NXXT Market Analysis: Floor Forming, Warrant Overhang, and Growth Validation Needs

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

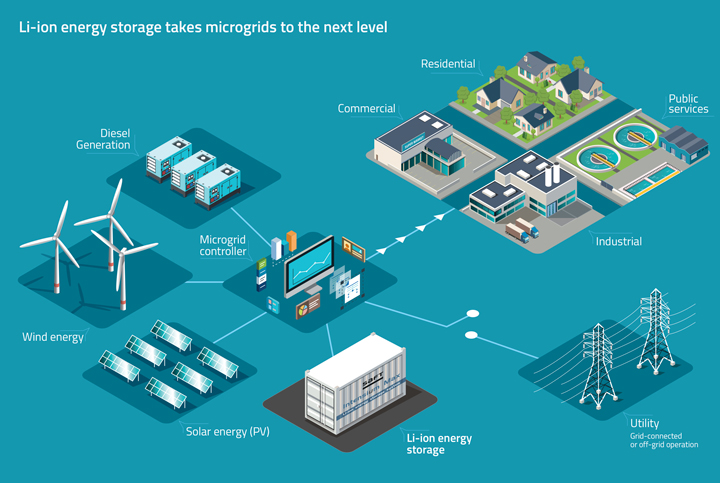

This analysis combines insights from a Reddit discussion [3] about NXXT (NextNRG Inc.) with recent company developments and market data [0]. NXXT’s stock price has declined 56% over the past 30 days to $1.10 but may be stabilizing around a floor of $0.98-$1.15 as suggested by Reddit users [3]. The company reported strong Q3 2025 results: 232% YoY revenue growth ($22.9M) and gross margin expansion to 11% from 8% [1]. Additionally, NXXT secured a 28-year microgrid power purchase agreement (PPA) with a California healthcare facility, marking its entry into the healthcare resilience market [2]. Sector performance shows utilities (NXXT’s sector) up 1.05% recently, aligning with broader market trends [0].

Cross-domain connections reveal that NXXT’s shift to microgrids and storage (especially for healthcare facilities) positions it to benefit from growing resilience trends. However, the need for additional contracts (as emphasized in the Reddit discussion [3]) highlights a critical gap in validating scalable growth. The tension between strong revenue growth [1] and negative EPS (-$0.48 TTM [0]) indicates a focus on top-line expansion over profitability in the short term.

Key metrics include Q3 2025 revenue of $22.9M (232% YoY [1]), 11% gross margin [1], 30-day price decline of 56% [0], and average daily volume of 1.9M shares [0]. The stock trades near its 52-week low ($0.93-$4.34 [0]), supporting the potential floor claim. NXXT’s pipeline of over a dozen projects (per CEO comments [1]) needs further detail to assess scalability.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.