U.S. Services PMI Surges to 52.4 in October, Driving Market Rally on Economic Strength

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

This analysis is based on the Wall Street Journal report [1] published on November 5, 2025, which detailed the Institute for Supply Management’s Services PMI data showing significant acceleration in U.S. services sector activity.

The Services PMI climbed to

The market reaction was immediate and broadly positive, with major indices posting gains on November 5, 2025 [0]:

- S&P 500: +27.92 points (+0.41%) to 6,797.69

- NASDAQ Composite: +153.91 points (+0.66%) to 23,511.98

- Dow Jones Industrial Average: +37.73 points (+0.08%) to 47,135.04

- Russell 2000: +18.90 points (+0.78%) to 2,448.03

Sector performance reflected the services strength, with Energy (+3.21%), Industrials (+1.33%), and Technology (+0.81%) leading gains, while Consumer Cyclical (-1.09%) and Consumer Defensive (-0.99%) sectors underperformed [0].

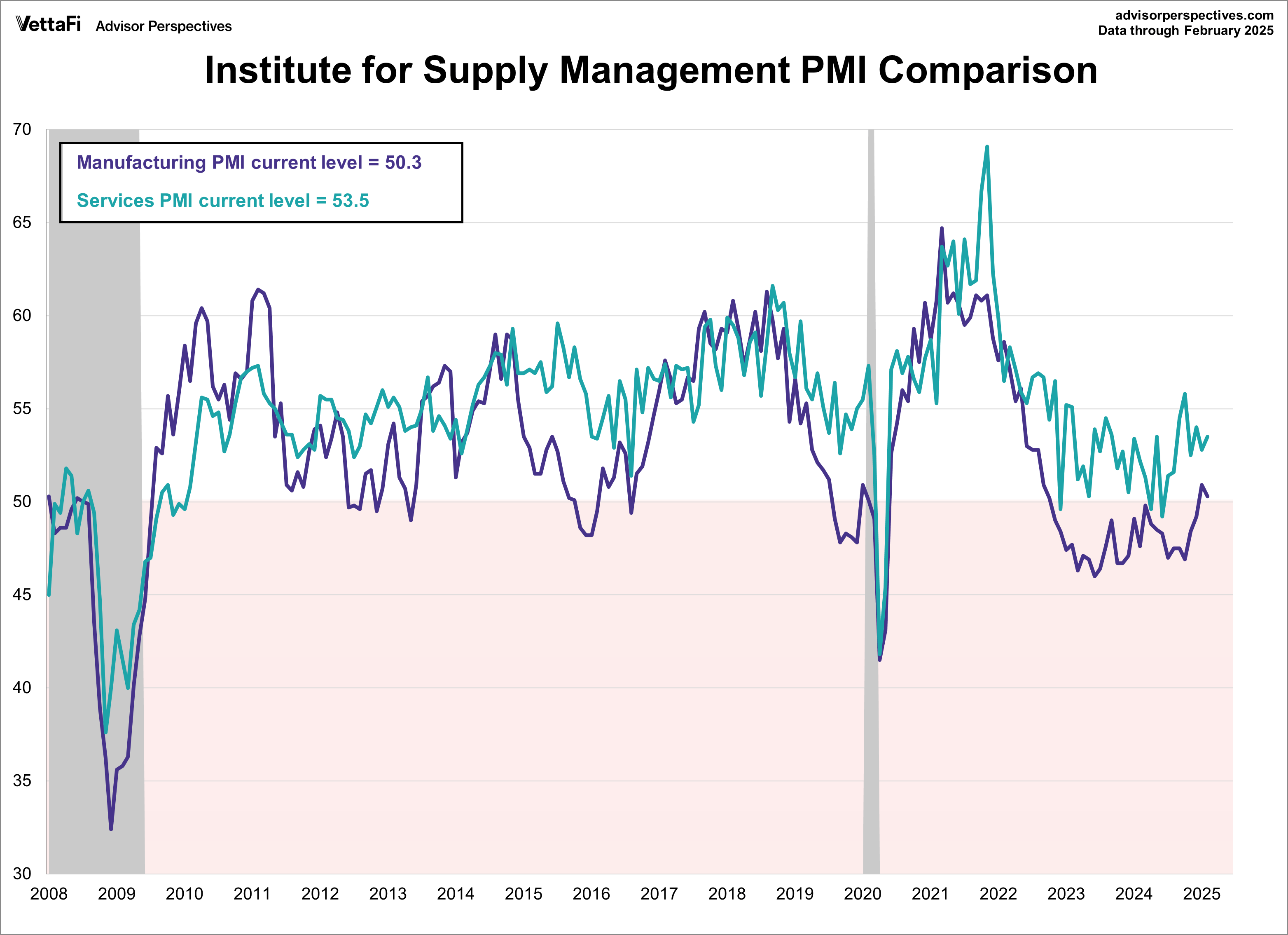

The October Services PMI reading of 52.4 represents a significant acceleration in U.S. services sector activity, with the Business Activity Index reaching 54.3% [2]. This strength contributed to broad market gains, particularly in technology and small-cap stocks. However, the data presents a mixed picture with persistent inflation concerns, manufacturing weakness, and sector divergence suggesting selective opportunities rather than uniform benefits across the economy.

The declining Prices Index at 40.8% indicates improving inflation dynamics, which could influence Federal Reserve policy considerations favorably [2]. Nevertheless, market analysts caution that the data may not support rate cuts in December due to remaining inflation pressures [3].

For decision-makers, the key consideration is that services sector strength may not translate uniformly across all industries, with individual company performance varying significantly despite the overall positive trend. The divergence between sector performance and individual stock reactions suggests that careful stock selection within the services universe may be more important than broad sector exposure [0].

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.