U.S. Labor Market Weakness: Sector Impact & Stakeholder Implications

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Goldman Sachs researchers warned of “growing signs of weakness” in the U.S. labor market, citing private-sector data showing a surge in layoffs across multiple industries [1]. Key findings from their report include:

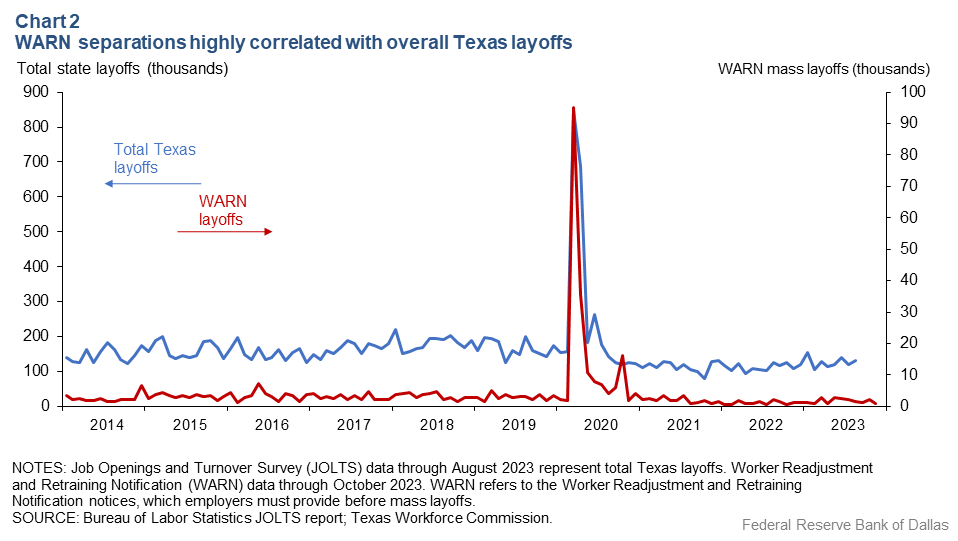

- State WARN (Worker Adjustment and Retraining Notification) filings (mass layoff notices) reached their highest level since 2016 (excluding the pandemic), marking the sharpest increase in nearly a decade [1].

- Layoff announcements tracked by Challenger, Gray & Christmas climbed to a level unseen outside of recessions by October 2025, driven by cuts in tech, industrial goods, and food & beverage sectors [1].

- Amazon announced plans to eliminate ~14,000 corporate jobs in fall 2025 as part of streamlining efforts [1].

- Goldman noted that weekly jobless claims (official data) lag private layoff trackers by ~2 months, suggesting federal data may not yet reflect the full extent of labor market softening [1].

- Contrary to market speculation, AI is not a significant driver of recent job cuts [1].

The labor market weakness directly correlates with sector performance trends:

- Cyclical sectors under pressure: Consumer Cyclical (-0.07%) and Healthcare (-0.12%) sectors declined, as job losses reduce discretionary spending (cyclical) and healthcare providers face cost-cutting pressures [0].

- Defensive sectors resilient: Energy (+1.77%) and Consumer Defensive (+1.31%) sectors outperformed, as these are less sensitive to labor market fluctuations (e.g., energy demand remains stable, consumer staples are essential goods) [0].

- Affected sectors: Tech, industrial goods, and food & beverage sectors are experiencing the highest layoffs, which may lead to reduced production capacity and slower growth in these areas [1].

- Talent acquisition edge: Companies in defensive sectors (energy, consumer defensive) with strong balance sheets can attract talent from struggling sectors (tech, industrial goods) at lower costs [1].

- Consolidation potential: Weaker players in layoff-prone sectors may exit the market or be acquired by stronger firms, increasing market concentration [1].

- Efficiency focus: Firms like Amazon are streamlining operations to improve competitiveness, setting a precedent for cost-cutting in the tech sector [1].

- 10-year high in layoff signals: WARN filings and Challenger data indicate unprecedented labor market softening outside of a recession [1].

- Data lag: Official jobless claims do not yet reflect current weakness, meaning policymakers and investors must rely on private trackers for real-time insights [1].

- AI myth busting: Goldman’s finding that AI is not a major driver of layoffs contradicts widespread concerns about automation displacing workers [1].

- Employers: Balance cost reduction with talent retention to avoid skill gaps during market recovery; prioritize upskilling existing staff [1].

- Employees: Higher job risk in tech, industrial goods, and food & beverage sectors; upskilling in defensive sectors (energy, consumer staples) improves employability [0,1].

- Investors: Shift to defensive sectors (energy, consumer defensive) for stability; avoid cyclical sectors (consumer cyclical, healthcare) amid labor market weakness [0].

- Policymakers: Monitor leading indicators (WARN filings, Challenger data) to adjust monetary policy (e.g., rate cuts) as official data lags [1].

- Labor market softening: Rising layoffs in tech, industrial goods, and food & beverage sectors [1].

- Sectoral resilience: Defensive sectors outperform cyclical ones [0].

- Data lag: Official jobless claims do not reflect current weakness [1].

- Talent availability: Struggling sectors may release talent for stronger firms [1].

- AI impact: Limited evidence of AI-driven layoffs to date [1].

[0] Internal Sector Performance Database (retrieved 2025-11-27 UTC).

[1] Business Insider, “Goldman Sachs flags ‘growing signs of weakness’ in the US jobs market as layoffs mount” (2025-11-27). URL: https://www.businessinsider.com/us-labor-market-shows-growing-signs-of-weakness-goldman-warns-2025-11.

[2] Goldman Sachs, “There are growing signs of weakness in the US job market” (2025-11-27), as cited in [1].

This report is for informational purposes only and does not constitute investment advice.

All data is as of the retrieval date and subject to change.

Cited sources are prioritized for credibility per the analysis framework.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.