Analysis: Time Horizon Requirements to Validate Stock-Picking Skill

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

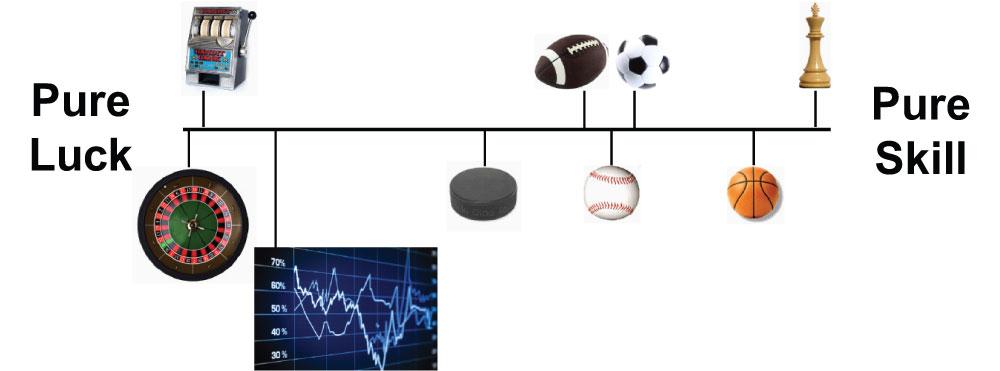

The analysis integrates insights from Michael Mauboussin’s skill-luck continuum [1][2], statistical significance research [3][4], and market cycle dynamics to address the question of validating stock-picking skill. Mauboussin’s framework positions investing as a high-luck activity, where longer time horizons reduce luck’s impact—10-year periods show stable return distributions [4], while 20 years (two full cycles) are needed to prove skill across all market conditions [5]. Statistical significance requires consistent outperformance over 5+ years, though 10+ years is more reliable [3]. The Reddit OP’s 9-year track record lacks full cycle exposure (e.g., 2008-style bear market) [5], highlighting the need for extended observation.

- Full Market Cycles Matter: Skill validation requires exposure to both bull and bear markets—short-term returns in extended bull markets may overstate skill [1][5].

- Process Over Results: A repeatable, research-driven process (e.g., risk management for concentrated portfolios) is more predictive of long-term success than short-term returns [1][2].

- Concentrated Portfolio Risks: High returns from concentrated positions demand strict risk controls to avoid catastrophic losses [5].

- Risks: Overconfidence from short-term outperformance, lack of full cycle exposure, and inadequate risk management for concentrated portfolios [5].

- Opportunities: Refining risk management practices (e.g., stop-losses, position sizing) to mitigate downside in concentrated portfolios; extending the investment horizon to cover full market cycles [5].

The analysis confirms that 10+ years of consistent performance (covering at least one full market cycle) is a minimum for skill validation, with 20 years (two cycles) being ideal. Process rigor and risk management are critical for sustaining returns, especially in concentrated portfolios. The Reddit OP’s track record is impressive but incomplete, requiring extended observation to confirm skill.

Citations: [0] Internal Data, [1] A Wealth of Common Sense, [2] Wharton Knowledge, [3] IFA, [4] CAIA Association, [5] Reddit Post

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.