Small Modular Reactors: Tech Giants Drive Nuclear Renaissance with Strategic Investments

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

This analysis is based on the Seeking Alpha report [1] published on November 6, 2025, highlighting how major technology companies are embracing Small Modular Reactors (SMRs) as a strategic solution to meet growing energy demands while addressing climate commitments. The entry of Google, Amazon, and Microsoft into the nuclear energy space represents a fundamental shift in the industry landscape, with the global SMR market projected to experience robust growth through 2035. However, significant challenges remain in achieving cost competitiveness, developing supply chains, and navigating regulatory frameworks.

The most significant development in the SMR landscape is the direct involvement of major technology companies as investors and customers. Google has partnered with Kairos Power for SMR deployment with first units expected by 2030 [1], Amazon made a $500 million investment in X-energy’s Series C-1 financing round [2], and Microsoft secured an agreement with Constellation Energy to revive the Three Mile Island nuclear power plant [1]. This represents a departure from the traditional utility-dominated nuclear industry model, with tech companies bringing substantial financial resources and specific energy reliability requirements that align well with SMR characteristics.

The SMR industry is experiencing divergent but consistently positive growth projections. According to Spherical Insights & Consulting, the global SMR market is projected to grow from USD 5.95 billion in 2024 to USD 8.20 billion by 2035, at a CAGR of 2.96% [2]. Other research suggests even more aggressive expansion, projecting growth from $159.4 million in 2024 to $5.17 billion by 2035, driven by a 42.31% CAGR [3]. This variation reflects different market definitions and methodologies, but all indicate strong momentum.

Geographic analysis shows North America dominated the SMR market in 2024, while Asia Pacific is estimated to expand at the fastest CAGR between 2025 and 2034 [4]. This regional diversification reflects different priorities and regulatory environments, with state legislatures across America increasingly embracing nuclear technology in 2025 after decades of skepticism [4].

Achieving economic viability remains a critical challenge for SMR deployment. Arthur D. Little analysis indicates that SMRs must achieve levelised costs of electricity between €52 and €119 per megawatt-hour to compete with other baseload energy sources [5]. For context, the International Energy Agency estimates advanced nuclear LCOE at $63.10/MWh, while renewable sources range from $30.43/MWh (solar) to $120.51/MWh (offshore wind) [6].

