Investment Evaluation of NVIDIA Amid Google TPU Competition: Reddit Discussion and Market Analysis

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

On November 28, 2025 (EST), a Reddit discussion debated NVDA’s investment appeal amid Google TPU competition [0]. The OP argued NVDA is undervalued at $180 (targeting $210 by year-end and $260 in 2026) due to its broader use cases (training, inference, graphics) and dominant CUDA ecosystem, which is critical for AI/ML engineers and infrastructure [0]. Counterpoints included concerns over a ~50x P/E ratio (per commenters), TPU competition reducing margins, TPU power efficiency, and AMD as an early-growth alternative [0].

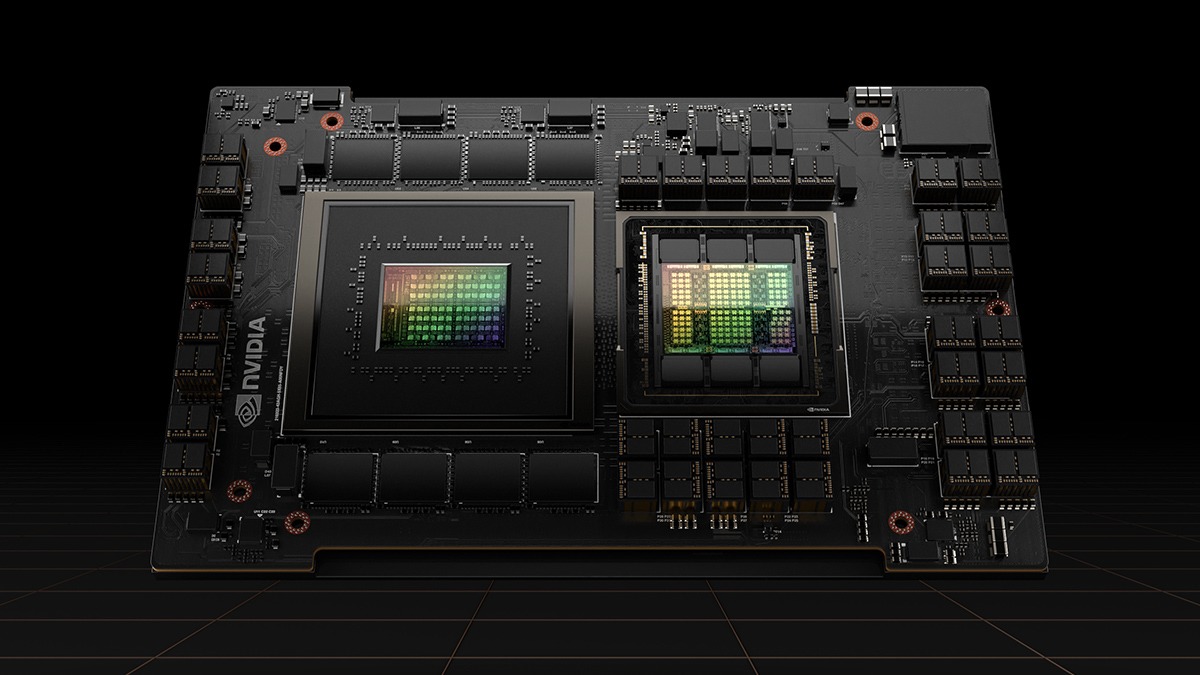

Market data from December 1, 2025 shows NVDA trading at $178.96 (+1.10% intraday), near the $180 level discussed [0]. A recent $2B investment in Synopsys to accelerate AI chip design has supported sentiment, reinforcing NVDA’s ecosystem lead [1]. Competitive context from Benzinga frames Google TPUs as a “cost-effective hedge” rather than replacements, due to tight supply for NVDA’s Blackwell and Rubin chips [2]. SemiAnalysis reports TPUv7 has higher Model FLOP Utilization (MFU) than Blackwell, but NVDA’s Vera Rubin is expected to compete with TPU v8 (2027) [3].

- Ecosystem Dominance as a Barrier: NVDA’s CUDA ecosystem remains its most significant moat, with no immediate replacement available (as noted in Reddit comments) [0]. This addresses TPU’s technical advantages (power efficiency, MFU) by limiting customer switching costs.

- Valuation Realignment: NVDA’s actual P/E ratio (44.30x) is lower than the ~50x cited in the Reddit post [0], but still high compared to mature tech peers. Analyst consensus price target of $250 (+39.8% from current) aligns with long-term bullish views.

- TPU’s Niche Role: Market analysis clarifies TPUs are not “GPU killers” but complementary tools, with supply constraints limiting their near-term impact on NVDA’s market share [2].

- Opportunities:

- Ecosystem expansion through investments like Synopsys [1]

- Strong analyst consensus (73.4% “Buy” rating) and price target of $250 [0]

- Broad use cases beyond AI (graphics, scientific computing) reducing reliance on a single market segment [0]

- Risks:

- Margin compression: TPU competition could reduce NVDA’s pricing power; a drop from 53.01% to 30% margins (as suggested in a comment) would significantly impact valuation [0]

- Valuation vulnerability: High P/E ratio (44.30x) exposes NVDA to market sentiment shifts or earnings misses [0]

- Supply chain constraints: Tight availability of Blackwell/Rubin chips could drive customers to TPU alternatives [2]

- Regulatory risks: As a leading AI chipmaker, NVDA faces potential export control or antitrust scrutiny [0]

- NVDA’s current price: $178.96 (December 1, 2025) [0]

- P/E ratio: 44.30x [0]

- Net profit margin: 53.01% (FY2025) [0]

- Data center revenue: 88.3% of total [0]

- Analyst consensus price target: $250 (+39.8%) [0]

- TPU’s role: “Cost-effective hedge” not replacement [2]

- NVDA’s moat: CUDA ecosystem dominance [0]

This summary provides objective context for decision-making without prescriptive investment recommendations.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.