Bull Market Outlook vs. Labor Market Deterioration: S&P 500 Targets Amid Rising Layoffs

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

This analysis is based on the Yahoo Finance Morning Brief [1] published on November 6, 2025, featuring Seaport Research Partners Managing Director Jonathan Golub’s bullish market outlook, alongside concerning employment data from Challenger, Gray & Christmas [2].

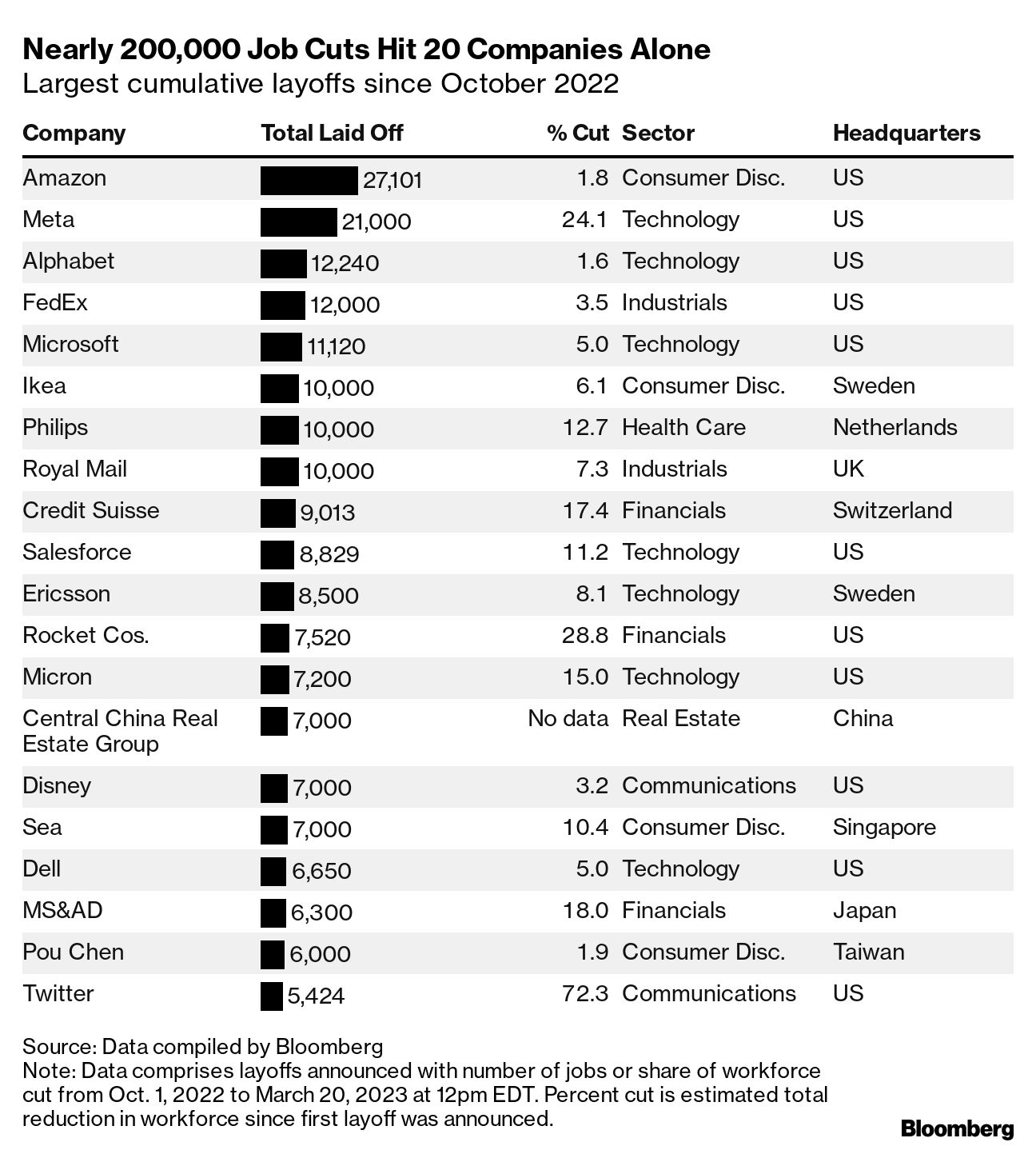

The market presents a significant divergence between equity market optimism and labor market deterioration. Jonathan Golub maintains ambitious S&P 500 targets of 7,050 for 2025 and 7,800 for 2026, suggesting continued bull market momentum [1]. However, these forecasts confront stark employment realities, with October 2025 job cuts surging to 153,074 - a 183% increase from September and the highest October total since 2003 [2].

Current market performance reflects this uncertainty, with the S&P 500 closing at 6,733.59, down 0.80% on November 6, 2025 [0]. The technology sector, crucial for growth expectations, underperformed with a -1.34% decline [0], while basic materials was the sole positive sector at +0.26% [0].

The employment data reveals structural shifts across industries:

- Technology: 33,281 October cuts (up from 5,639 in September), with 141,159 year-to-date cuts [2]

- Warehousing: 47,878 October cuts (up from 984 in September), representing a 378% year-to-date increase [2]

- Overall hiring plans: Down 35% from 2024, reaching the lowest year-to-date total since 2011 [2]

The market faces contradictory signals between optimistic equity forecasts and deteriorating labor market fundamentals. While Jonathan Golub maintains bullish S&P 500 targets through 2026 [1], employment data shows significant deterioration with October job cuts reaching 153,074 [2]. The technology sector’s underperformance [0] and broader market weakness suggest investor caution despite optimistic projections. The divergence between AI-driven productivity gains and employment losses creates uncertainty about sustainable economic growth paths. Decision-makers should monitor upcoming earnings reports, Federal Reserve policy responses, and the balance between technological advancement and employment impacts when assessing market sustainability.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.