AI Stock Market Selloff Analysis: AMD Beats Expectations Amid Sector-Wide Decline

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

This analysis is based on the Barron’s report [1] published on November 5, 2025, which examined the ongoing selloff in AI-related stocks and the factors that could determine whether this represents a temporary blip or a more significant market correction.

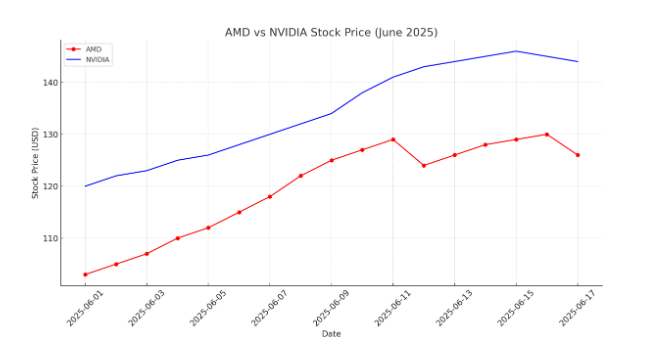

The AI stock selloff has created a complex market scenario where strong fundamental performance coexists with significant price declines. AMD reported robust Q3 2025 results with revenue of $9.25 billion (beating estimates by 6%) and data center segment revenue of $4.3 billion (+22% YoY) [2][3]. Despite these positive results, AMD’s stock declined 3.70% to $250.05, while NVIDIA fell 3.96% to $198.69 [0]. This disconnect between fundamentals and price action suggests deeper market dynamics at play.

The broader market context reveals widespread technology sector weakness, with the NASDAQ Composite declining 0.47% and the Technology sector underperforming with a 0.50% decline on November 4, 2025 [0]. The selloff appears to be primarily “positioning-driven, with recent outperforming names taking the worst of the move” [5], indicating that profit-taking and portfolio rebalancing are key factors rather than fundamental deterioration.

The AI stock selloff represents a complex market event driven by multiple factors rather than simple fundamental deterioration. While AMD delivered strong Q3 results with revenue beating estimates by 6% and data center growth of 22% YoY [2][3], both AMD and NVIDIA experienced significant price declines of 3.70% and 3.96% respectively [0].

The market reaction appears influenced by valuation concerns, with AMD trading at 143.20x P/E and NVIDIA at 55.91x P/E [0], positioning-driven selling pressure [5], and emerging concerns about AI sustainability [5]. However, underlying business fundamentals remain robust, with NVIDIA maintaining a $500 billion order book through 2026 [6] and both companies retaining strong analyst consensus ratings [0].

Investors should monitor several key indicators in the coming weeks and months, including Q4 2025 earnings guidance, AI infrastructure spending trends from major cloud providers, competitive developments in the AI chip market, and changes in interest rate policy. The distinction between a temporary market blip and a more sustained correction will likely depend on whether AI companies can continue delivering strong growth while justifying current valuation levels.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.