Analysis of Strong Performance of 300509 Newamstar: Driven by Explosive Earnings Growth and Industry Prosperity

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

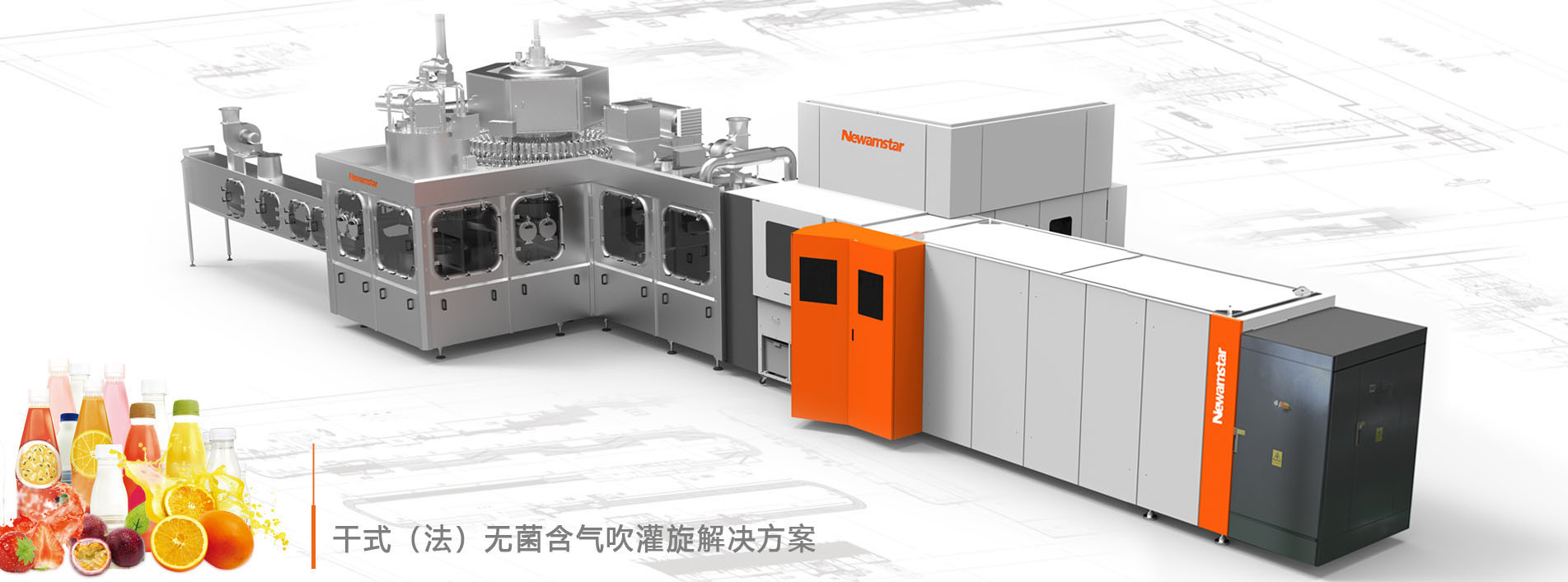

300509 Newamstar has recently entered the strong stock pool[0], with core driving factors including explosive earnings growth and improved industry prosperity. In the third quarter of 2025, the company’s net profit reached 38.4357 million yuan, an increase of 357.83% YoY[2]. The operating revenue in the first three quarters was 870 million yuan[2], far exceeding market expectations. The company continues to promote the “Grand Packaging Ecosystem Strategy”[3][4], has competitive advantages in the field of integrated solutions for liquid food packaging, and benefits from industry development trends.

- Sustainability of Earnings Growth: Net profit in Q1 increased by 118.37% YoY[3], and accelerated further in Q3, indicating sustained earnings growth.

- Increased Institutional Attention: The company was included in the holdings of BOCG AMC Specialized, Sophisticated, Unique, and New Quantitative Stock Selection Fund[6], and institutional investors recognize its development potential.

- Price Performance: On November 27, the company’s stock price hit the daily limit with an increase of 10.78%[5], and market attention has increased significantly.

- Improved industry prosperity, and the company’s strategy aligns with market demand[3][4];

- High earnings growth is expected to attract more investor attention[2][5].

- Need to pay attention to the pressure from intensified industry competition;

- The rapid short-term stock price rise may have a correction risk[5].

300509 Newamstar has performed strongly recently due to explosive earnings growth and strategic layout. Investors can pay attention to its earnings sustainability and industry dynamics, while noting the risk of short-term price fluctuations.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.