Nvidia Robotics Reveal: Market Positioning and Competitive Landscape Analysis

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

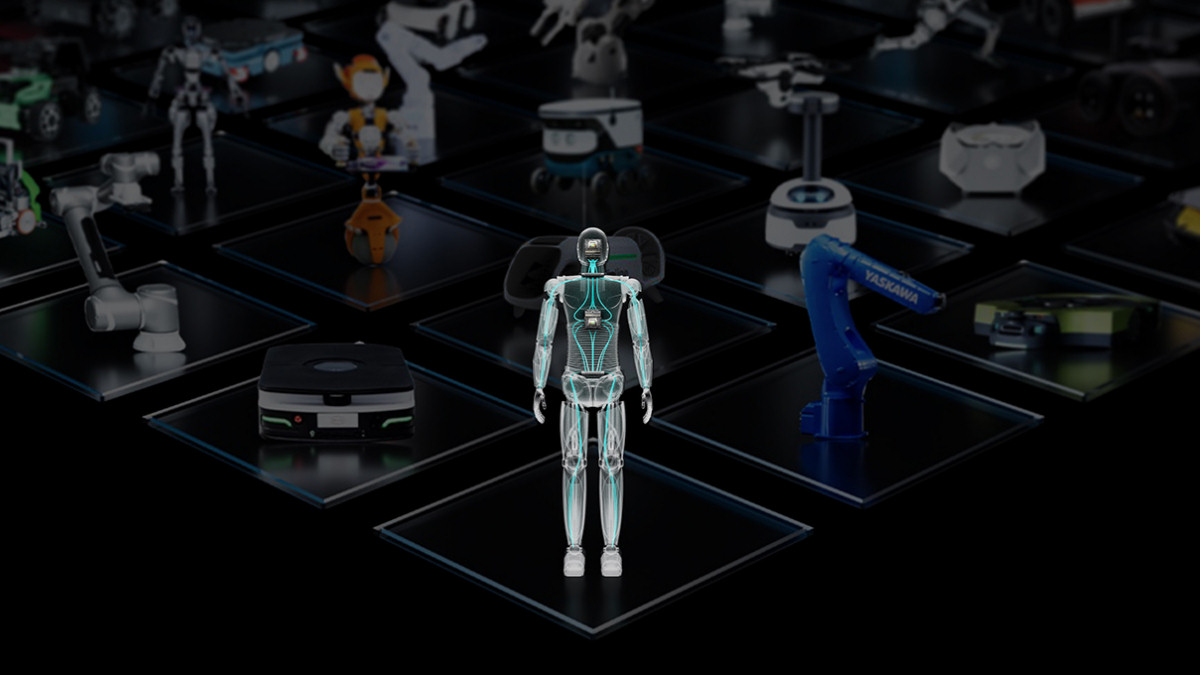

Nvidia’s upcoming robotics reveal (teased as the “reveal of the season” [Event Source]) is expected to focus on

- End-to-end ecosystem integration: Combining AI chips (Blackwell), cloud services (DGX Cloud), and software tools for robotics perception/motion control [1].

- Specialized accelerators: Jensen Huang framed 2025 as a tipping point for accelerators optimized for robotics workloads [2].

- Industrial use case focus: Nvidia’s participation in Foxconn’s Tech Day (Nov 21) highlighted AI-powered supercomputing for factory automation [1].

Differentiation from existing solutions: Unlike standalone robotics hardware, Nvidia’s offering leverages its dominant AI chip ecosystem to deliver scalable, software-defined intelligent machines [1,3].

- Target Segments: Enterprise manufacturing (Foxconn partnership), logistics, and industrial robotics [1].

- Pricing Strategy: Expected to follow Nvidia’s premium positioning (consistent with its data center chip business [7]).

- Distribution Channels: Existing enterprise partners (cloud providers, industrial OEMs like Foxconn) and Nvidia’s direct sales network [1].

- Google: Meta’s potential TPU deal (billions in spending from 2027) positions Google as a cost-effective alternative to Nvidia chips [4]. Google aims to capture10% of Nvidia’s revenuevia TPUs [4].

- Chinese Firms: DeepSeek and others are adapting to U.S. export controls by optimizing model efficiency and using overseas channels to access Nvidia chips [5,6].

