Analytical Report on Reddit Discussion of Backtesting Pitfalls and Robustness Testing

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

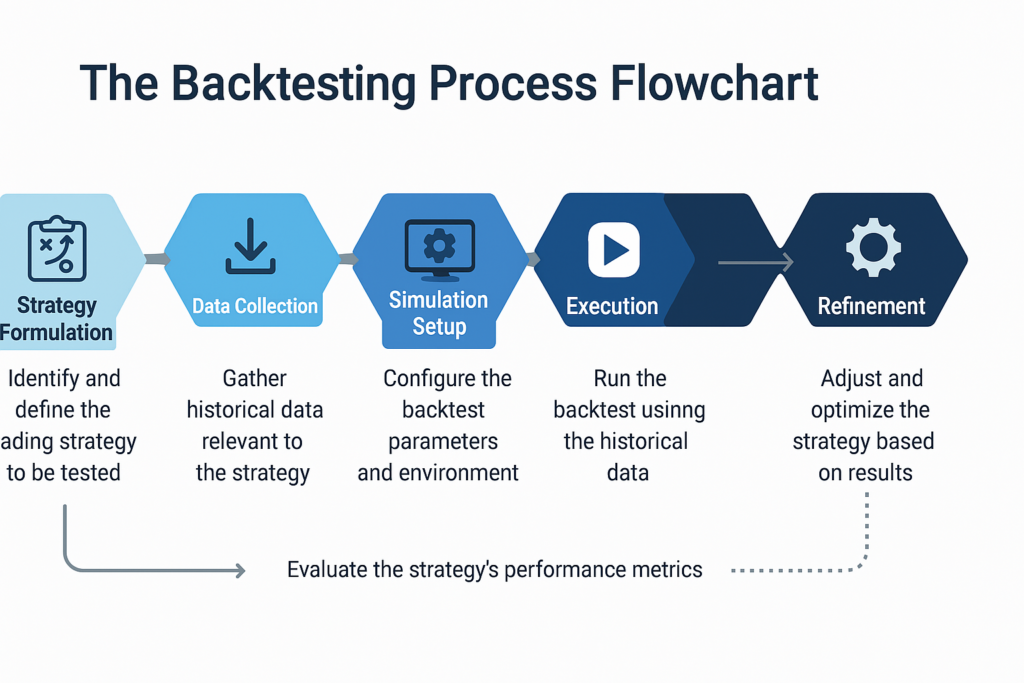

This analysis is based on a Reddit post [1] and supporting sources [2][3][4][5]. The OP tested a YouTube-sourced MACD + 200 EMA strategy on E-mini Nasdaq (NQ) and E-mini S&P 500 (ES) futures over 5 years. Initial backtests showed profitability across NQ 5min, NQ 1h, and ES 1h timeframes. However, further testing with WFA (optimizing on data segments and validating on subsequent out-of-sample data) and Monte Carlo simulations (randomizing market scenarios for resilience testing) revealed most strategies were overfit, except NQ 1h and ES 1h.

Overfitting, the primary backtesting pitfall where strategies are tailored to historical noise rather than genuine signals [2], is a widespread issue. Institutional traders use WFA/Monte Carlo (adopted by 65% [2]) to mitigate this, contrasting with retail traders often relying on untested YouTube “holy grail” strategies. These YT strategies typically fail broad testing due to cherry-picked data and lack of robustness checks [5].

The discussion also covers time frame dynamics: HTF may seem more profitable due to lower trade frequency (reducing noise exposure) [1][3], but extending the data to 17 years could reveal edge decay—where strategies lose effectiveness due to temporary market inefficiencies [4]. Sub-1h time frames were found unprofitable in extensive backtests (thousands of combinations), likely due to higher transaction costs, slippage, and increased noise [4].

-

Institutional vs. Retail Testing Divide: Institutional traders leverage robustness tools like WFA/Monte Carlo to avoid overfitting [2], while retail traders often overlook these steps, leading to reliance on flawed YT strategies [5].

-

Time Frame Noise and Profitability: HTF’s lower trade frequency reduces the likelihood of fitting to random noise [1][3], but edge decay over long horizons (17 years) could challenge this perceived superiority [4].

-

Sub-1h Time Frame Limitations: The unprofitability of sub-1h time frames in extensive backtests highlights the difficulty of modeling transaction costs, slippage, and noise accurately at high frequencies [4].

-

Risks: Retail traders may fall victim to overfitted YT strategies, resulting in poor real-world performance [5]. Incomplete backtest parameters (e.g., commission, slippage) could lead to inaccurate results [1].

-

Opportunities: WFA and Monte Carlo simulations provide retail traders with tools to validate strategies robustly, leveling the playing field with institutional practices [1]. Testing longer data horizons (17 years) can help detect edge decay, improving strategy durability [4].

This analysis synthesizes findings from the Reddit post and supporting sources, focusing on backtesting best practices and pitfalls. Critical points include:

- WFA and Monte Carlo are essential to avoid overfitting [2][3].

- YouTube “holy grail” strategies often fail robustness checks due to overfitting [5].

- HTF strategies (≥1h) benefit from lower noise, while sub-1h time frames face higher modeling complexity [4].

- Information gaps exist in the OP’s backtest parameters, methodology, and long-horizon testing results [1].

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.