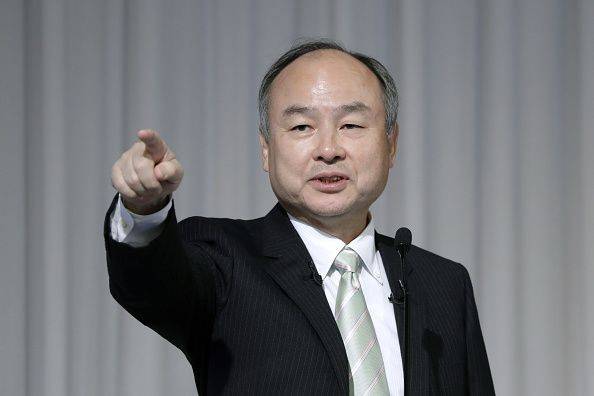

SoftBank CEO Masayoshi Son’s AI Bubble Comments Spark Viral Bearish Debate

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

On December 1, 2025, SoftBank Group CEO Masayoshi Son addressed the FII Priority Asia forum in Tokyo, making controversial remarks dismissing critics of AI investment as “not smart enough” while defending trillions in AI spending, claiming AI could eventually capture 10% of global GDP [1][0]. He also expressed emotional regret (“crying”) over selling SoftBank’s entire $5.8 billion Nvidia stake to fund AI bets, including investments in OpenAI [2][3][0]. The remarks went viral on Reddit’s r/stocks, where a thread garnered 549 points and 175 comments within hours [4][0].

Public sentiment leaned heavily bearish (602 upvotes) [0], driven by three key concerns:

- Son’s credibility, undermined by past high-profile failures like WeWork [4][0].

- Skepticism of his 10% global GDP claim for AI as overly optimistic [4][0].

- Worries about SoftBank’s leveraged financial position, which forced the sale of high-performing Nvidia shares [4][6][7][0].

A minority bullish sentiment (36 upvotes) cited Son’s track record, such as his early investment in Alibaba, as justification for his AI optimism [4][0]. A neutral viewpoint (6 upvotes) acknowledged AI’s real demand and productivity benefits but warned of overhyped startups in the space [4][0].

- Credibility asymmetry: Son’s past WeWork failure (a high-profile investment misstep) has a far stronger negative resonance with retail investors than his successful Alibaba bet, driving the dominant bearish sentiment [4][0].

- Strategic contradiction: Selling a top-performing AI stock (Nvidia) to fund other AI investments raises questions about the consistency of SoftBank’s AI investment strategy [2][3][0].

- Systemic leverage risk: SoftBank’s leveraged position (using company holdings as collateral) creates potential cascading risk if AI valuations correct sharply, amplifying market concerns [4][6][7][0].

- Reputational damage: Son’s blunt comments risk further polarizing investor perceptions of SoftBank’s aggressive AI strategy, especially amid existing leverage concerns [7][0].

- Market volatility: The remarks may contribute to short-term fluctuations in AI-related stocks (e.g., SoftBank’s portfolio companies) as investors react to the bubble debate [1][0].

- Regulatory scrutiny: SoftBank’s leveraged position and large AI investments could draw closer examination from financial regulators [6][0].

- Long-term AI upside: If AI captures even a fraction of Son’s projected 10% global GDP, SoftBank’s investments could yield significant returns, vindicating his strategy [1][4][0].

This report synthesizes the following critical points:

- SoftBank CEO Masayoshi Son made controversial remarks on December 1, 2025, dismissing AI bubble critics and expressing regret over selling Nvidia shares [1][2][3][0].

- Reddit’s r/stocks community responded with dominant bearish sentiment (602 upvotes) focused on credibility, leverage, and unrealistic GDP claims, with minority bullish views on Son’s track record [4][0].

- The event highlights the tension between AI’s proven demand and concerns over investment hype, SoftBank’s strategy, and Son’s past failures.

No prescriptive investment recommendations are provided; this analysis aims to inform decision-making through objective context and market sentiment assessment.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.