AI Power Bottleneck Analysis: Energy Infrastructure Constraints and Market Implications

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

This analysis is based on a comprehensive industry examination highlighting that AI’s primary constraint has shifted from chip availability to power generation capacity [0]. The timing of this paradigm shift is particularly significant as it coincides with unprecedented growth in artificial intelligence development and data center expansion globally.

The power infrastructure is experiencing extreme pressure, with Goldman Sachs Research forecasting that global power demand from data centers will increase 50% by 2027 and up to 165% by 2030 compared to 2023 levels [3]. Current global data center power usage stands at approximately 55 gigawatts, with AI workloads representing 14% of total consumption but projected to grow to 27% by 2027 [3]. This surge is creating fundamental challenges for utility infrastructure, with Goldman Sachs estimating approximately $720 billion of grid spending through 2030 may be needed to support this demand [3].

The grid interconnection process has emerged as a critical bottleneck. Utilities across North America and Europe report exponential increases in connection requests, with data centers driving the majority of new demand [3]. In Europe, utilities have seen a dramatic rise in connection requests over the past couple of years, mostly driven by data centers [3]. These delays are particularly problematic in regions like Northern Virginia, which has become a major data center hub.

Different regions are experiencing varying levels of impact from the AI power surge. PJM Interconnection, the largest U.S. grid operator, reported capacity auction prices hitting unprecedented levels, rising from $28.92/MW-day to $269.92/MW-day in the 2025/2026 auction—a nine-fold increase [2]. For the 2026/2027 delivery year, capacity prices hit the federally mandated price cap of $329.17 per MW-day, representing a 22% increase from the previous year and reflecting the tightest reserve margins in over a decade [6].

Virginia’s data center power demand is projected to reach roughly 12.1 GW in 2025, up from 9.3 GW in 2024, representing a 30% year-over-year increase [7]. Similarly, Texas utility power demand from data centers will hit approximately 9.7 GW in 2025, rising from less than 8 GW in 2024 [7].

The nature of data center infrastructure is evolving to meet AI-specific demands. AI-dedicated data centers represent an emerging class of infrastructure designed for high absolute power requirements, higher power density racks, and additional hardware such as liquid cooling [3]. Power density is expected to increase from 162 kilowatts per square foot to 176 kW per square foot by 2027 [3].

Approximately 35-40% of a hyperscaler’s energy consumption is from cooling, which presents significant opportunities for efficiency gains across different technologies [3]. This efficiency challenge is compounded by the fact that more than 70% of power transformers in the United States are more than 25 years old and in need of replacement [5].

The analysis reveals several critical risk factors that warrant attention:

The power constraint is fundamentally changing data center site selection criteria, with access to reliable, affordable power becoming more important than traditional factors like fiber connectivity or tax incentives. This shift is driving geographic diversification of data center locations, as traditional hubs like Northern Virginia face capacity constraints while emerging markets with available power capacity become more attractive.

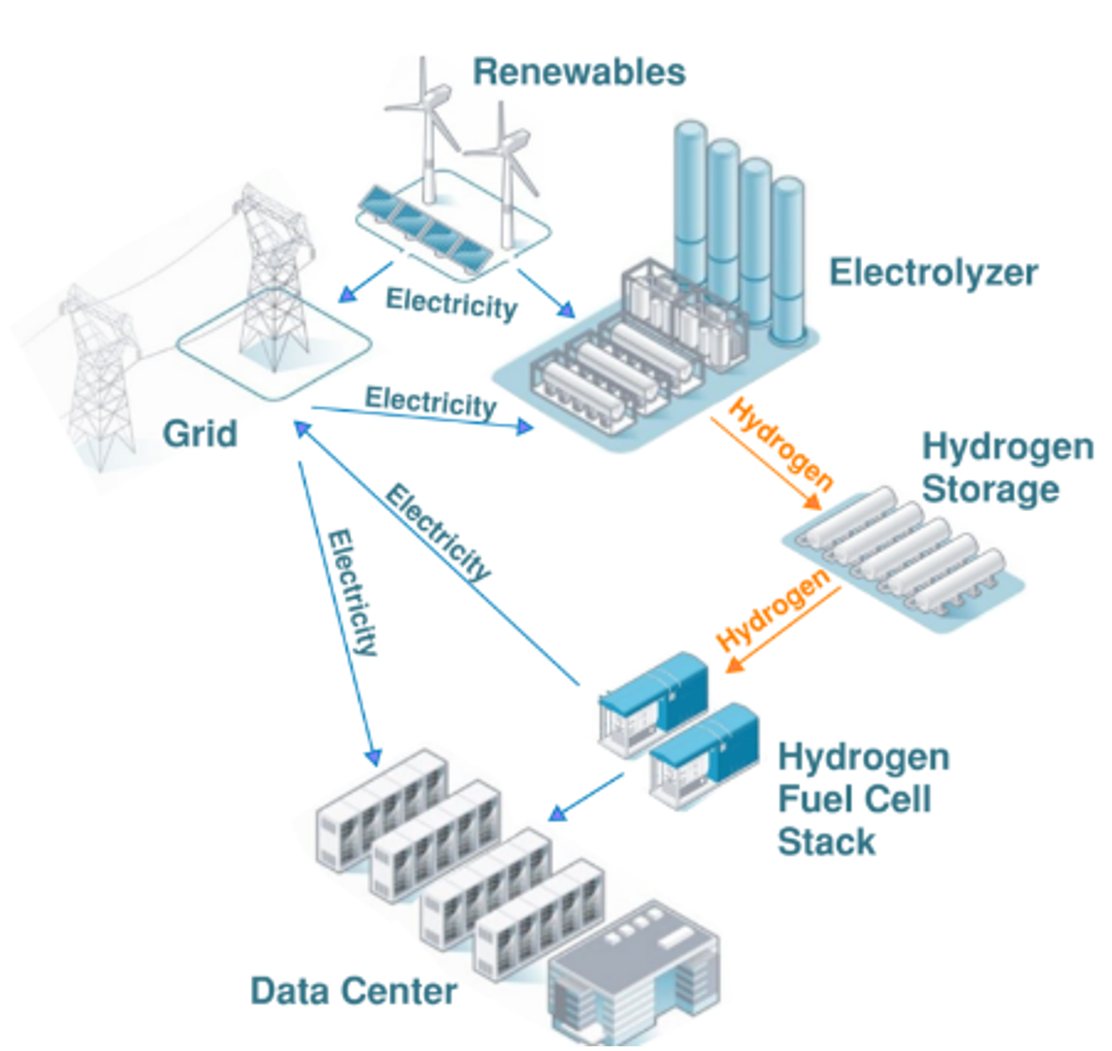

For utilities, the shift requires moving from traditional planning to rapid execution mode. They face growing pressure to keep firm capacity projects on schedule, reduce curtailment, and lower costs while supporting unprecedented demand growth [8]. Utilities are also exploring partnerships with hyperscale data centers as potential grid assets rather than just loads [8].

The analysis suggests focusing on “time-to-power” beneficiaries rather than traditional AI infrastructure plays, emphasizing companies that can rapidly deploy power solutions to meet immediate AI-driven demand growth. The transformer market’s projected growth to $33.25 billion by 2033 [5] underscores the massive infrastructure upgrade cycle underway to support AI expansion.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.