U.S. Market Speed Bump Analysis: Rally Potential Despite October 22 Pullback

Related Stocks

This analysis is based on the MarketWatch report published on October 22, 2025, which reported that U.S. stocks encountered a “rough patch” but experts anticipate more positive developments ahead. The market experienced a notable pullback with all major indices declining significantly, yet underlying fundamentals remain strong with robust earnings performance supporting the case for a resumed rally.

On October 22, 2025, U.S. stocks faced substantial downward pressure across all major indices. The S&P 500 declined 0.62% to close at 6,699.40, the Dow Jones Industrial Average dropped 0.75% to 46,590.41, and the NASDAQ Composite fell 0.87% to 22,740.40 [0]. The market exhibited significant intraday volatility, with the S&P 500 trading in a range from 6,655.69 to 6,741.75 [0], suggesting active institutional participation in the price movements.

Trading volumes were notably elevated, with the S&P 500 recording 3.40 billion shares and the NASDAQ trading 13.24 billion shares [0]. This high volume indicates strong conviction behind the sell-off, potentially reflecting institutional rebalancing rather than retail panic selling.

The market decline revealed a clear risk-off sentiment with pronounced sector rotation patterns:

- Communication Services: -2.05% [0]

- Utilities: -2.04% [0]

- Consumer Cyclical: -1.23% [0]

- Healthcare: -1.42% [0]

- Industrials: -1.29% [0]

- Consumer Defensive: +0.44% [0]

- Real Estate: +0.42% [0]

- Basic Materials: +0.05% [0]

This rotation toward defensive sectors suggests investors were seeking safety amid market turbulence, potentially indicating a temporary shift in risk appetite rather than a fundamental change in market outlook.

The technology sector, which has been a key driver of recent market gains, underperformed with a 0.82% decline [0]. Major technology stocks experienced significant pressure:

- Apple (AAPL): Declined 1.64% to $258.45, with high trading volume of 40.85M shares [0]

- Tesla (TSLA): Dropped 0.82% to $438.97 on heavy volume of 74.40M shares [0]

Despite these declines, both stocks remain well above their 52-week lows, suggesting the pullback may be more profit-taking than fundamental deterioration. Valuation metrics remain elevated but not extreme, with Apple’s P/E ratio at 35.60x and Tesla’s at 231.04x [0].

Despite the market decline, the earnings season has been remarkably strong. Approximately 85% of S&P 500 companies that have reported third-quarter earnings so far have surpassed profit estimates, marking the best performance since 2021 [1]. This strong earnings performance provides fundamental support for the market’s longer-term outlook and suggests the current pullback may be temporary.