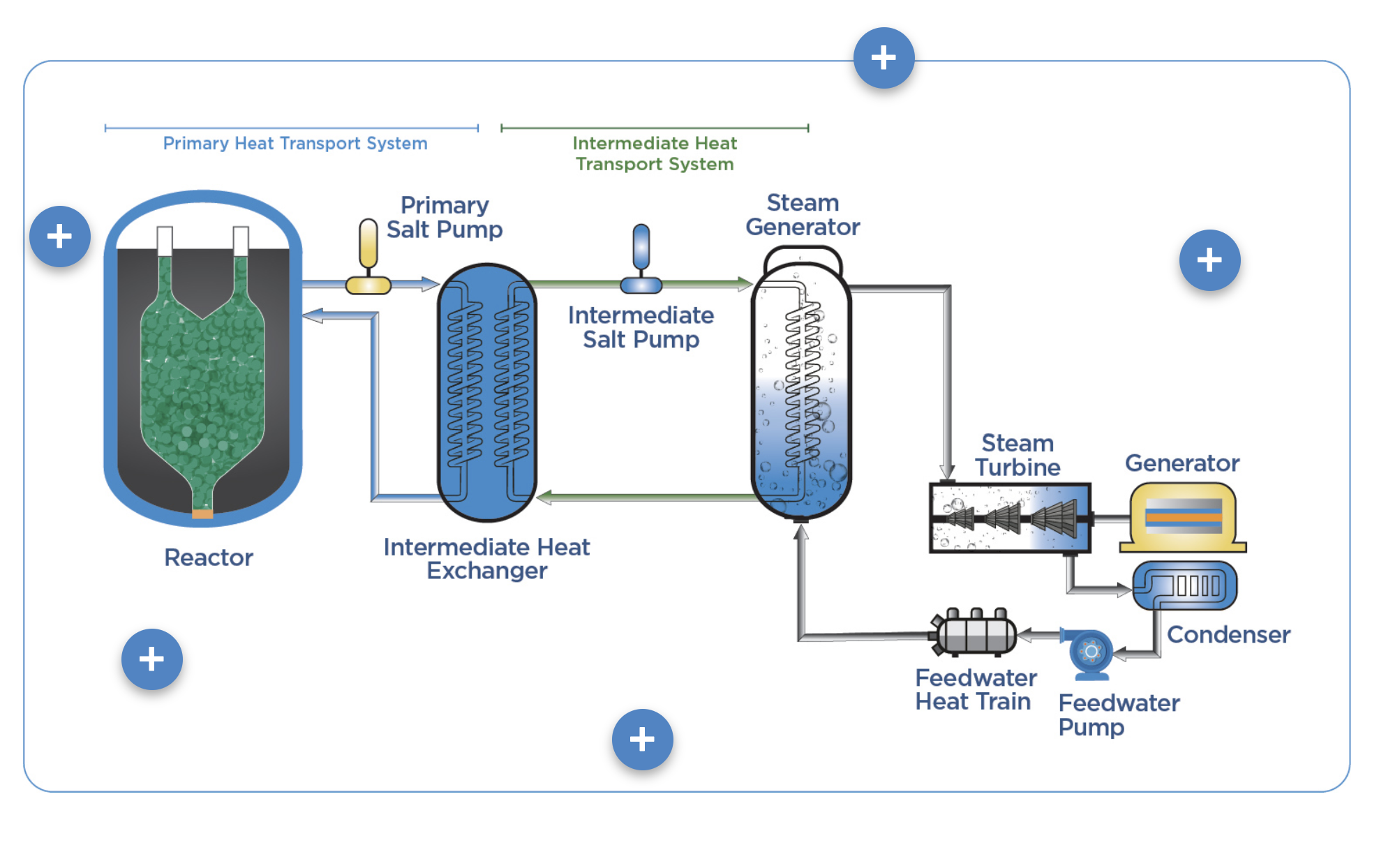

SMRs promise to address traditional nuclear energy’s key challenges—cost overruns and construction delays—through factory production methods and modular design [1]. The technology offers enhanced safety features, lower capital costs through modular construction, flexible deployment options, and scalability through incremental unit additions.

The SMR industry faces significant supply chain challenges, particularly regarding nuclear fuel. Many leading SMR companies including Oklo, X-energy, TerraPower, and Kairos Power plan to use high assay low enriched uranium (HALEU)-based fuels [7]. However, current supply constraints are severe:

- Only one domestic conversion plant (ConverDyn) capable of meeting 30-60% of U.S. demand

- U.S. commercial reactors rely on international suppliers: Cameco (Canada), Orano (France), Rosatom (Russia), and CNNC (China)

- Limited current capacity for advanced reactor fuels [7]

These dependencies create potential vulnerabilities that could impact deployment timelines and costs.

The SMR developer landscape is consolidating around key players with distinct technological approaches:

- X-energy: Developing 80 MW Xe-100 reactors with modular, road-shippable design optimized for multi-unit plants (320-960 MW) [2]

- Kairos Power: Partnered with Google for SMR deployment [1]

- NuScale Power: Received $227.7 million cash infusion in December 2024, enhancing international expansion capabilities [3]

- Traditional Nuclear Giants: Westinghouse, Rolls-Royce, and ROSATOM are also developing SMR variants

The technology company investments are accelerating this consolidation, with resources flowing to developers that can demonstrate near-term deployment capabilities.

State legislatures across America are showing dramatically increased support for nuclear technology in 2025 [4]. This policy evolution is driven by three converging factors:

- Surging electricity demand from AI infrastructure and data centers

- Climate commitments requiring carbon-free baseload power

- Energy security concerns following recent global events

The regulatory approval timeline will significantly impact deployment schedules, with first-of-a-kind (FOAK) projects facing particular scrutiny. However, successful early deployments could shape technology and policy “for decades to come” [6].

The SMR industry stands at a critical inflection point, with technology company investments signaling growing confidence in the technology’s potential to address both climate and energy security challenges. The convergence of rising electricity demand from AI infrastructure, climate commitments, and technological maturation creates favorable conditions for SMR deployment.

For technology companies, SMR investments represent strategic moves to secure reliable, carbon-free power for data centers and AI infrastructure, with the modular nature allowing for scalable deployment matching growth in computing demand [1].

For traditional utilities, SMR technology offers opportunities to modernize generation portfolios with smaller, more manageable projects compared to traditional large-scale nuclear plants, though it also presents competitive threats as technology companies bypass traditional utility models.

For investors, the SMR sector presents diverse opportunities across the value chain—from reactor developers to fuel suppliers and component manufacturers. The technology’s lower upfront capital requirements compared to traditional nuclear projects broaden the potential investor base [5].

Success will depend on achieving cost competitiveness targets, developing robust HALEU fuel supply chains, and navigating regulatory frameworks efficiently. The next 3-5 years will be crucial in determining whether SMRs can transition from promising technology to mainstream energy solution.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.