Dongtian Micro (301183) Limit-Up Analysis: Driven by Optical Chip Sector Heat and Silicon Photonics Technology

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Dongtian Micro (301183) achieved a 20% limit-up on the ChiNext board on November 28, 2025, with a closing price of 122.22 yuan and a turnover of 87.06 million yuan [0]. The company mainly engages in the R&D and manufacturing of optical components and optical communication devices, whose products are widely used in consumer electronics, optical communication and other fields [0]. This limit-up was mainly driven by the following factors:

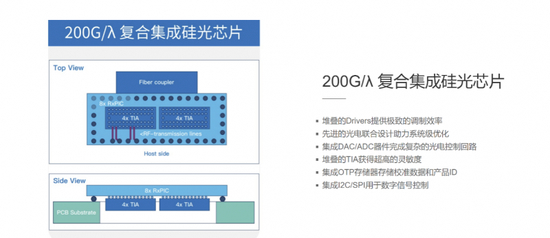

- Optical Chip Sector Heat: Optical chips and silicon photonics technology have become hot spots pursued by market funds, and the industry prosperity has rebounded [0][6];

- Semiconductor Industry Recovery: The global semiconductor industry is gradually emerging from the trough, and related concept stocks have performed strongly [0][6];

- Event-driven: Industry events such as Jensen Huang’s visit to Taiwan have pushed up the stock prices of the silicon photonics group, driving the performance of individual stocks in the sector [5];

- Sector Effect: On the same day, a total of 70 individual stocks in the A-share market had a limit-up, and the optical optoelectronics and semiconductor sectors performed actively overall [1][2].

- Cross-domain Linkage: Global tech trends (silicon photonics technology) and local market events (industry leader’s Taiwan visit) jointly promoted the performance of individual stocks, reflecting the global linkage characteristics of the tech sector [5][6];

- Demand Driver: The demand for optical communication devices continues to grow, especially in data centers, 5G and other fields. Dongtian Micro’s product layout is highly aligned with high-growth fields [0][6];

- Short-term Momentum: The first-board limit-up shows high market attention, but short-term price fluctuations caused by speculation need to be wary of [1][3].

- Industry Growth: The optical photonics industry has significant long-term growth potential, benefiting from the continuous penetration of cloud computing, artificial intelligence and 5G [6];

- Product Advantages: Dongtian Micro’s technical accumulation in the optical communication device field is expected to be converted into an increase in market share [0].

- Short-term Volatility: Sector heat may lead to short-term overvaluation, with callback risks [1][3];

- Industry Competition: The optical component market is highly competitive, and attention should be paid to the company’s technological innovation and cost control capabilities [0];

- Cyclical Risk: The semiconductor industry has cyclical characteristics, and the sustainability of the industry recovery remains to be observed [6].

Dongtian Micro (301183)'s recent limit-up reflects the strong short-term momentum of the optical chip and silicon photonics sectors, driven by factors including industry upturn, event-driven factors and sector effects. Investors should combine the company’s fundamentals (such as product competitiveness, financial status) with long-term industry trends to balance short-term opportunities and long-term risks.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.