Market Volatility Analysis: Put Option Strategies During Fear-Based Market Conditions

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

This analysis is based on the Barron’s article [1] published on November 4, 2025, which discusses strategies for profiting from market volatility through put option selling during periods of increased investor fear.

The current market landscape presents a complex risk-reward scenario for options strategies. US major indices showed consistent weakness on November 4, with the S&P 500 closing at 6,771.54 (-0.25%), NASDAQ at 23,348.64 (-0.47%), and Dow Jones at 47,085.25 (-0.13%) [0]. The Russell 2000 underperformed significantly with a 0.83% decline, suggesting broader market weakness beyond large-cap stocks [0].

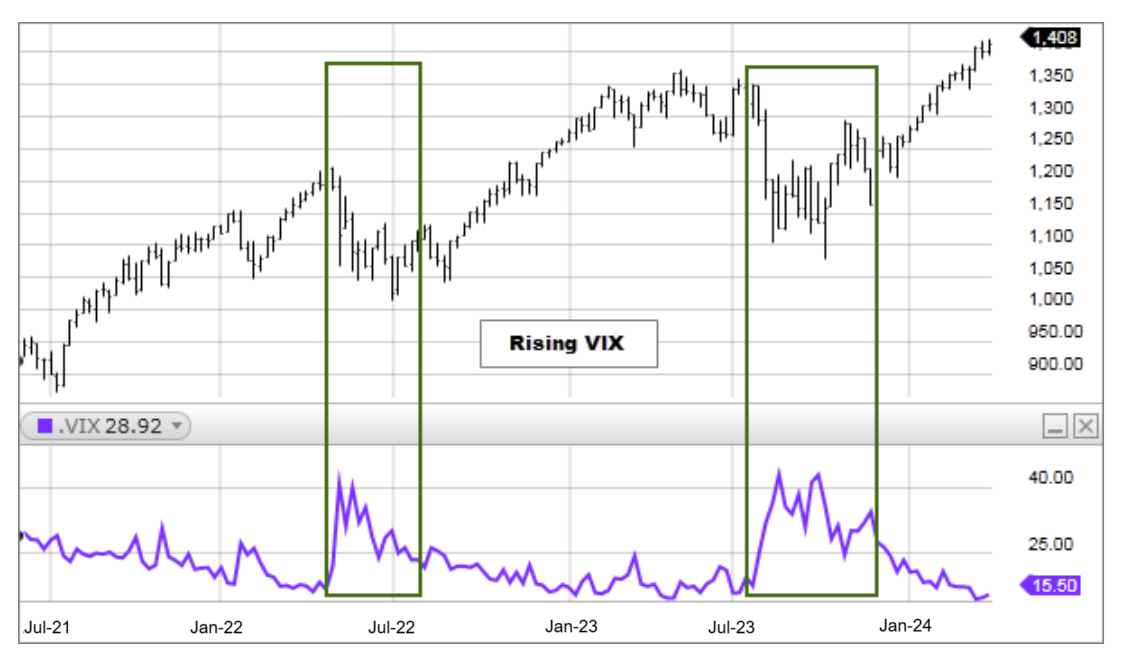

Volatility indicators reveal elevated but not extreme fear levels. The VIX stands at approximately 17.86 as of November 3, 2025, representing a 2.41% increase [2]. Historical analysis indicates that VIX levels below 20 typically suggest market complacency, while levels above 40 indicate extreme fear [3]. Current conditions create an attractive environment for option premium collection without indicating severe market distress.

Defensive sector rotation patterns provide crucial context for the Barron’s strategy recommendations. Consumer Defensive (+0.64%) and Basic Materials (+0.32%) sectors outperformed, while Utilities (-0.85%), Financial Services (-0.74%), and Technology (-0.50%) lagged significantly [0]. This risk-off sentiment aligns with the article’s premise of spreading market fear.

Global market weakness reinforces this risk assessment, with Chinese markets showing pronounced declines: Shanghai Composite (-0.18%), Shenzhen Component (-1.35%), and ChiNext Index (-0.96%) [0]. The synchronous global weakness suggests systemic concerns rather than isolated market events.

The Barron’s article focuses on put selling strategies during market declines, which is particularly relevant given current market dynamics [1]. This strategy allows investors to generate income through premium collection while potentially acquiring quality stocks at predetermined lower prices. The current environment offers several advantages:

- Elevated Premiums: Increased market fear drives up option premiums through higher implied volatility

- Stock Selection Opportunities: Market declines may create attractive entry points for fundamentally sound companies

- Income Generation: Premium collection provides income during uncertain market conditions

However, the strategy requires careful implementation given current market weakness and the potential for continued downside.

The analysis reveals important correlations across market dimensions that weren’t immediately apparent from individual data points. The defensive sector rotation combined with small-cap underperformance (Russell 2000 -0.83%) suggests a broad risk reduction rather than sector-specific concerns [0]. This indicates that put selling strategies should focus on fundamentally strong companies rather than attempting to time market bottoms.

Current VIX levels of 17.86 [2] represent a sweet spot for option sellers - high enough to provide attractive premiums but not so elevated as to suggest extreme market distress. Historical patterns show that sustained VIX levels above 25-30 typically precede more severe market corrections [3], making current conditions potentially optimal for implementing put selling strategies with appropriate risk management.

The weakness in Chinese markets [0] provides additional context for the US market decline, suggesting global economic concerns may be driving investor fear. This global dimension reinforces the importance of selecting companies with strong international exposure and robust balance sheets for put selling strategies.

Investors should monitor several critical indicators:

- VIX levels sustained above 25-30 [3]

- Major indices breaking key technical support levels

- Continued defensive sector rotation patterns [0]

- Options flow data showing institutional sentiment

- Economic data releases that could impact market volatility

The current market environment, characterized by moderate fear (VIX 17.86) [2], declining major indices [0], and defensive sector rotation [0], creates conditions suitable for implementing put selling strategies as discussed in the Barron’s article [1]. However, the strategy requires careful stock selection, appropriate position sizing, and robust risk management protocols.

The elevated volatility premiums provide attractive income opportunities, but investors should be prepared for potential assignment and ensure they have sufficient capital and willingness to own the underlying stocks at strike prices. Global market weakness suggests the need for focusing on companies with strong fundamentals and international resilience.

The analysis reveals that while opportunities exist for premium collection, the current market weakness requires conservative implementation with emphasis on quality over yield, and careful monitoring of volatility escalation risk factors [2, 3].

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.