AI-Driven Memory Shortage: Industry Impact and Long-Term Investment Opportunities

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

The event originates from a Reddit discussion where users debated strategies to capitalize on AI-driven memory shortages, prioritizing safe long-term investments. The shortage has triggered significant industry impacts: DRAM prices surged by 171% year-over-year (YoY) in Q3 2025 [2], and RAM prices increased by up to 500% since October 1, 2025 [4]. Leading-edge DRAM capacity is being redirected from consumer devices (gaming PCs, laptops) to AI data centers, making high-end gaming unaffordable for years [1]. System builders like CyberPowerPC will implement price hikes starting December 7, 2025 [4].

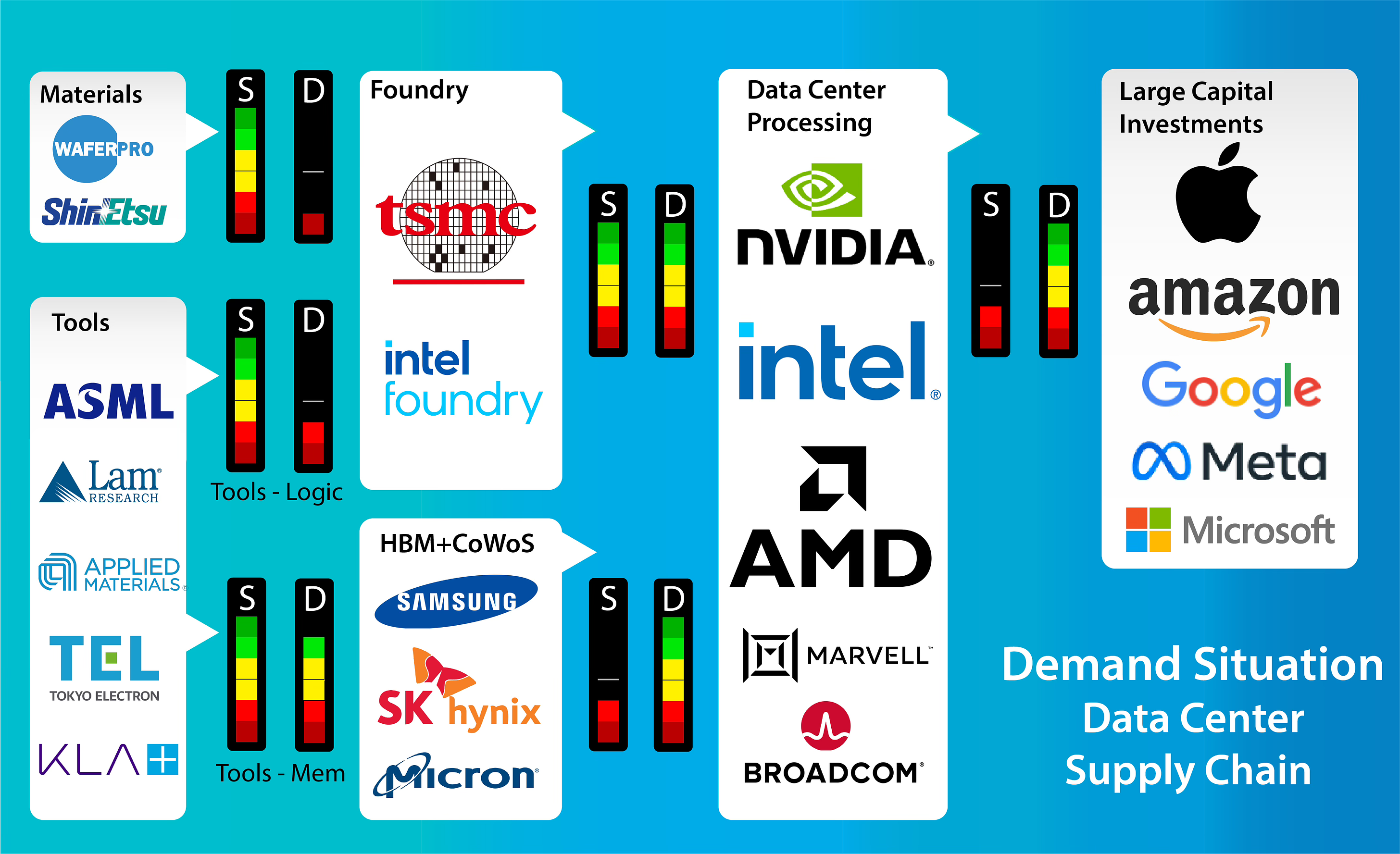

The industry is highly consolidated: Micron (MU) derives 77.1% of FY2025 revenue from DRAM [0], with YTD growth of +170.79% [0]. Equipment suppliers ASML (ASML) and Applied Materials (AMAT) benefit indirectly from fab builds, with YTD growth of +51.33% and +53.97% respectively [0]. ASML’s EUV machines create high barriers to entry [0]. A structural shift is underway: High Bandwidth Memory (HBM) will dominate the DRAM segment by 2030 [3].

- Cross-Domain Synergy: AI demand drives growth for both memory producers and equipment suppliers, creating a mutually beneficial ecosystem.

- Demand Trade-Off: AI data centers are outbidding consumer segments for memory, exacerbating consumer price hikes.

- Barriers to Entry: ASML’s EUV monopoly limits new competition, preserving market share for established players.

- Stockpiling Strategies: Companies like Lenovo are stockpiling memory to mitigate future cost increases [5].

- Cyclicality: High prices are temporary; supply catch-up may lead to price drops [event content].

- Geopolitical Tensions: ASML and AMAT derive ~37% of revenue from China, risking supply chain disruptions [0].

- Equipment Constraints: ASML’s EUV machine shortages limit memory production capacity [0].

- Top Players: Micron (DRAM producer), ASML (equipment), Applied Materials (equipment) are positioned for long-term growth.

- Price Trends: DRAM prices up 171% YoY; RAM prices up to 500% since October 2025.

- Stakeholder Impacts: Investors should prioritize established players; consumers face higher PC upgrade costs; system builders adjust prices; data centers face bidding wars for memory.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.