, questioning if this was “market makers in action.” The thread featured conflicting views: some attributed the blocks to market maker liquidity provision, while others identified algorithmic spoofing.

Formal market maker functions clarify the distinction: per Investopedia, market makers are legally obligated to quote continuous bid/ask prices and take the other side of trades when no natural counterparty exists—this core role ensures market liquidity [1]. A 2025 academic study confirms market makers accumulate inventory risk by absorbing order imbalances, directly contradicting the Reddit claim that they “don’t take the other side of trades” [2].

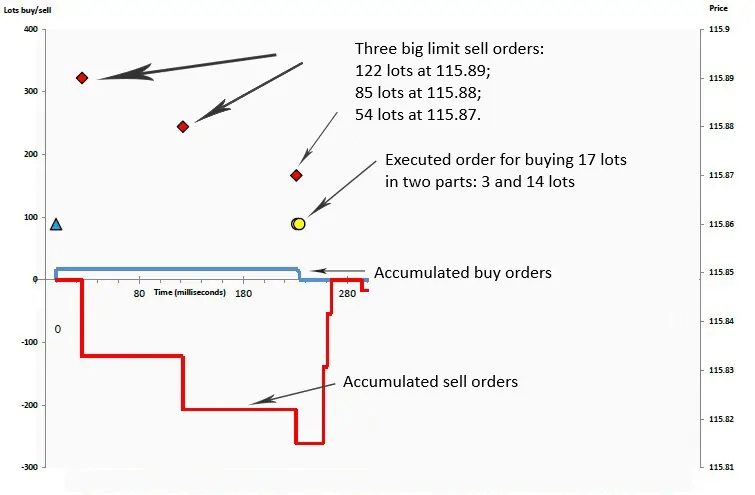

However, the user’s observed pattern (large blocks disappearing without execution) does not match legitimate market maker behavior. This is a hallmark of spoofing—a manipulative practice where traders place large orders with no intention to execute, canceling them once prices move artificially. FOCAL AI identifies “price impact without trade execution” and “high cancellation rates” as key spoofing indicators, aligning with the OP’s observation [3]. Spoofing relies on algorithmic speed, with both retail algo traders and institutions using this tactic across asset classes [4].

Bookmap’s orderflow visualization, as referenced in the thread, is critical for detecting such anomalies. The platform’s historical order book data reveals canceled large orders, a capability traditional Level II books lack. Bookmap’s blog emphasizes its tool “exposes spoofing behavior” by preserving order placement/cancellation history [5].

- Common Market Maker Misunderstanding: The Reddit discussion highlighted a prevalent misconception that market makers avoid taking the other side of trades. In reality, this is their primary liquidity provision obligation [1][2].

- Spoofing vs. Legitimate Activity: Large blocks disappearing without execution are a distinct spoofing red flag, differentiable from market maker behavior via trade execution data [3][4].

- Tool Evolution: Bookmap addresses the limitations of traditional order book data by visualizing historical order flow, making spoofing patterns more detectable [5].

- Context Dependency: Definitive confirmation of spoofing requires additional context (ticker, time frame, execution details) to rule out legitimate strategies like iceberg orders [0].

- Regulatory Risk: Spoofing is illegal under SEC Rule 9b-5 and CFTC regulations, but proving intent requires regulatory surveillance data—market participants may unknowingly act on false signals [4].

- Liquidity Risk: The pattern occurred during low-volume conditions, where spoofing has a more pronounced price impact [3].

- Tool Limitation Risk: While Bookmap identifies anomalies, it does not confirm manipulative intent; further analysis with trade data is needed [5].

- Enhanced Detection: Traders can use tools like Bookmap to identify order flow anomalies, reducing exposure to fake price signals [5].

- Education: The discussion highlights the need for improved understanding of market maker functions and spoofing indicators, which can help participants make more informed decisions.

- A Reddit user observed large order blocks acting as temporary price caps that disappeared entirely, questioning market maker involvement.

- Market makers are obligated to take the other side of trades when no counterparty exists, so the observed pattern is inconsistent with their legitimate activity.

- The pattern aligns with spoofing—algorithmic placement of fake orders to manipulate price signals.

- Bookmap’s orderflow visualization is a valid tool for identifying such anomalies, though it cannot confirm intent.

- Information gaps (missing ticker, time frame) limit definitive conclusions, emphasizing the need for additional context.

- Market participants should exercise caution with order book signals during low-volume periods and use advanced tools to validate patterns.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.