German Manufacturing Orders Show First Monthly Growth in Five Months Amid Ongoing Structural Challenges

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

This analysis is based on the Wall Street Journal report [1] published on November 5, 2025, which documented German factory orders posting their first rise in five months, signaling a potential rebound after trade uncertainty had dented demand over the summer.

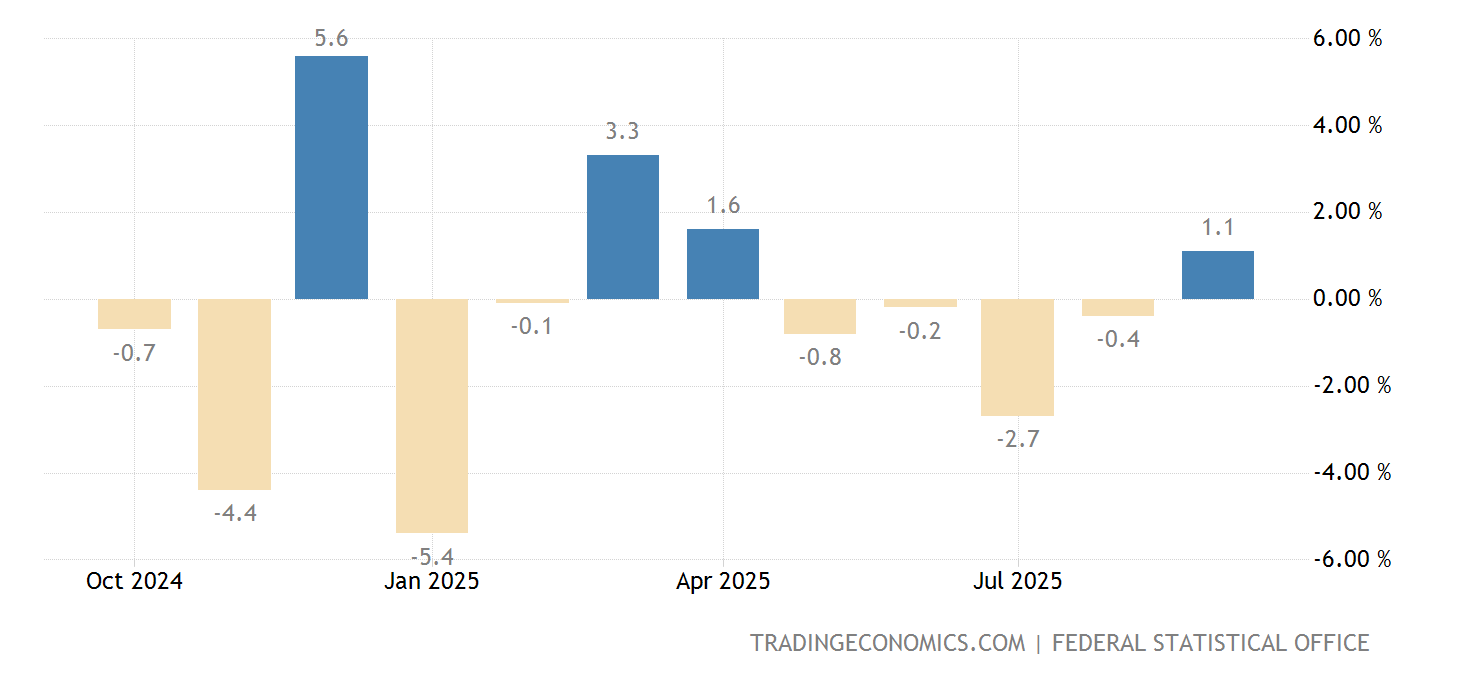

The September 2025 data reveals a complex picture of Germany’s manufacturing landscape. German manufacturing orders increased 1.1% month-on-month, breaking a five-month declining streak [1]. When excluding large-scale orders, the growth was even more robust at 1.9% [2]. However, the recovery remains fragile, with the less volatile three-month comparison showing new orders were still 3.0% lower in Q3 2025 compared to Q2 2025 [2].

The recovery was primarily export-driven, with foreign orders rising 3.5% overall, including 4.3% growth from outside the euro area and 2.1% from within the euro area [2]. This contrasts sharply with domestic orders, which declined by 2.5% [2], highlighting the sector’s heavy reliance on external demand for any recovery momentum.

The September rebound was not uniform across manufacturing subsectors. Strong performances in automotive (+3.2%), electrical equipment (+9.5%), and other transport equipment (+7.5%) were partially offset by significant declines in fabricated metal products (-19.0%) and basic metals (-5.6%) [2]. This pattern suggests that Germany’s high-value, technology-intensive manufacturing segments are showing resilience, while traditional heavy industry continues to struggle.

The strong foreign order growth, particularly from outside the euro area (+4.3%), indicates that German manufacturing maintains competitive advantages in certain global markets despite overall challenges [2]. However, this export strength coexists with concerning domestic market weakness, suggesting that German industrial recovery may be vulnerable to global trade tensions and currency fluctuations.

Despite the positive September data, German manufacturing faces deep structural challenges. The HCOB Germany Manufacturing PMI remained at 49.6 in October 2025, staying below the crucial 50.0 expansion threshold [3]. The sector has experienced employment declines for 28 consecutive months, reflecting ongoing capacity pressures and hiring freezes [3]. German industrial energy costs remain up to three times higher than U.S. competitors and double those of French firms [4], creating persistent competitive disadvantages.

German exports to the United States fell to €10.9 billion in August 2025, marking the fifth consecutive monthly decline and the lowest value since November 2021 [5]. Year-over-year exports to the U.S. fell by 20.1% [5], with automotive shipments down 20% year-over-year [6]. This weakness in a crucial market underscores the impact of new tariffs and trade tensions on German manufacturing.

- Energy Cost Disadvantage: Persistent high energy costs relative to international competitors continue to pressure German manufacturing margins and competitiveness [4]

- Trade Policy Uncertainty: Ongoing geopolitical tensions and trade policy volatility create significant uncertainty for order book development [8]

- Domestic Demand Weakness: The 2.5% decline in domestic orders [2] suggests fragile domestic economic conditions that could undermine recovery sustainability

- Employment Contraction: The 28-month consecutive employment decline [3] indicates ongoing structural adjustments that may limit capacity for growth

- Export Diversification: Strong foreign demand growth (+3.5%) [2] suggests opportunities for market diversification beyond traditional U.S. and European markets

- High-Value Manufacturing: Strength in automotive and electrical equipment sectors [2] indicates competitive advantages in technology-intensive manufacturing

- Supply Chain Optimization: Building supply chain pressures [3] create opportunities for companies that can demonstrate reliability and efficiency

- Energy Transition Leadership: Despite current challenges, Germany’s energy transition could position certain manufacturing segments for future competitive advantages

The September 2025 German factory orders increase of 1.1% [1] represents a potentially important inflection point, but the recovery remains tentative and uneven. The export-driven nature of the rebound, combined with ongoing domestic weakness and structural challenges, suggests that German manufacturing recovery will likely be gradual and volatile.

Key data points indicate mixed conditions: while foreign orders showed strength (+3.5%) [2], manufacturing turnover actually declined 2.1% month-on-month and was 2.7% lower than September 2024 [2]. This disconnect between orders and production suggests manufacturers remain cautious about capacity expansion until recovery signals become more consistent.

The competitive landscape continues to evolve, with German manufacturing facing significant pressure from high energy costs while maintaining advantages in high-value sectors like automotive and electrical equipment. The sector’s ability to navigate these competing forces will determine the sustainability of any recovery.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.