Dongfang Jinggong (002611) Limit-Up Analysis: Driven by Both Asset Restructuring and Robot Concept

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

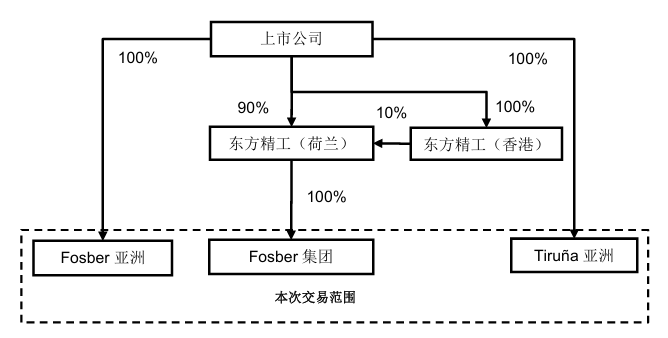

Dongfang Jinggong (002611) hit the limit-up today mainly driven by multiple positive factors. The company recently announced a major asset restructuring plan to sell the equity of three subsidiaries including its Fosber Group to a company controlled by Brookfield for 774 million euros [0][4][5]. This transaction is expected to bring about 6.34 billion yuan in cash inflow to the company, helping it focus on core businesses [0]. Meanwhile, the IPO expectation of its affiliated company Leju Robot has become an important catalyst; Dongfang Jinggong holds a 6.83% stake and is expected to gain considerable equity returns [0][2]. The company has solid fundamentals: its net profit in the first three quarters of 2025 was 510 million yuan, a year-on-year increase of 54.64% [0]. Coupled with policy support and market enthusiasm for the humanoid robot sector [0][7], these factors jointly推动 the stock price up.

- Asset restructuring and robot concept form a synergistic effect: while asset restructuring optimizes the business structure, the robot concept brings about valuation re-rating, driving the stock price performance together [0].

- Institutional attention has increased significantly: the number of institutional shareholders increased from 32 to 95 this year, reflecting the market’s recognition of the company’s strategic adjustment and growth potential [0].

- The asset restructuring needs to go through approval procedures such as multi-country antitrust reviews, which has uncertainties [0][4].

- The company’s stock price has risen by 90.71% this year, and may face short-term volatility risks [0][6].

- If Leju Robot’s IPO is successful, it will bring direct returns and valuation improvement to the company [0][2].

- The cash obtained from the asset restructuring can be used for core business expansion or technology research and development [0][5].

The limit-up of Dongfang Jinggong (002611) is the result of the combined effect of asset restructuring, robot concept, performance growth and other factors. The company’s strategic adjustment focuses on core businesses, while benefiting from the enthusiasm of emerging sectors, institutional attention continues to increase. Investors need to pay attention to the progress of asset restructuring approval and the dynamics of Leju Robot’s IPO, balancing short-term volatility and long-term growth potential.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.