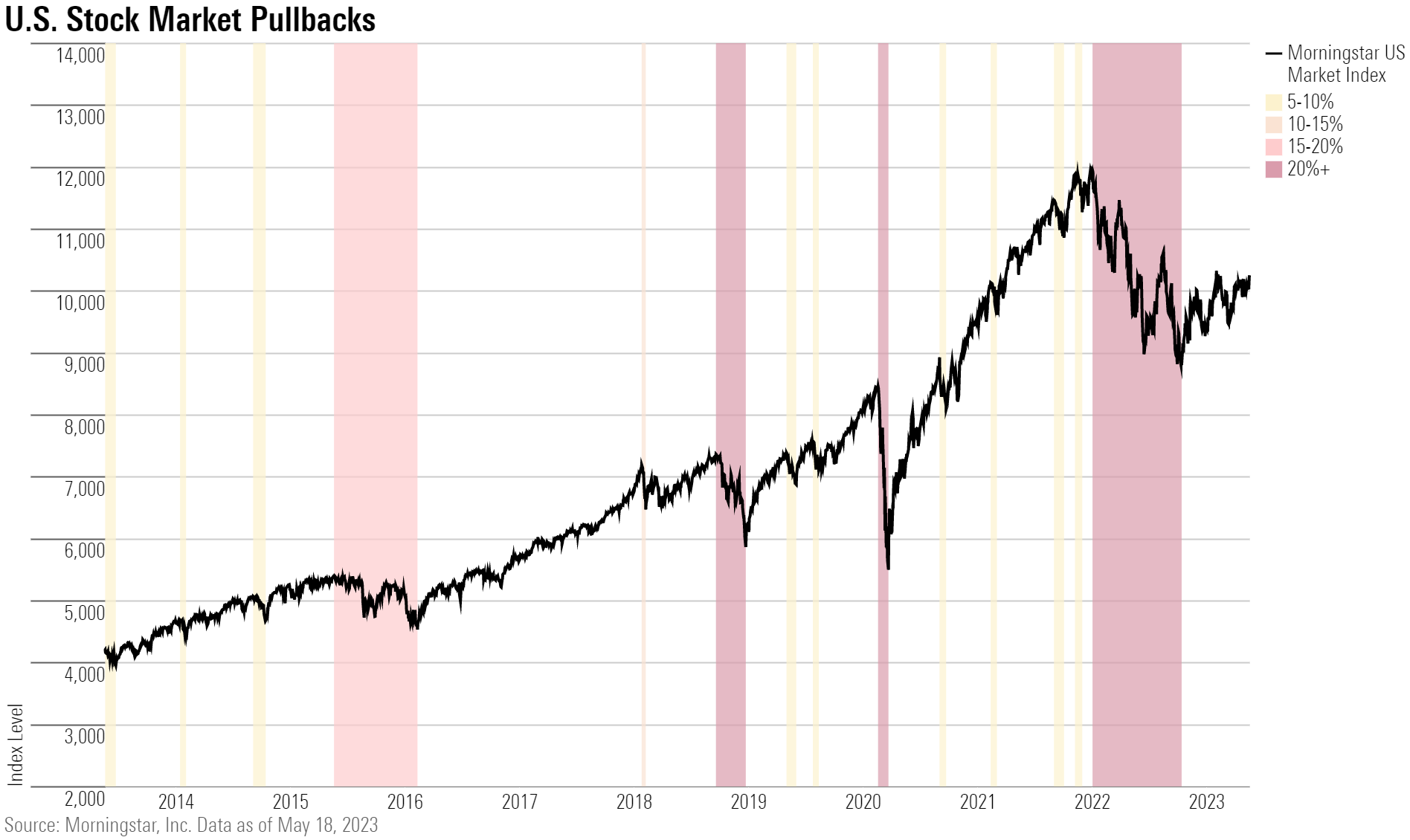

The current market pullback appears to be driven more by technical factors and sentiment rather than fundamental concerns. The divergence between strong earnings fundamentals and short-term price weakness creates an interesting dynamic where technical consolidation may be occurring within a fundamentally supported bull market.

The elevated trading volumes and sector rotation patterns suggest the market may be entering a more mature phase of the current rally. The shift toward defensive sectors could indicate changing investor preferences and potentially reduced appetite for risk, which may influence market dynamics in the near term.

- Earnings Fatigue: With 85% of companies beating estimates, expectations may be running high, increasing the risk of disappointment [1]

- Valuation Pressure: Extended valuations in technology names could face continued pressure if growth expectations moderate

- Sector Concentration Risk: Heavy reliance on mega-cap technology stocks for market performance creates concentration risk

- Technical Breakdown Risk: The recent decline could signal the beginning of a more significant technical correction if support levels fail to hold

- Defensive Sector Strength: The outperformance of consumer defensive and real estate sectors may present opportunities for risk-averse investors

- Potential Oversold Conditions: The strong volume-driven decline may create attractive entry points in fundamentally sound technology stocks

- Earnings Momentum: Continued strong earnings reports could provide catalysts for market recovery

Decision-makers should closely monitor:

- Upcoming Earnings: Remaining major company reports could set the tone for market direction

- Economic Data Releases: Key inflation and employment data will influence Federal Reserve expectations

- Market Breadth: Watch for confirmation of whether the decline is broad-based or concentrated

- Volatility Indicators: VIX levels and options positioning can provide insight into market sentiment

The October 22, 2025 market decline represents a notable technical pullback within a fundamentally supported market environment. The strong earnings performance, with 85% of S&P 500 companies beating estimates [1], provides underlying support for potential rally resumption. However, the sector rotation toward defensive positions and elevated trading volumes suggest investors are becoming more selective and risk-averse.

The technology sector’s underperformance, particularly in mega-cap names like Apple and Tesla, reflects profit-taking rather than fundamental deterioration. Current valuation levels, while elevated, remain within historical ranges for growth stocks.

[0] Ginlix Analytical Database - Market data and real-time quotes

[1] Bloomberg - “Early US Earnings Point to Best Corporate Results in Four Years” (October 22, 2025)

[2] MarketWatch - “U.S. stocks are hitting a speed bump. Why the rally could soon resume” (October 22, 2025)

[3] Morningstar/MarketWatch - “Why stock-market investors will be hanging on every CEO’s word this earnings season” (October 22, 2025)

[4] Yahoo Finance - “Stock Market News for Oct 22, 2025” (October 22, 2025)

[5] StockAnalysis.com - Market news and analysis (October 22, 2025)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.