Reddit Debate on AI Bubble: Component Demand vs. ROI and Financial Risks

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

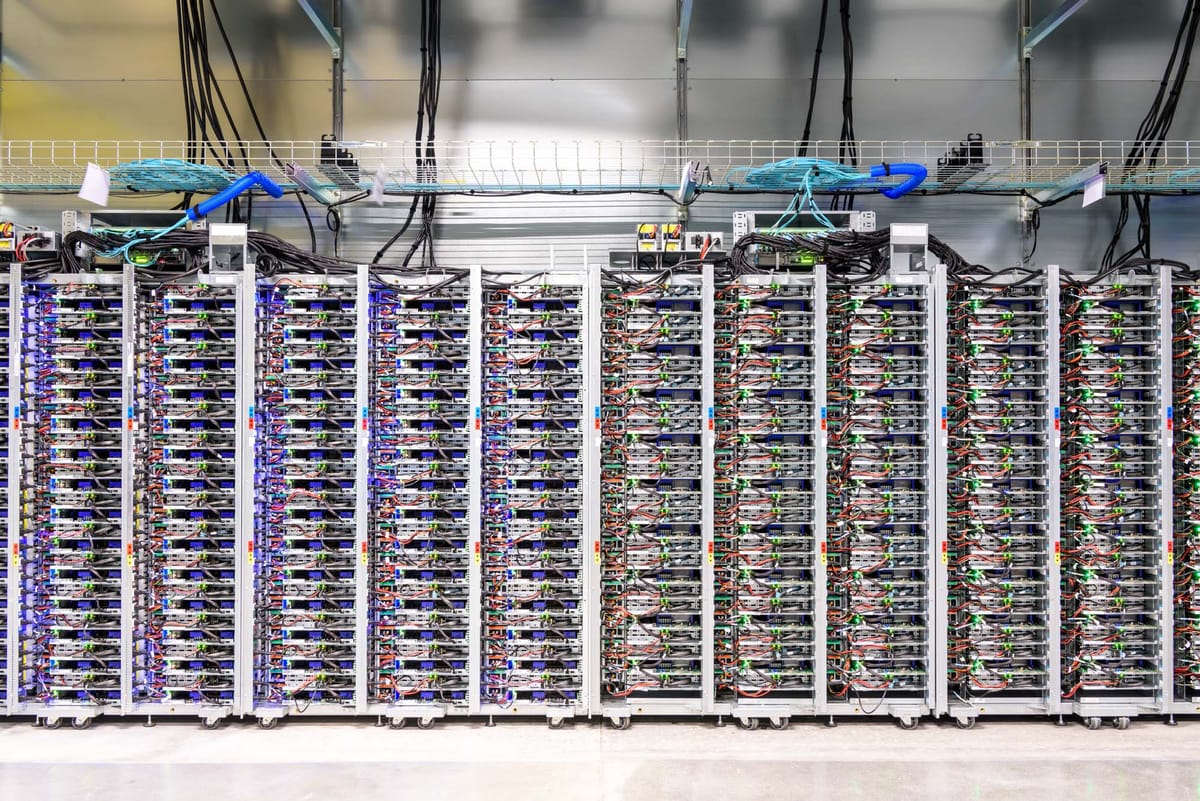

This analysis is based on a Reddit discussion (2025-11-23 UTC) [5] that debated the existence of an AI bubble. The original poster (OP) argued against a bubble, citing a tripling of RAM prices in two months and Nvidia’s inability to meet GPU demand—evidence of real, supply-constrained component demand. However, critics pushed back on multiple fronts: they argued the OP misframed bubble claims, which relate to lack of ROI on AI investments (not demand itself, analogous to the dot-com bubble where website demand was real but many firms failed to generate returns); they highlighted Nvidia’s 89% surge in accounts receivable (Q3 2025) as a potential risk; and they drew valid comparisons to historical bubbles like tulips, where genuine demand preceded a collapse [5].

Industry data supports the OP’s claim of component demand: RAM prices for AI-relevant modules (high capacity, tight timings) surged 80-300% from September to November 2025, driven by AI demand [2][3][4]. For example, the Team T-Force Vulcan 32GB DDR5-6000 kit rose from $82 to $310 (a 278% increase) [4]. Cloud service providers securing long-term DRAM allocations (2026-2027) reduced supply for consumer devices, amplifying price spikes [2][3]. However, these price surges do not definitively refute bubble claims, as critics correctly distinguish between demand and the financial returns generated from that demand.

Analyst Ming-Chi Kuo addressed concerns about Nvidia’s accounts receivable, explaining that rising days sales outstanding (DSO) is normal when receivables are concentrated in large hyperscaler customers with strong bargaining power—an industry commonality [1]. Kuo also noted that Nvidia’s 32% QoQ inventory jump was preparation for mass production of its new Blackwell B300 GPU, not a sign of slowing demand [1].

- Bubble Definition Dispute: The core of the debate lies in conflicting definitions of a “bubble.” The OP defines it as pre-revenue/non-product companies with inflated valuations, while critics frame it as investments failing to produce ROI. Historical bubbles (dot-com, tulips) demonstrate that genuine demand can coexist with bubble conditions if ROI expectations are unrealistic [5].

- Component Supplier vs. End-User ROI: While component suppliers like Nvidia and memory manufacturers benefit from AI demand, end-users investing in AI infrastructure face uncertain ROI, which is the critics’ primary concern. This disconnect highlights the need to distinguish between supply chain performance and broader AI investment returns.

- Hyperscaler Influence: Large cloud service providers drive both AI component demand and influence the financial terms of suppliers like Nvidia, explaining the latter’s rising receivables and DSO [1][2][3].

- Consumer PC Markets: The RAM price surge is expected to reduce shipments for cost-sensitive consumer PC segments [2].

- Investor Uncertainty: Mixed market reactions (Nvidia’s stock fell post-earnings but remains long-term bullish, while investors like Peter Thiel and SoftBank reduced stakes) create volatility [1][0].

- AI Overinvestment: ROI concerns may slow overinvestment in unproven AI use cases.

- Memory Manufacturers: The RAM price surge benefits memory producers, driving higher revenue margins [2].

- AI Adoption Validation: Component shortages highlight AI’s growing importance, supporting long-term industry growth despite the bubble debate.

- The AI bubble debate hinges on conflicting definitions: demand for components vs. ROI on AI investments.

- RAM prices for AI modules surged 80-300% (Sept-Nov 2025) due to hyperscaler long-term allocations [2][3][4].

- Nvidia’s accounts receivable surge (89% Q3 2025) was addressed by Kuo as normal for large hyperscaler customers, with inventory growth attributed to upcoming GPU production [1].

- Historical bubble analogies (dot-com, tulips) have merit but differ from current AI dynamics (component suppliers generate real revenue vs. pre-revenue dot-com firms).

- The debate highlights a disconnect between supply chain performance and end-user ROI, which remains an information gap.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.