Apple Set to Overtake Samsung in Smartphone Shipments Amid US Market Rally

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

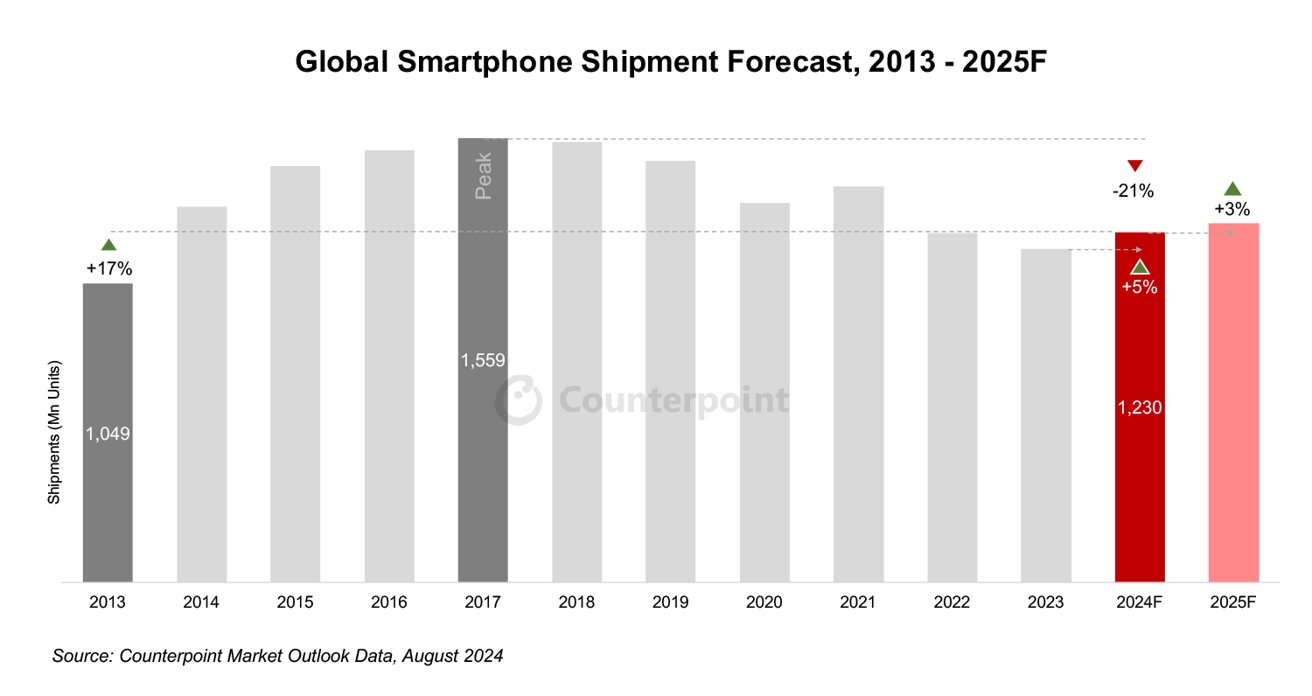

Apple is projected to overtake Samsung as the world’s top smartphone shipper in 2025 with 243M units vs Samsung’s235M (Counterpoint Research via CNBC [1]). This news coincided with a four-day US market rally: S&P500 (+1.6%), NASDAQ (+1.5%), and Dow Jones (+2.1%) gains over November23-26 [0]. Tech sector outperformed, with Oracle (ORCL) rising ~4% after Deutsche Bank’s upgrade and Nvidia (NVDA) and Microsoft (MSFT) gaining in sympathy [1]. The rally is supported by 85% market expectation of a December Fed rate cut [1], linking macroeconomic policy to tech sector momentum.

- Cross-Domain Correlation: Apple’s shipment lead reflects strength in the premium segment, aligning with tech sector outperformance amid rate cut optimism.

- Emerging Market Risks: Regulatory challenges in India (potential $38bn fine) highlight the balance between growth in emerging markets and compliance [2].

- Supply Chain Implications: Apple’s higher shipments could benefit semiconductor suppliers like TSMC (TSM) and Qualcomm (QCOM) [0].

- Regulatory: Apple’s challenge to India’s $38bn fine may impact international operations if unsuccessful [2].

- Macroeconomic: Fed failing to cut rates in December could trigger a market sell-off [1].

- Competitive: Samsung may respond with aggressive pricing or new launches to regain share [0].

- Tech Sector: Rate cut implementation could sustain tech upside [1].

- Apple: Higher shipments may drive Q4 revenue growth [0].

- Semiconductors: Supply chain partners (TSM, QCOM) could benefit from increased component demand [0].

- Apple projected to ship 243M iPhones in2025 vs Samsung’s235M [1].

- US indices gained 1.5-2.1% over four days (Nov23-26) [0].

- Affected tickers: AAPL, SSNHZ, ORCL, NVDA, MSFT, TSM, QCOM.

- Key risks: India regulatory fine, Fed policy, Samsung’s response.

- Key opportunities: Tech sector upside, Apple revenue growth, semiconductor supply chain benefits.

All information supports decision-making and is not investment advice.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.