AI Stock Volatility Reveals US Market Tech Dependence Risks

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

This analysis is based on the Reuters report [1] published on November 6, 2025, which highlighted recent volatility in artificial intelligence-related stocks as a stark reminder of the U.S. stock market’s increasing dependence on the technology sector.

The Reuters report documented significant market volatility on November 4th, with the S&P 500 and Nasdaq Composite experiencing their largest single-day declines in nearly a month [1]. Market data confirms this pattern, showing the S&P 500 (^GSPC) dropping 0.25% to 6,771.55, while the Nasdaq Composite (^IXIC) fell 0.47% to 23,348.64 [0]. Both indices recovered on November 5th, with gains of 0.39% and 0.61% respectively, though tech sector weakness persisted [0].

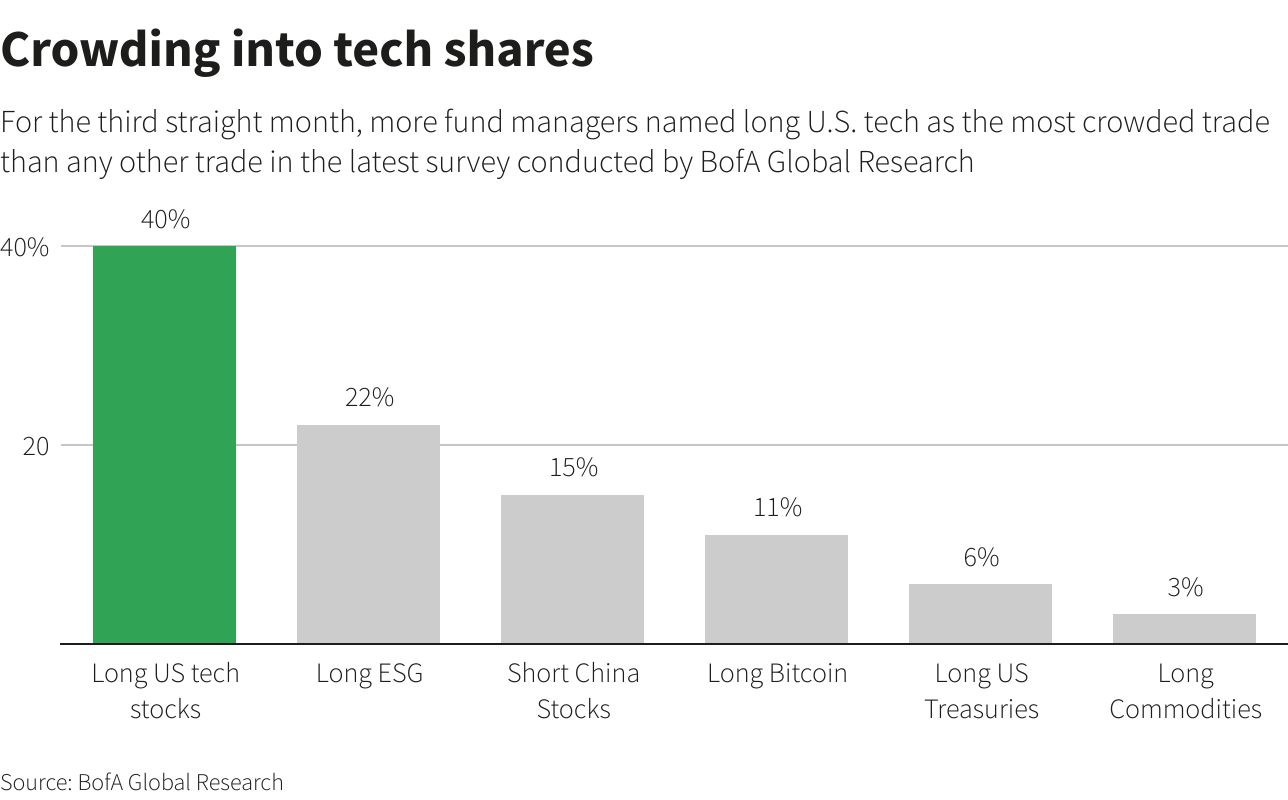

The most concerning revelation from the Reuters analysis is the unprecedented concentration of technology within the U.S. market. Technology now accounts for approximately 36% of the S&P 500’s market value - exceeding the concentration levels seen during the dot-com bubble era 25 years ago [1]. When including megacap companies not officially classified as tech (Alphabet, Amazon, Tesla, Meta), this combined weight reaches nearly 50% of the S&P 500 [1].

This concentration creates significant systemic vulnerability. As Matt Maley from Miller Tabak noted in the Reuters report, “If the tech stocks go down in any kind of sustained meaningful way, the indexes will go down” [1].

The Reuters analysis reveals concerning valuation metrics. The S&P 500’s forward P/E ratio stands at approximately 23x versus its 10-year average of 18.8x, while the tech sector’s forward P/E of about 32x significantly exceeds its 10-year average of 22.2x [1]. Individual AI stocks show even more elevated valuations, with NVIDIA at 55.46x and Palantir at 427.05x [0].

Tech’s performance has dramatically outpaced the broader market, gaining 186% during the current bull market versus the S&P 500’s 90% gain [1]. Year-to-date, tech remains the best-performing sector at +27% compared to the S&P 500’s +15% [1]. This outperformance has driven tech’s S&P 500 weighting from 33% at the start of 2025 to 36% currently [1].

Technology companies are expected to account for approximately 25% of aggregate S&P 500 earnings in Q3 2025, according to LSEG data cited by Reuters [1]. This earnings concentration amplifies market dependence on tech sector performance and creates vulnerability to any tech earnings disappointments.

