Reddit Discussion Analysis: NVDA CEO Jensen Huang’s AI Automation Directive Claims (2025-12-01)

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

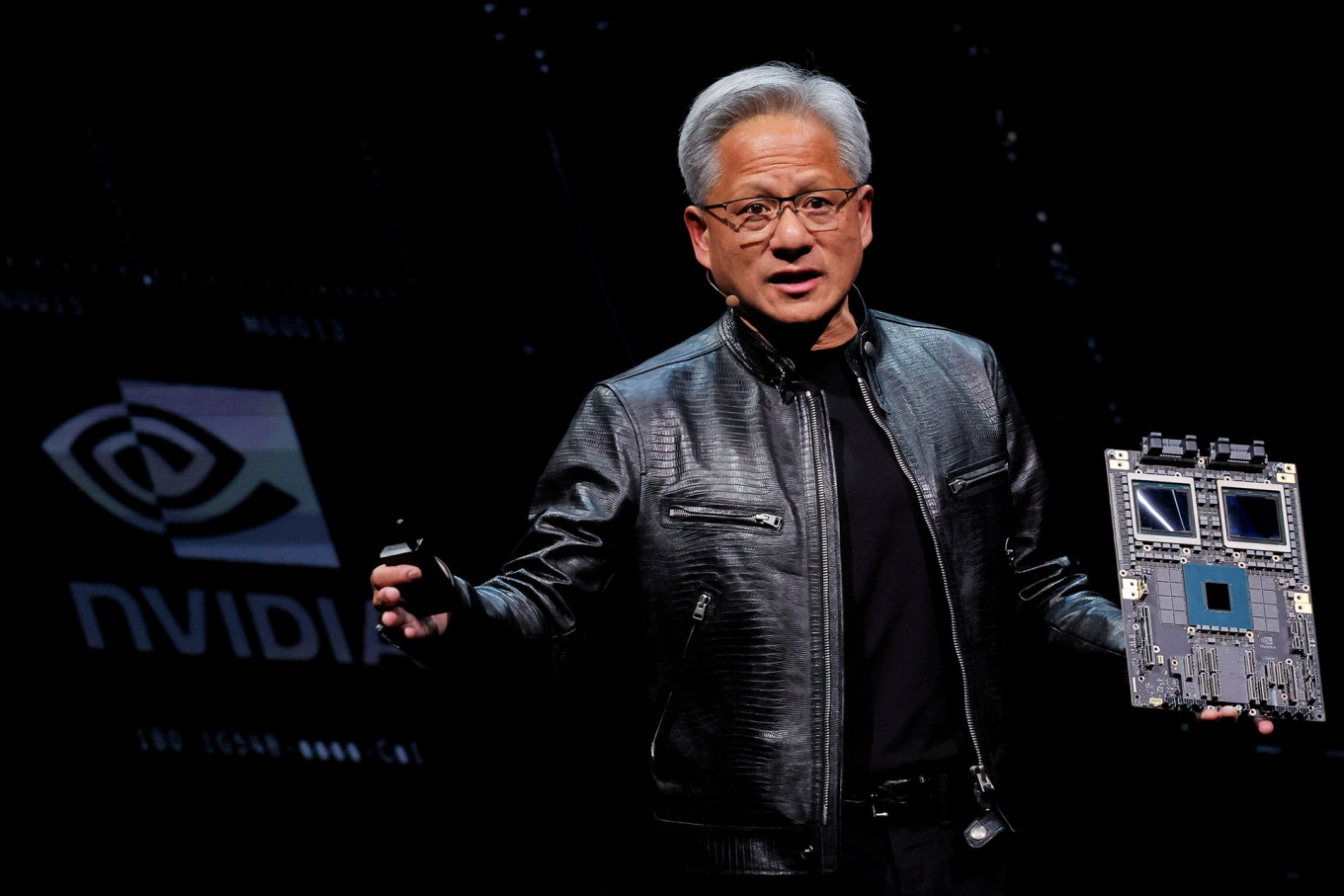

On December 1, 2025 (EST), a Reddit post (ticker: NVDA) shared news that Nvidia CEO Jensen Huang was urging employees to automate every possible task using AI, citing a TechSpot article that could not be verified via searches of major outlets [1][2]. The discussion centered on four key themes:

- Bearish: Huang’s push is self-serving to promote Nvidia’s AI hardware (3784 upvotes, analogy: “Man who sells lemonade says you need a drink”).

- Bearish: Automation signals upcoming layoffs (196 upvotes, reasoning: automation allows layoffs without operational disruption).

- Bearish: AI produces unreliable results in professional contexts (59 upvotes, lawyer’s anecdote of AI-generated legal motion with fake case law).

- Bullish: Huang’s goal is to multiply engineer productivity (3 upvotes, citing Nvidia’s “intellectual honesty” culture).

Verification of claims reveals:

- Huang’s automation directive: Unverified(no matching public report found).

- Self-serving motive: Opinion (based on Huang’s public advocacy for AI hardware [1], but motive unconfirmed).

- Layoff fears: Unverified(no public NVDA layoff announcements [0]).

- AI unreliability: Verified(Bloomberg Law reported 7x increase in 2025 AI hallucinations in legal filings [3]; Business Insider documented 73 such instances [4]).

On the day of the discussion, NVDA closed at $179.46, up 2.69% with 111.07M volume [0]. This movement likely reflects the $2B Synopsys partnership announced the same day [2], not the Reddit post (which occurred mid-session).

- Misinformation risk: The viral claim about Huang’s directive lacks verification, highlighting social media’s role in spreading unconfirmed corporate news.

- Sentiment drivers: Bearish views dominated due to skepticism of corporate motives, job insecurity fears, and well-documented AI reliability issues.

- Market decoupling: Stock price movement was linked to material partnerships, not the social media discussion, showing limited short-term impact of unverified social sentiment.

- Reputational risk for NVDA if misinformation about the directive spreads unchecked.

- Investor skepticism if layoff rumors persist without company clarification.

- AI implementation challenges due to ongoing reliability issues in professional contexts [3][4].

- Potential engineer productivity gains if AI tools are deployed effectively (minority bullish view).

- Market confidence from unrelated positive announcements (e.g., Synopsys partnership [2]).

- The original TechSpot article claiming Huang’s “automate every task” directive could not be verified.

- Discussion sentiment was predominantly bearish (98% of upvotes on negative claims).

- NVDA’s December 1, 2025, stock performance was likely driven by the Synopsys partnership, not the Reddit discussion.

- AI unreliability in professional contexts is a verified issue, supporting one of the bearish arguments.

All findings are based on cited sources and social media analysis; no prescriptive investment recommendations are made.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.