- Traditional Robotics Players: ABB and Fanuc may enhance AI capabilities to compete [1].

| Nvidia Strengths | Nvidia Weaknesses |

|---|---|

| Integrated hardware/software ecosystem [1] | Rising competition from Google’s TPUs [4] |

| 13-quarter revenue growth (from $5.9B to $57B [Event Source]) | Export control risks limiting global sales [5] |

| Dominant brand in AI chips [7] | Dependence on data center revenue (80%+ of Q3 2025 revenue [7]) |

Google aims to capture 10% of Nvidia’s revenue via TPUs [4], which could reduce Nvidia’s market share in AI chips.

- Business Context: The robotics reveal comes amid intensifying AI hardware competition (Meta-Google TPU partnership [4]) and geopolitical tensions (U.S. export controls [5]).

- Company Impact: If successful, the robotics segment could diversify Nvidia’s revenue stream beyond data center chips, mitigating risks from competition and export controls [Event Source].

- Industry Impact: Nvidia’s push into robotics could accelerate the adoption ofembodied AIin manufacturing, shifting the industry toward AI-powered intelligent machines [3].

- Regulatory Risks: Export controls on AI chips used in robotics could limit Nvidia’s ability to sell to global customers, especially in China [5].

- Competitive Response: Google may expand its TPU offerings to robotics customers, and traditional players could enhance their AI capabilities to compete [4].

- Market Adoption Uncertainties: Enterprise uptake depends on pricing, integration with existing systems, and ROI [Event Source].

- Technical Challenges: Scaling production of AI-integrated robotics hardware may face supply chain or technical issues [1].

[1] Financial Times: Hon Hai Tech Day 2025 Opens To Showcase Foxconn’s Powerful Partnerships And Vertical Integration Strengths

URL: https://markets.ft.com/data/announce/detail?dockey=600-202511210003PR_NEWS_EURO_ND__EN30750-1

[2] ETC Journal: Thanksgiving 2025 Tribute for Significant Contributions to AI

URL: https://etcjournal.com/2025/11/27/thanksgiving-2025-tribute-for-significant-contributions-to-ai/

[3] Nvidia News: NVIDIA and US Manufacturing and Robotics Leaders Drive Physical AI

URL: https://nvidianews.nvidia.com/news/nvidia-us-manufacturing-robotics-physical-ai

[4] The Wall Street Journal: Meta Is in Talks to Use Google’s Chips in Challenge to Nvidia

URL: https://www.wsj.com/tech/ai/meta-is-in-talks-to-use-googles-chips-in-challenge-to-nvidia-be390a51?gaa_at=eafs&gaa_n=AWEtsqcUka5xuXTvxFQT9hosunFvxDJIdLWF663GhbYkzSYxXArjAkWQSKFq&gaa_ts=6928d4f1&gaa_sig=eMVQQpu0StFmWdRkoRVhGG9viBt2TlPk4s5vrmfO0IH6HRrT-DsIkSmu5xITppwdMo5b0R0oPGLyAUkwx1yTxg%3D%3D

[5] PC Gamer: The WSJ says it’s tracked how 2,300 Nvidia Blackwell chips ended up in the hands of a Chinese AI company

URL: https://www.pcgamer.com/software/ai/a-wall-street-journal-investigation-claims-to-have-tracked-how-2-300-nvidia-blackwell-ai-chips-made-their-way-to-china-via-an-indonesian-telecoms-provider/

[6] The Atlantic: What the U.S. Can Learn From China’s Technological Success

URL: https://www.theatlantic.com/ideas/archive/2025/10/united-states-china-technology/684754/

[7] Forbes: Nvidia Shares Jump After AI Juggernaut Beats Revenue Expectations

URL: https://www.forbes.com/sites/antoniopequenoiv/2025/11/19/nvidia-shares-jump-after-ai-juggernaut-beats-revenue-expectations/

[8] ts2.tech: Nvidia (NVDA) News Today – November22,2025

URL: https://ts2.tech/en/nvidia-nvda-news-today-november-22-2025-wall-street-upgrades-china-h200-review-and-renewed-ai-bubble-jitters/

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.