Broadcom (AVGO) Valuation & Market Impact: AI Catalysts vs. Overvaluation Concerns

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

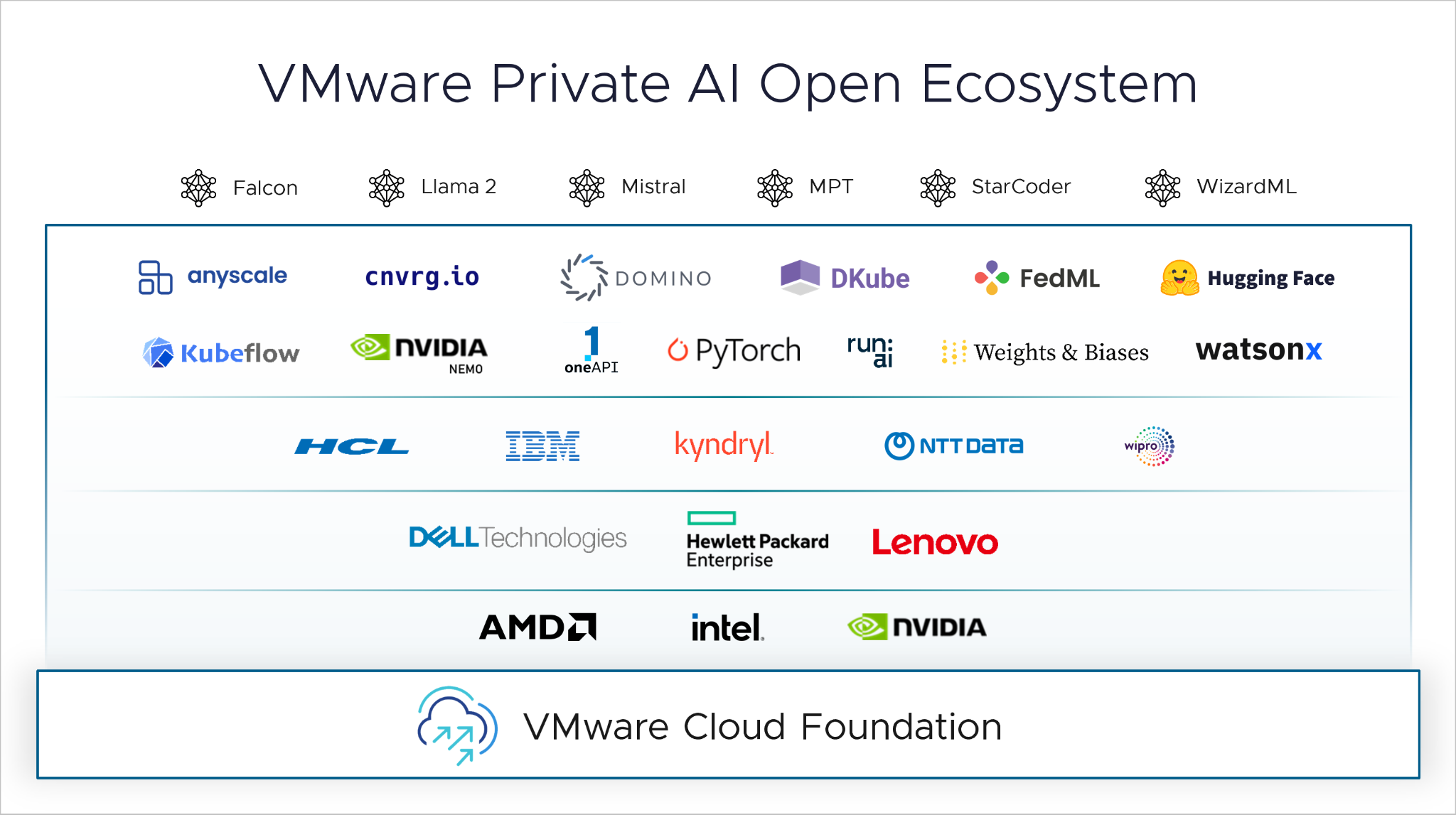

Broadcom’s (AVGO) market position is a subject of intense debate, as highlighted in a Reddit discussion [4] questioning its ~$1.87T valuation [0]. Bullish arguments center on AI growth catalysts—including a 66% YoY Q4 AI revenue forecast ($6.2B) [2] and a $110B AI backlog [2]—and successful VMware integration (90%+ of top 10k customers adopted VCF [2]). These factors have driven recent gains, with AVGO rising 3.26% on 2025-11-26 despite sector growth of only 0.15% [3], fueled by Google/Meta AI partnerships [1].

Bearish concerns focus on valuation: AVGO’s P/E ratio (98.99x) is double NVIDIA’s (44.62x) [0,2], and Reddit users cite VMware price hikes driving customers to alternatives like ProxMox [4]. While earnings data shows VMware revenue growth (17% YoY [2]), concrete churn metrics are missing, creating an information gap.

- AI Growth vs. Valuation: The disconnect between AVGO’s AI growth (63% YoY Q3 [2]) and its premium valuation suggests market expectations are heavily tied to future AI demand.

- VMware Integration Trade-offs: Success in onboarding top customers masks potential long-term churn risks from price hikes, as highlighted by anecdotal Reddit reports [4].

- Institutional vs. Retail Sentiment: Institutional support (91.2% Buy ratings [0]) contrasts with retail skepticism about valuation, indicating a divide in market perspectives.

- Valuation Risk: High P/E ratio leaves little room for AI growth misses [0,2].

- VMware Churn: Anecdotal reports of customer attrition [4] warrant monitoring, even with strong current adoption [2].

- Non-AI Recovery: Slow non-AI segment growth (u-shaped recovery [2]) could limit overall performance if AI demand slows.

- AI Partnerships: Google/Meta TPU deals offer upside (Jefferies set a $480 target [1]).

- VMware Recurring Revenue: VMware’s $6.8B Q3 revenue [2] provides stable cash flow to support AI investments.

- Market Cap: $1.87T [0]

- AI Revenue: $5.2B Q3 (63% YoY [2]), $6.2B Q4 forecast (66% YoY [2])

- VMware Adoption: >90% of top 10k customers [2]

- P/E Ratio: 98.99x (vs. NVDA’s 44.62x [0,2])

- Recent Performance: +3.26% on 2025-11-26 [3]

This summary provides objective data for decision-making without prescriptive recommendations.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.