Systematic Options Trading Without Technical Analysis: 3-Month Experience Analysis

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

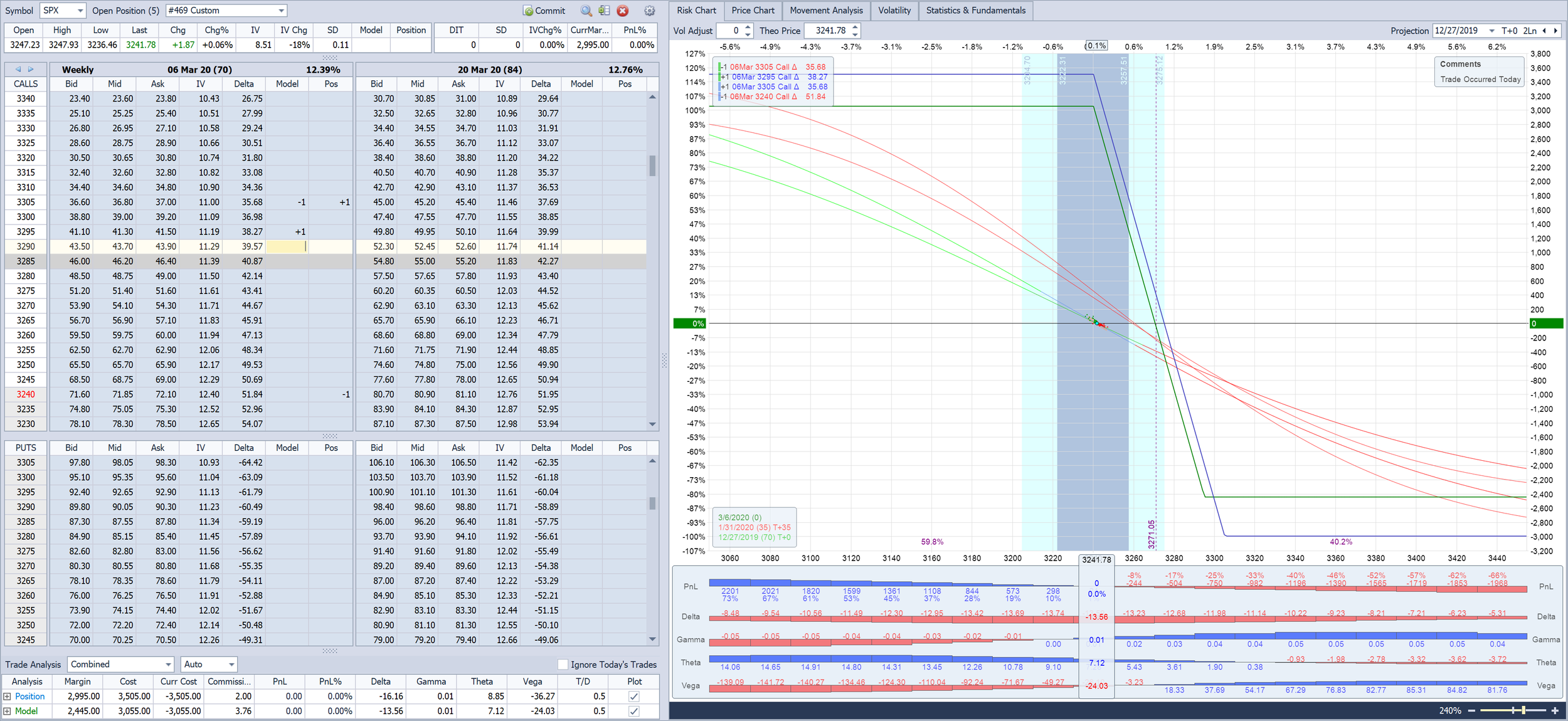

This analysis leverages a Reddit post [0] detailing a trader’s 3-month systematic SPX credit spread strategy without technical analysis. Key metrics:74% win rate,8% average win,12% average loss, max risk per trade <4%. The strategy aligns with bull put spread norms (75-90% win rate) [1]. Market context includes SPX’s Nov20 2.96% drop [2] and VIX’s 60-day high of28.99 [4].

- Systematic strategies work without TA if disciplined: The trader’s win rate (above60% breakeven for negative RR) ensures profitability now [5].

- Psychological retraining is critical: 3 months were needed to follow signals emotion-free [0].

- Volatility is an untested risk: Performance during spikes (VIX28.99) requires validation [4].

The strategy is profitable now but has risks. Breakeven win rate is60% [5]. Market context: SPX volatility (Nov20 drop) and VIX spikes [2,4]. Recommendations focus on risk management and refinement (non-prescriptive).

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.