Health Care Sector Rally Analysis: Drivers, Metrics, and Risk Considerations (Nov 2025)

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

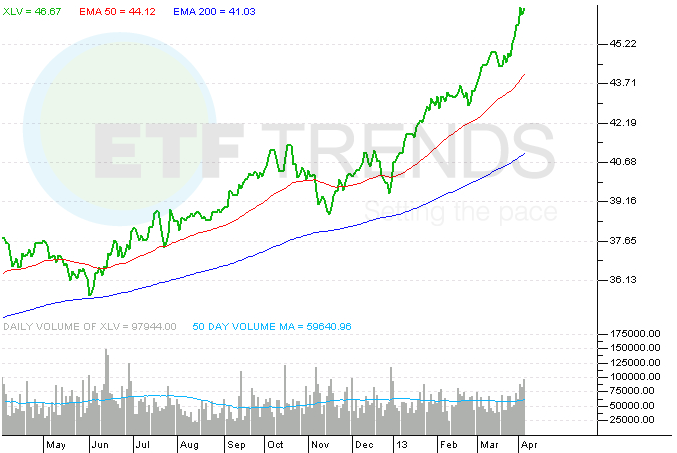

The health care sector experienced a robust rally in Nov 2025, with the Healthcare Select Sector SPDR Fund (XLV) rising ~8.44% over the month ending Nov 26 [0]. This aligns with the reported trend of the sector being 10% above its 50-day moving average and 2.5 standard deviations above it [4]. Key drivers include:

- Policy expectations: A proposed two-year extension of Affordable Care Act (ACA) subsidies [2].

- Defensive rotation: Investors shifted to defensive sectors amid market uncertainty [1].

- Company-specific gains: Eli Lilly (LLY) surged ~29% due to pipeline and earnings strength [1].

The sector saw a minor pullback (-0.117%) on Nov 26, indicating possible short-term consolidation [0].

Cross-domain connections highlight the interplay between policy (ACA subsidy extension), market sentiment (defensive rotation), and company fundamentals (LLY’s growth). The rally underscores the sector’s defensive role during volatile periods [1,2].

- Short-term pullback: Nov 26 decline suggests temporary pause potential [0].

- Policy uncertainty: Failure to extend subsidies could reverse gains [2].

- Overvaluation: Sector’s position (2.5 std dev above 50-day MA) may signal overbought conditions [4].

- Defensive appeal: Continued market uncertainty could sustain demand [1].

- Policy tailwinds: Subsidy extension would stabilize sector revenue [2].

- XLV ETF: +8.44% (Oct26-Nov26, $146.09 → $158.42) [0].

- Top performer: LLY up ~29% [1].

- Policy driver: Proposed two-year ACA subsidy extension [2].

- Risk indicators: Nov26 pullback (-0.117%) and policy uncertainty [0,2].

This summary provides objective context without prescriptive recommendations.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.