In-depth Analysis of Recent Popular Driving Factors for Tongyu Communication (002792.SZ): Balancing Concept Hype and Fundamentals

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

###1. Executive Summary

This analysis is based on Tongyu Communication (002792.SZ) recently appearing on the hot list, combined with internal analyst reports [0] and external market information. Core driving factors include increased investment in the commercial aerospace track [5][9], benefits from the CPO concept [0], policy support for satellite internet [4], and a large inflow of main capital [2]. Although the company’s fundamentals were under pressure in the first three quarters of 2025 [0], concept hype has driven strong short-term stock price performance.

###2. Comprehensive Analysis

Tongyu Communication’s recent popularity mainly stems from the resonance of multiple concepts:

- Commercial Aerospace Layout: The company invested RMB120 million to increase its stake in the commercial aerospace track, specifically investing in Beijing Lingkong Tianxing Technology [5][9], and layout in the cutting-edge field of hypersonic technology [6];

- CPO Concept Support: Shareholding subsidiary Sichuan Guangwei’s 800G optical modules have been shipped in small batches, and the 1.6T optical modules are in the R&D and testing phase [0], benefiting from the CPO concept hype [1];

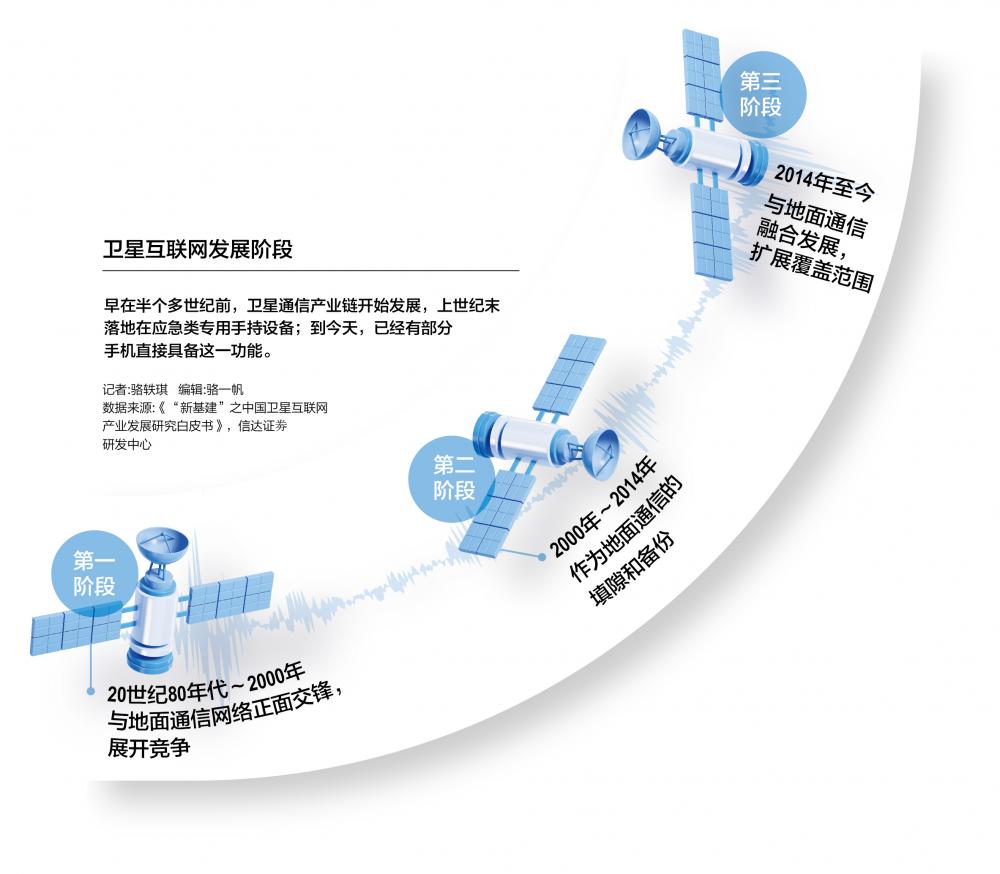

- Satellite Internet Dividends: Fully layout the ‘satellite-ground-terminal’ satellite internet industry chain, benefiting from national 6G and constellation construction policy support [4];

- Capital-driven: Continuous limit-ups on November 27-28, with main capital net buying RMB187 million in a single day [2], and market attention increased sharply [8].

At the same time, the company’s revenue in the first three quarters of 2025 was RMB815 million (YoY -3.34%), and net profit attributable to parent company was RMB25.2746 million (YoY -50.91%) [0], forming a sharp contrast between fundamentals and concept hype.

###3. Key Insights

- Concept Speculation Dominates Short-term Performance: Stock price rise is mainly driven by hot concepts such as commercial aerospace and CPO, not fundamental improvement [0][4];

- Overseas Business Becomes Potential Growth Point: Overseas revenue exceeded domestic revenue for the first time in the first half of the year, and cooperation with strategic customers like Ericsson was deepened [0];

- Risks and Opportunities Coexist: Concept hype brings short-term opportunities, but attention should be paid to fundamental pressure and concept retreat risks [0][3].

###4. Risks and Opportunities

- Risk Points: Sustained fundamental pressure, concept speculation retreat, intensified market volatility [0][3];

- Opportunity Window: Long-term track potential of commercial aerospace and satellite internet, possibility of CPO technology breakthrough [1][5];

- Priority Assessment: In the short term, attention should be paid to capital flow and sustainability of concept hype; in the long term, track fundamental improvement [0][2].

###5. Key Information Summary

Tongyu Communication’s recent popularity is the result of concept hype and capital promotion. Investors need to balance concept speculation opportunities and fundamental risks. It is recommended to pay attention to the progress of the company’s commercial aerospace layout, CPO product R&D, and overseas business expansion results, while alerting to market volatility and concept retreat impacts.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.