Sector Rotation Analysis: Economic Recovery Drives Market Realignment

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

This analysis is based on the Seeking Alpha report [1] published on November 6, 2025, which highlighted emerging sector rotation patterns as investors responded to positive economic developments and policy shifts.

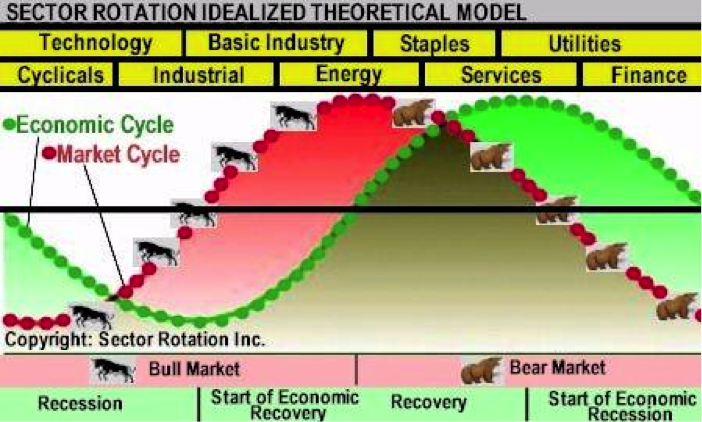

The market demonstrated notable sector rotation on November 6, 2025, with investors reallocating capital toward cyclical and undervalued sectors following multiple positive catalysts. The S&P 500 closed modestly higher at 6,787.94 (+0.35%), while the NASDAQ underperformed with a slight decline of 0.09% [0], supporting the rotation thesis away from technology toward other sectors.

- The ADP employment report confirmed 42,000 new private sector jobs in October 2025, with trade, transportation, and utilities leading job creation at 47,000 positions [2]

- ISM Services PMI reached 52.4% in October, up from 50.0% in September, marking the strongest expansion since February 2025 [3]

- Annual pay growth of 4.5% year-over-year indicated improving wage conditions [2]

- President Trump announced tariff reductions with China by 10 percentage points effective November 10, 2025 [5]

- Signs of government reopening reduced policy uncertainty, with Interactive Brokers’ prediction market showing 50-50 odds of reopening by November 5 [8]

Current market data confirms the rotation pattern with Energy (+2.80%) and Industrials (+2.32%) leading gains, while Technology (+0.40%) significantly underperformed relative to broader market sectors [0]. This aligns with the article’s assertion about investors buying the dip in undervalued sectors.

The convergence of improving services sector data (ISM PMI 52.4% [3]), employment growth (ADP +42,000 jobs [2]), and policy easing (tariff reductions [5]) creates a powerful catalyst for sector rotation. The services sector’s expansion to 54.3% on the Business Activity Index [4] suggests sustainable momentum beyond short-term trading patterns.

S&P 500 Q3 2025 earnings showed strong performance with a blended earnings growth rate of 10.7% year-over-year, exceeding initial expectations of 7.9% [6]. Expected earnings growth for calendar years 2025 and 2026 increased to 11.2% and 14.0% respectively [6], providing fundamental support for the rotation toward value sectors.

The relatively modest market response (S&P 500 +0.35%) despite strong positive catalysts suggests investor caution rather than euphoric buying. This measured approach may indicate a more sustainable rotation pattern rather than speculative trading.

- Government Shutdown Impact: The ongoing federal shutdown has created a “blackout of critical federal data” [9], limiting investors’ ability to make fully informed decisions and potentially leading to overreactions to limited data points

- Policy Uncertainty: Potential Supreme Court intervention on tariff legality [1] creates significant uncertainty that could reverse current rotation trends

- Information Vacuum: Limited official data during the shutdown increases reliance on alternative indicators like ADP reports, which may not fully capture economic trends

- Cyclical Sector Momentum: Energy and Industrials showing strong performance may continue benefiting from improving economic data and policy support

- Service Sector Expansion: The ISM Services PMI expansion [3] suggests sustained growth opportunities in service-oriented businesses

- Valuation Gaps: Technology’s relative underperformance may present selective opportunities if rotation proves temporary

The current rotation appears to be in early stages, with the government shutdown resolution potentially serving as a catalyst for accelerated reallocation. Investors should monitor official BLS employment data when released to validate ADP findings [2].

The market is experiencing a meaningful rotation toward cyclical sectors supported by improving economic fundamentals and policy easing. The ADP employment report showing 42,000 new jobs [2], combined with ISM Services PMI at 52.4% [3], indicates the services sector is leading economic recovery. Tariff reductions announced for November 10, 2025 [5] provide additional policy support for broader economic expansion.

Current sector performance shows Energy (+2.80%) and Industrials (+2.32%) outperforming significantly, while Technology (+0.40%) lags behind [0]. S&P 500 earnings growth of 10.7% year-over-year [6] provides fundamental support for continued market rotation.

However, the ongoing government shutdown creates an information vacuum that increases market volatility risk. The Supreme Court’s potential ruling on tariff legality [1] represents another significant uncertainty factor that could impact current rotation patterns.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.