Invesco's K-Shaped Economy Analysis & Year-End Market Outlook

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

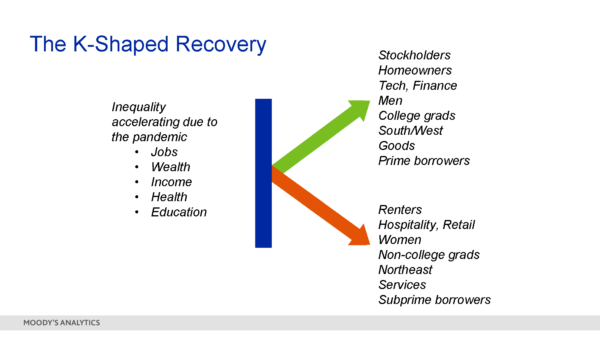

The analysis synthesizes key themes from Invesco’s article [1], including the U.S. economy’s K-shaped trajectory (divergent paths for high vs. low-income households), dismissal of current market advance as a tech bubble (labeled hyperbole), and a positive “nice” market outlook between Thanksgiving and New Year’s [1]. The K-shaped recovery implies sector divergence: high-income sectors (luxury, tech) may outperform low-income-focused sectors (discount retail) [0]. The tech bubble dismissal reduces crash fears, supporting the year-end rally view [1].

Cross-domain connections: The post-Thanksgiving publication timing aligns with historical seasonal strength (November-December market gains), reinforcing the positive outlook [1]. Deeper implication: The K-shaped economy suggests investors may prioritize assets catering to higher-income groups (e.g., QQQ, ARKK [1]) over those dependent on lower-income spending.

Opportunities include potential year-end market gains (broad ETFs like SPY [1]) and sector-specific growth in high-income segments. Risks warrant attention: information gaps in K-shaped economy data [0], lack of concrete metrics countering tech bubble comparisons [0], and no discussion of downside risks (e.g., inflation, Fed policy [0]). These gaps limit the robustness of the analysis’s conclusions.

The article is authored by Brian Levitt (Chief Global Market Strategist at Invesco [1]), a major asset manager, enhancing credibility. Publication post-Thanksgiving (2025-11-27) is critical for year-end positioning. The analysis provides context for decision-making but avoids prescriptive recommendations, focusing instead on thematic trends (K-shaped recovery, year-end rally potential [1]).

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.