The Great Mini Rotation: Sector Leadership Dynamics Sustaining Market Rallies

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

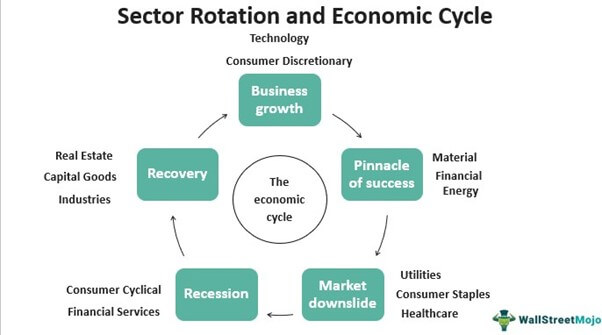

On November 29, 2025, Forbes published an article by Adam Sarhan titled “The Market’s Hidden Engine = The Great Mini Rotation” [0]. The piece introduces a recurring market pattern where sectors alternate leadership roles to sustain broader rallies:

- Pattern Mechanics: Leading sectors (e.g., AI/tech in 2025) pause, while undervalued/lagging sectors (healthcare, energy) take over, preventing deep corrections.

- Recent Observations: Energy stocks breaking out as AI stocks consolidate; healthcare/biotech rallies earlier in 2025 after lagging.

- Risk Note: Complacency is a key risk—simultaneous sector pullbacks could trigger corrections.

- Sector Rotation: Energy (+1.13%) led gains on November 29, aligning with the article’s observation of energy breakouts [1]. Healthcare (-0.03%) was the weakest, suggesting it may be resting after earlier rallies [1].

- Index Recovery: Major indices rebounded from the November 20 dip (NASDAQ: -4.25%):

- S&P500: +0.39% (Nov28)

- Dow Jones: +0.49% (Nov28)

- Russell2000 (small caps): +0.34% (Nov28) [2]

This recovery reflects rotation offsetting tech weakness.

Alternating leadership has sustained the bull market:

- Post-Nov20 dip: Russell2000 rose 2.00% (Nov25) and1.75% (Nov24), indicating broad participation [2].

- NASDAQ’s 0.32% gain (Nov28) vs Dow’s0.49% suggests tech is consolidating while cyclicals/value sectors lead [2].

| Metric | Value | Source |

|---|---|---|

| Energy Sector Change (Nov29) | +1.13% | [1] |

| Healthcare Sector Change (Nov29) | -0.03% | [1] |

| S&P500 Nov28 Gain | +0.39% | [2] |

| NASDAQ Nov20 Loss | -4.25% | [2] |

| Russell2000 Nov25 Gain | +2.00% | [2] |

- Directly Impacted Sectors:

- Leaders: Energy (XLE), Basic Materials (+0.62% [1]), Utilities (+0.60% [1])

- Laggards: Healthcare (XLV), Financial Services (-0.00% [1])

- Related Indices: Russell2000 (small-cap cyclicals), Dow Jones (value/cyclicals) [2]

- Verify energy stock breakouts (e.g., ExxonMobil (XOM), Chevron (CVX) recent price action).

- Confirm healthcare sector is resting (check XLV ETF volume/trend).

- Validate forward earnings estimates for S&P500 (as article claims they are climbing).

- Complacency Risk: The article warns against assuming rotation will always sustain the market—simultaneous sector pullbacks could trigger corrections [0].

- Macro Shocks: Geopolitical events or Fed policy changes may disrupt rotation (e.g., sudden rate hikes hit utilities).

- Sector performance trends (energy vs tech vs healthcare).

- Volume in rotating sectors (institutional inflows).

- Earnings estimate revisions for S&P500.

[0] Forbes Article: “The Market’s Hidden Engine = The Great Mini Rotation” by Adam Sarhan (2025-11-29)

[1] Sector Performance Data (2025-11-29)

[2] Market Indices Data (2025-11-19 to2025-11-28)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.