High-Leverage Box Spread Investing: Reddit Discussion & Risk Analysis

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

On December 1, 2025 (20:20:36 EST), a Reddit user (OP) sparked a discussion about their high-leverage investing strategy: using box spreads to maintain 3.2x leverage, growing their portfolio from $20k (2017) to $2.3M (post-$250k withdrawal), and planning to increase leverage to 4x while refusing to de-leverage. The Reddit community raised critical concerns, which are validated by historical market data and financial analysis [0][1].

-

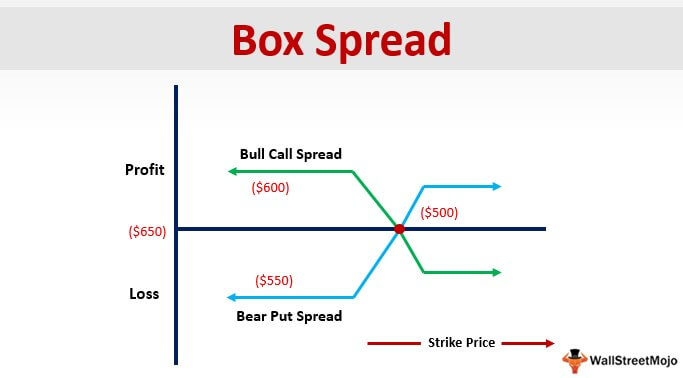

Leverage Risk Magnitude: For 4x leverage, a 25% market drop results in 100% equity loss (4 × 25% = 100%). Historical S&P 500 drawdowns (2020 COVID: ~35.4%; 2022 bear market: ~27.5%) exceed this threshold, confirming the risk of catastrophic loss [0]. Box spreads, while structured as low-credit-risk synthetic loans, do not eliminate market risk—they merely provide leverage, so drawdowns are still magnified [1].

-

Performance Comparison: OP’s 3.2x leveraged strategy achieved a claimed 27% CAGR, but underperformed relative to the 2x leveraged S&P 500 ETF (SSO), which returned ~499% (2017-2025) with a ~23.6% CAGR. The lack of proportional returns with higher leverage is likely due to box spread costs (synthetic loan interest) [0][1].

-

Disproportionate Risk from Leverage: Box spreads do not protect against market volatility. A 4x leverage ratio creates a binary risk: a moderate market drop results in total equity loss [0][1].

-

Survivorship Bias in Bull Market Context: OP’s success occurred during a 2017-2025 bull market (S&P 500 returned 202.57% over this period), which has not tested the strategy in severe, prolonged bear markets (e.g., 2008 financial crisis) [0].

-

Critical Risk Management Gap: OP’s refusal to de-leverage eliminates a safety net. In past downturns, investors without de-leveraging plans faced forced liquidation at market bottoms, locking in permanent losses [0].

- Catastrophic Loss: 4x leverage ensures a 25% market drop wipes out all equity, with historical crashes showing such declines are not rare [0].

- Survivorship Bias: The strategy’s performance is inflated by the bull market context, and it may fail in a bear market [0].

- Poor Risk Management: The absence of a de-leveraging plan increases the likelihood of forced liquidation during downturns [0].

- Box Spread Costs: Unconfirmed synthetic loan interest rates or fees could further reduce net returns [1].

No significant opportunities are identified. The high risk of total loss outweighs potential return enhancements.

- OP used 3.2x leverage via box spreads to grow their portfolio from $20k (2017) to $2.3M (post-$250k withdrawal), with a claimed 27% CAGR.

- They plan to increase leverage to 4x without a de-leveraging plan.

- Reddit community and historical data warn of catastrophic loss risk, underperformance vs. 2x leveraged ETFs, survivorship bias, and poor risk management.

- Box spreads provide leverage but do not eliminate market risk.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.