JPMorgan Analysis: IPO Market Shows Strong Recovery with $29.3B Raised in 2025

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

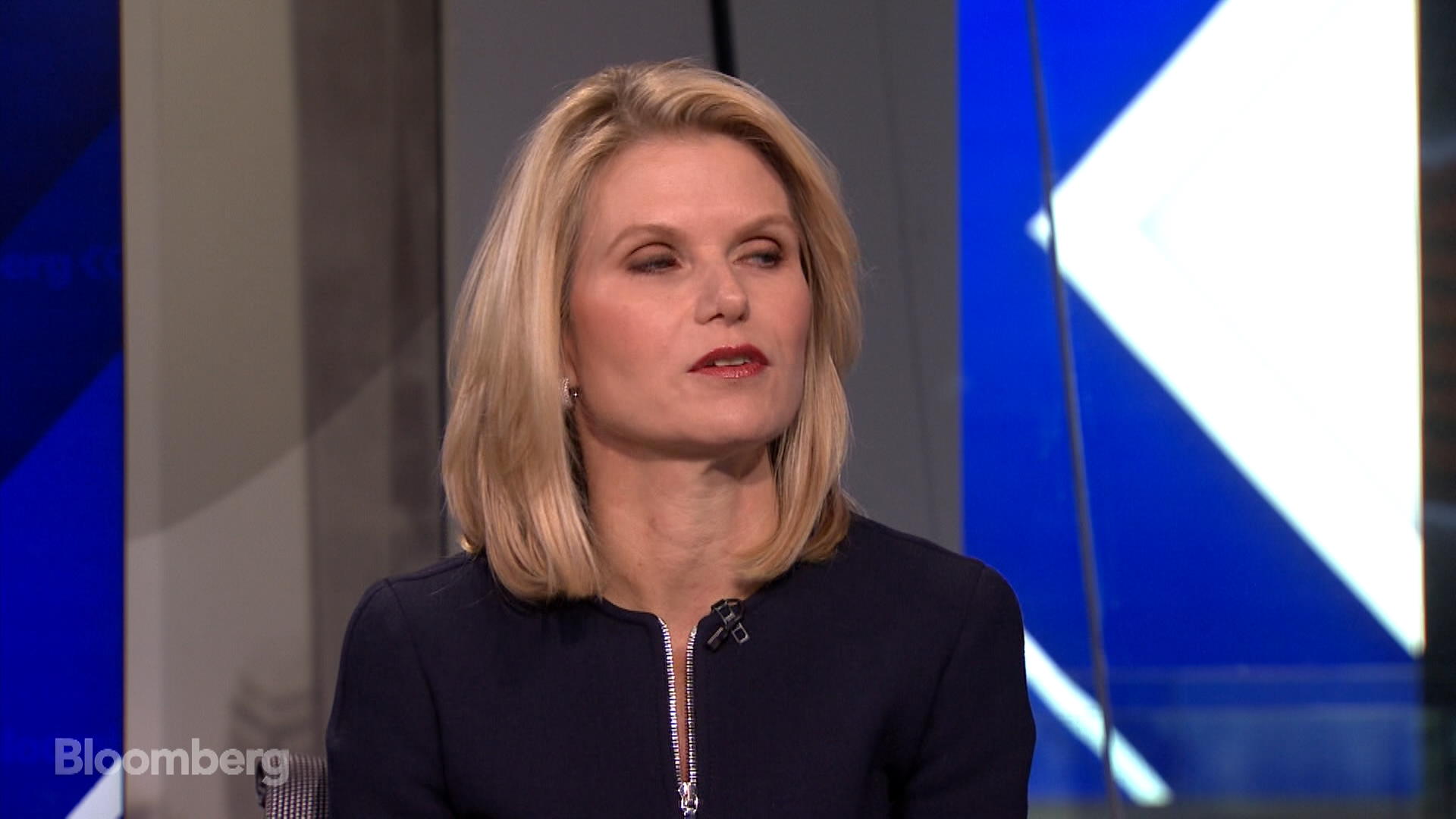

This analysis is based on the CNBC interview [1] with Liz Myers, JPMorgan’s Global Chairman of Investment Banking and Capital Markets, published on October 28, 2025, where she declared that “the IPO market has been really vibrant.”

The IPO market has experienced a remarkable resurgence in 2025, validating Myers’ assessment of vibrant activity. Through Q3 2025, traditional IPOs have raised more than $29.3 billion year-to-date, representing a 31% increase from the previous year [2]. September 2025 was particularly notable, with 13 IPOs raising over $8 billion, making it the busiest month for new listings since November 2021 [2].

The recovery extends beyond US markets, with EMEA IPO volumes surging over 150% year-over-year in Q3 2025 [3]. JPMorgan has established dominant market leadership, ranking as the number one global ECM bank and leading 4 of the 5 largest post-summer IPOs in EMEA, including SMG, Noba Bank, Alec Holdings, and Verisure [3][4].

Technology sector IPOs have been at the forefront of this resurgence. September 2025 saw 20 tech IPOs price, raising just over $16 billion—more than double last year’s volume and representing the busiest tech IPO month since November 2021 [4]. The quality of offerings has improved significantly, with average revenue for tech IPOs reaching $831 million and approximately 25% of IPO companies being profitable, compared to all 27 of the largest tech IPOs being loss-making in 2021 [2].

A virtuous cycle has emerged in the IPO market where deals price well, issuers receive healthy valuations, markets trade up, and investors make money, collectively sustaining continued IPO activity [4]. This cycle is supported by strong performance metrics—2025 IPOs are outperforming the broader market significantly, with average returns of approximately 27% compared to a 14% gain in the S&P 500 as of September 30 [2].

The pipeline strength suggests sustained momentum, with preparation levels described as “as busy as it’s felt quite literally since 2021” [4]. EMEA alone has a pipeline of over $30 billion in potential IPOs slated for Q4 and early 2026, with multiple billion-euro offerings in energy, healthcare, fintech, and industrials preparing to launch [3].

Macroeconomic factors are supporting this recovery, including the European Central Bank’s signals of rate stabilization and improved macroeconomic visibility, which reduce uncertainty that previously hampered IPO activity [3]. Global dealmaking has also found its stride in 2025, with M&A volumes up 27% compared to the previous year, while IPO market volumes have climbed around 12% [5].

The current environment presents significant opportunities across market participants. Companies considering going public are receiving “relatively healthy valuations” [4] and benefit from investor conviction that remains “very high and robust” [4]. For investors, IPO investments have delivered premium performance, outpacing broader market indices by a significant margin [2].

However, maintaining this momentum requires careful execution. Smart pricing strategies and proper syndicate formation are essential for sustaining the virtuous cycle [4]. The market’s continued health will depend on maintaining discipline around pricing, company selection, and investor returns to avoid the boom-bust patterns of previous cycles.

The IPO market in 2025 demonstrates strong recovery characteristics with $29.3 billion raised through Q3, representing 31% year-over-year growth [2]. Technology IPOs lead the surge with $16 billion raised in September alone [4], while overall IPO performance averages 27% returns versus 14% for the S&P 500 [2]. JPMorgan has established market leadership, ranking number one globally in ECM and leading major transactions across regions [3][4]. The pipeline shows sustained strength with over $30 billion in potential EMEA IPOs and robust US activity through 2026 [3][4]. Improved deal quality is evident with 25% of IPO companies being profitable compared to 0% in 2021’s largest tech IPOs [2].

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.