Analysis Report: SLV Put LEAPs Discussion (Reddit)

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

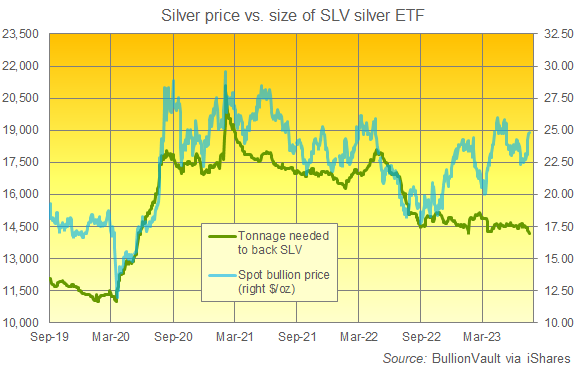

On 2025-11-30 (EST), a Reddit user questioned buying SLV Jan 2028 put LEAPs (strike $40, cost ~$4, breakeven $36) citing past silver crashes. Counterarguments highlighted theta decay, liquidity risks, fundamental support (supply deficit, industrial demand), and inverse ETF alternatives like ZSL.

SLV rallied 17.24% to $51.21 (Oct-Nov 2025), reducing put value via price appreciation and theta decay. ZSL (inverse) fell 30.53%.

Fundamentals: 5th successive silver supply deficit, industrial demand (solar/electronics), and Fed rate cut hopes support upside. No extreme WSB hype detected yet.

| Metric | Value | Source |

|---|---|---|

| SLV Price | $51.21 | [1] |

| SLV Monthly Return | +17.24% | [1] |

| ZSL Monthly Return | -30.53% | [2] |

| Silver Supply Deficit | 5th successive | [4] |

- Direct: SLV (bullish), ZSL (bearish), SLV puts (bearish)

- Related: Silver miners (PAAS, AG), solar/electronics sectors

- SLV Jan2028 put liquidity [6]

- Recent WSB activity [5]

- Exact theta decay rates

- Theta decay erodes put value over time

- Wide bid-ask spreads may hinder exit

- Fundamental support could keep prices elevated

[0] Ginlix Analytical Database

[1] SLV Price Data (2025-10-30 to 2025-11-28)

[2] ZSL Price Data (2025-10-30 to 2025-11-28)

[3] Ticker News Tool (SLV)

[4] Web Search: Silver Supply Deficit 2025

[5] Web Search: SLV WSB Mentions

[6] Web Search: SLV Put Liquidity

— End of Report —

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.