Analysis of the Strong Performance of 300619 Jinyinhe: Dual Drivers from Solid-State Batteries & Rubidium Cesium Salts and Performance Support

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

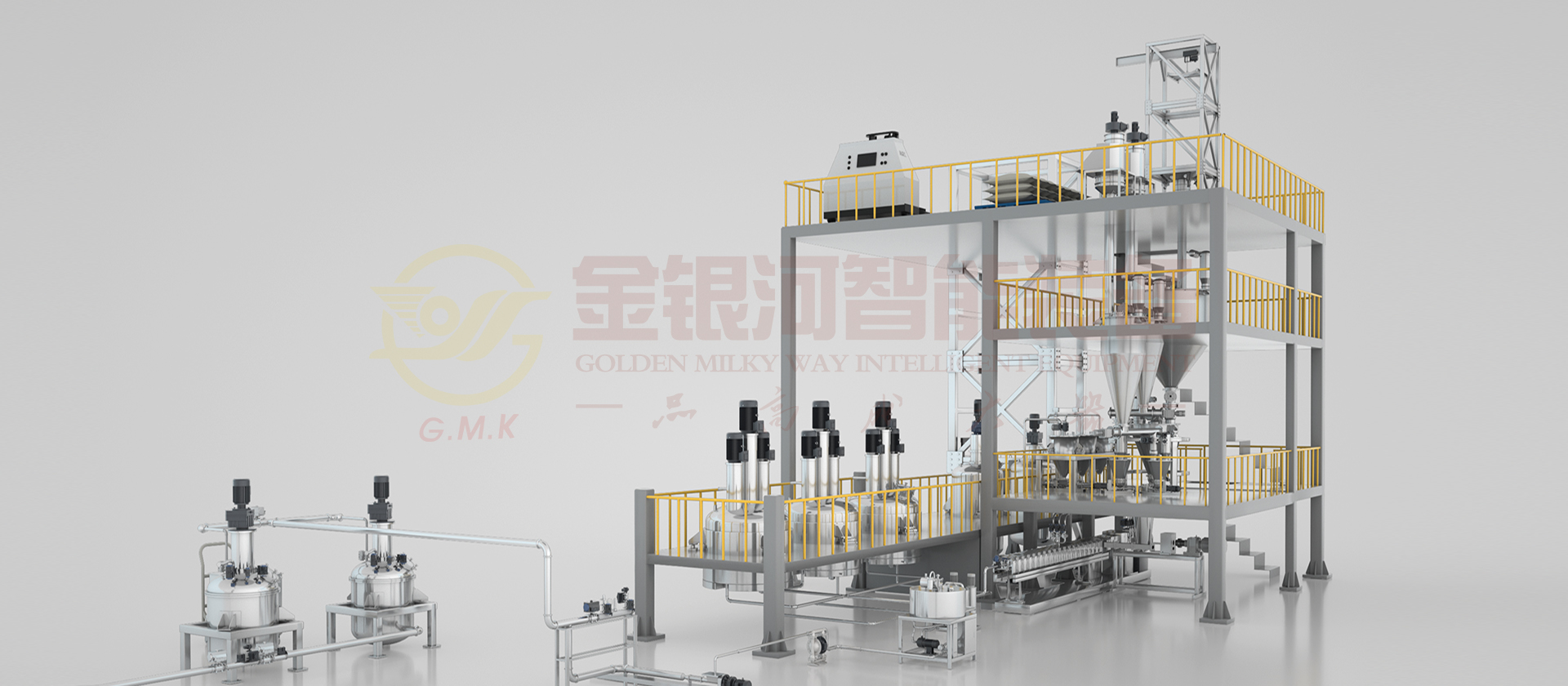

300619 Jinyinhe (Foshan Jinyinhe Intelligent Equipment Co., Ltd.) is a listed company in the power equipment sector, focusing on new energy material equipment manufacturing [2][3]. On November 27, 2025, the stock rose by 15.6% in a single day and entered the strong stock pool [0]. Its strong performance is mainly supported by three factors:

- Catalysis from the solid-state battery industry chain: The solid-state battery concept has been rising recently, and the industry chain is expected to enter a critical pilot period from 2026 to 2027. As an equipment supplier, the company directly benefits [1][5];

- Breakthrough in rubidium cesium salt business: The company’s rubidium cesium salt products have been sold, and it has built the world’s largest rubidium cesium production base, becoming a new growth engine [4][5];

- Performance turnaround: The first three quarters’ performance turned from loss to profit, verifying the effectiveness of the dual-driven business model of solid-state battery equipment and rubidium cesium salts [5];

- Overall upward trend of the industry: The new energy sector (including lithium batteries and energy storage) has entered a new upward cycle, further boosting the performance of individual stocks [7].

- Cross-domain synergy: The solid-state battery equipment and rubidium cesium salt businesses form a synergistic effect, benefiting from new energy technology iteration and expanding into high-value-added new material fields [5];

- Industry positioning advantage: The company’s leading position in solid-state battery equipment and rubidium cesium salt fields gives it an advantageous position in the industrial chain upgrade [1][4];

- Performance verification logic: The turnaround from loss to profit breaks the market’s doubts about the company’s transformation and provides fundamental support for valuation repair [5].

- The pilot phase of the solid-state battery industry chain from 2026 to 2027 will bring an explosion in equipment demand [1];

- The rubidium cesium salt market has great potential, and the company’s leading position is expected to continue to expand its share [4];

- The upward cycle of the new energy sector continues, and the valuation improvement of the sector drives individual stocks [7].

- The industrialization progress of solid-state battery technology is less than expected, affecting the landing of equipment orders [1];

- Increased market competition for rubidium cesium salt products and price fluctuation risks [4];

- Changes in macroeconomics and policies may lead to valuation fluctuations in the new energy sector [0].

The strong performance of 300619 Jinyinhe is the result of the combined effect of fundamental improvement (turnaround from loss) and industry catalysis (solid-state batteries, new energy upward trend). Future focus should be on:

- The pilot progress of the solid-state battery industry chain and the company’s equipment order situation;

- The sales scale and profit contribution of rubidium cesium salt products;

- Changes in the overall trend of the new energy sector.

(Note: This report is only for information analysis and does not constitute investment advice.)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.