The market’s AI dependence coincides with increasing geopolitical tensions. Recent developments show China banning Nvidia, AMD, and Intel AI chips from state-funded data centers [2], while Nvidia CEO Jensen Huang has warned that “China is going to win the AI race” due to Western “cynicism” [3]. These factors add complexity to the AI investment thesis and could impact growth prospects.

The Reuters report emphasizes that heavy reliance on a single investment theme typically leads to increased volatility [1]. Walter Todd from Greenwood Capital warned that “A significant percentage of the S&P is tied to one single sector and one single theme” [1], creating conditions ripe for sharp corrections if sentiment shifts.

- Tech Capital Spending Trends: Any reduction in AI-related capital spending could trigger broader market weakness [1]

- Regulatory Developments: China’s restrictions on foreign AI chips and potential Western countermeasures [2]

- Earnings Quality: Whether tech companies can sustain the growth rates implied by current valuations

- Sector Rotation: Signs of capital flowing from tech to other sectors could indicate broader market shifts

Current sector performance data shows Technology underperforming many sectors today, gaining only 0.40% compared to Energy (+2.80%), Industrials (+2.32%), and Healthcare (+1.73%) [0]. This relative weakness could present opportunities for diversification and risk management.

The recent AI stock volatility serves as a critical warning signal about market structure and concentration risks. The technology sector’s 36% weighting in the S&P 500 represents unprecedented concentration that exceeds dot-com bubble levels [1]. Combined with elevated valuations - tech’s forward P/E of 32x versus its 10-year average of 22.2x [1] - the market appears vulnerable to corrections.

Key AI stocks like NVIDIA (down 3.91% over the past week to $195.21) and Palantir (declining 0.58% on November 5th to $187.90) [0] show the fragility of current market sentiment. Technology’s expected 25% contribution to Q3 2025 S&P 500 earnings [1] further amplifies this concentration risk.

The market’s recovery on November 5th, while tech continued to extend losses slightly [1], suggests potential decoupling patterns that warrant close monitoring. Current relative underperformance of tech versus other sectors [0] could indicate early stages of sector rotation, though the high concentration makes any sustained tech decline likely to impact broader market performance.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.