Analysis of Driving Factors for Zhongji Innolight's (300308) Strong Performance: Dual Catalysts from AI Computing Power Demand and Google Industry Chain Cooperation

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

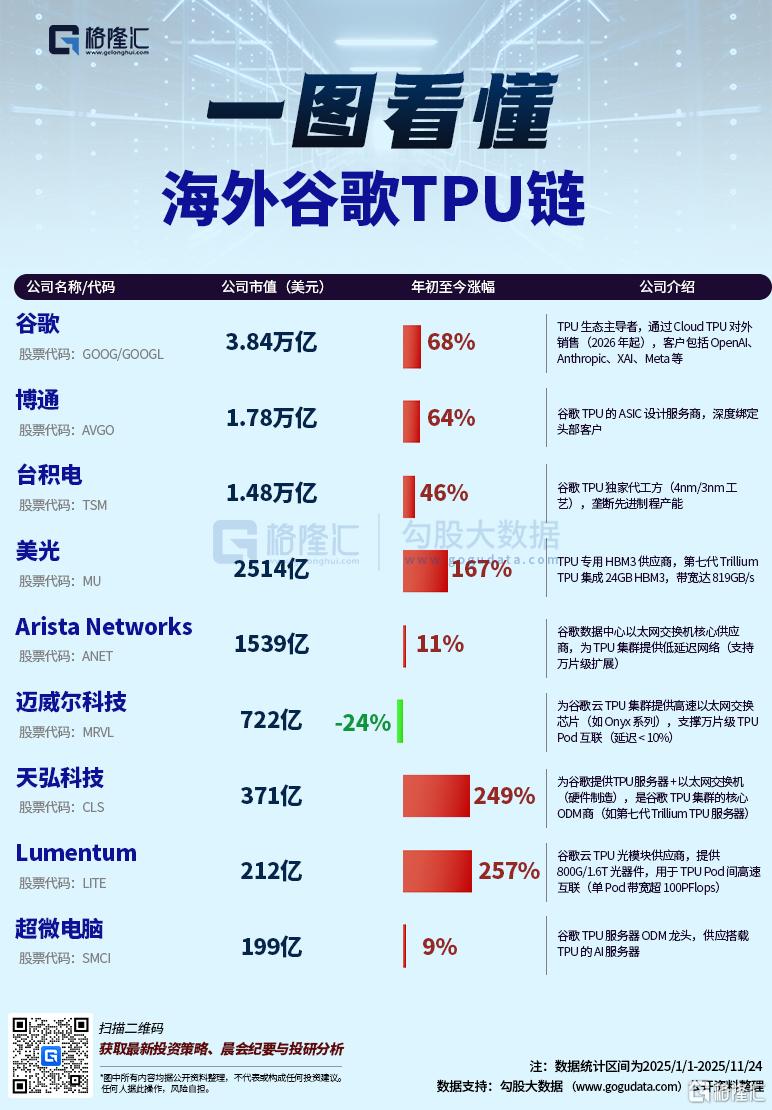

Zhongji Innolight (300308) has shown strong performance recently, with key driving factors including the explosion in AI computing power demand, expectations of cooperation with Google’s industry chain, better-than-expected results, and improved industry prosperity [0]. As a leading enterprise in the optical communication field, the company focuses on R&D and production of high-speed optical modules, whose products are applied in data centers, cloud computing and other fields [0]. In Q3 2025, its revenue reached 10.22 billion yuan and EPS was 2.82 yuan, both exceeding market expectations [0]. The revaluation of Google’s industry chain has become a direct catalyst; Meta plans to rent Google’s TPU computing power, driving the revaluation of related suppliers [1]. The company leads in 1.6T optical module technology, which synergizes with Google’s OCS technology [0]. Its global production capacity layout (Suzhou and Thailand bases) benefits from cooperation with North American cloud giants [0]. Under the sector rotation effect, the CPO concept has become a hot topic, driving the collective rise of the optical module sector [2].

In terms of cross-domain correlation, AI computing power demand and optical module industry growth show a strong positive correlation [0]. The deeper implication is that as a core component of AI infrastructure, the technological iteration of high-speed optical modules (such as 1.6T products) directly affects the deployment efficiency of AI computing power [0]. The systemic impact is reflected in Zhongji Innolight’s strong performance driving the valuation improvement of the entire optical module sector, with Eoptolink and Yuanjie Technology following the rise [2].

Risk points include: intensified industry competition (e.g., technological catch-up by other manufacturers) [0], fluctuations in global cloud capital expenditure [0], and the impact of geopolitical uncertainty on the supply chain [0]. Opportunities lie in: long-term demand from the continuous expansion of AI computing power [0], deepened cooperation with major customers like Google [1], and the conversion of technological leadership into market share growth [0]. In terms of time sensitivity, the short term is obviously driven by sentiment due to news about Google’s industry chain; the long term requires attention to the ability to continuously deliver results [0].

Zhongji Innolight’s strong performance is based on multiple positive factors such as the explosion in AI computing power demand, cooperation with Google’s industry chain, better-than-expected results, and industry prosperity [0][1][2]. The company has leading technology and reasonable production capacity layout, and is expected to continue to benefit from industry growth [0]. The market needs to pay attention to the progress of subsequent cooperation with major customers and changes in industry demand [0].

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.