Market Pullback Analysis: Valuation Fears Trigger Major Tech Sector Decline

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

This analysis is based on the CNBC Fast Money segment discussing “stocks retreating on valuation fears” [Event] and comprehensive market data from November 4, 2025. The U.S. stock markets experienced their largest single-day decline since October 10, 2025, with technology stocks bearing the brunt of the sell-off. The correction was triggered by warnings from major banking executives about stretched valuations, particularly in the AI-driven technology sector that had been powering recent market highs.

The sell-off demonstrated broad market participation with all three major indices declining significantly [0][1]:

- S&P 500: -1.17% to 6,771.55 points

- Nasdaq Composite: -2.04% to 23,348.64 points

- Dow Jones: -0.53% to 47,085.24 points

Market breadth indicators confirmed the severity of the decline, with declining issues outnumbering advancers by 2.45-to-1 on NYSE and 3.16-to-1 on Nasdaq [1]. The technology sector emerged as the worst performer, falling 2.3% among the 11 major S&P 500 sectors [1].

The market correction was fundamentally driven by valuation concerns, with major banking executives providing explicit warnings about potential market corrections [1]. Morgan Stanley and Goldman Sachs CEOs specifically noted that the S&P 500 had reached “a series of all-time highs, largely powered by the artificial intelligence boom” [1]. This assessment aligns with historical patterns where narrow leadership in high-valuation sectors often precedes broader market corrections.

The analysis reveals a clear pattern where stocks with extreme valuation multiples experienced the steepest declines [0]:

Notably, defensive sectors showed relative strength during the sell-off, with Consumer Defensive gaining 0.64% and Basic Materials adding 0.32% [0]. This sector rotation pattern suggests investors were seeking safety amid valuation concerns, a typical behavior during market corrections.

The substantial decline in the semiconductor index (.SOX) and AI-related stocks indicates that the artificial intelligence trade, which had been the primary market driver, is experiencing a meaningful correction [1]. Six of the “Magnificent Seven” AI-related stocks lost ground, suggesting the market’s primary momentum drivers are losing steam [1].

The public warnings from major banking executives carry significant weight as leading indicators. JPMorgan Chase CEO Jamie Dimon’s October warning about “heightened risk of a significant stock market correction within the next six months to two years” appears to be materializing [1]. Historical analysis suggests that when bank CEOs publicly warn of market corrections and high-valuation momentum stocks decline simultaneously, it typically signals the beginning of a more extended period of volatility.

Trading volume reached 19.82 billion shares, below the 20-day average of 21.04 billion shares [1]. This below-average volume during a significant decline suggests that the sell-off may not yet reached capitulation levels, potentially indicating further downside risk as institutional participation increases.

-

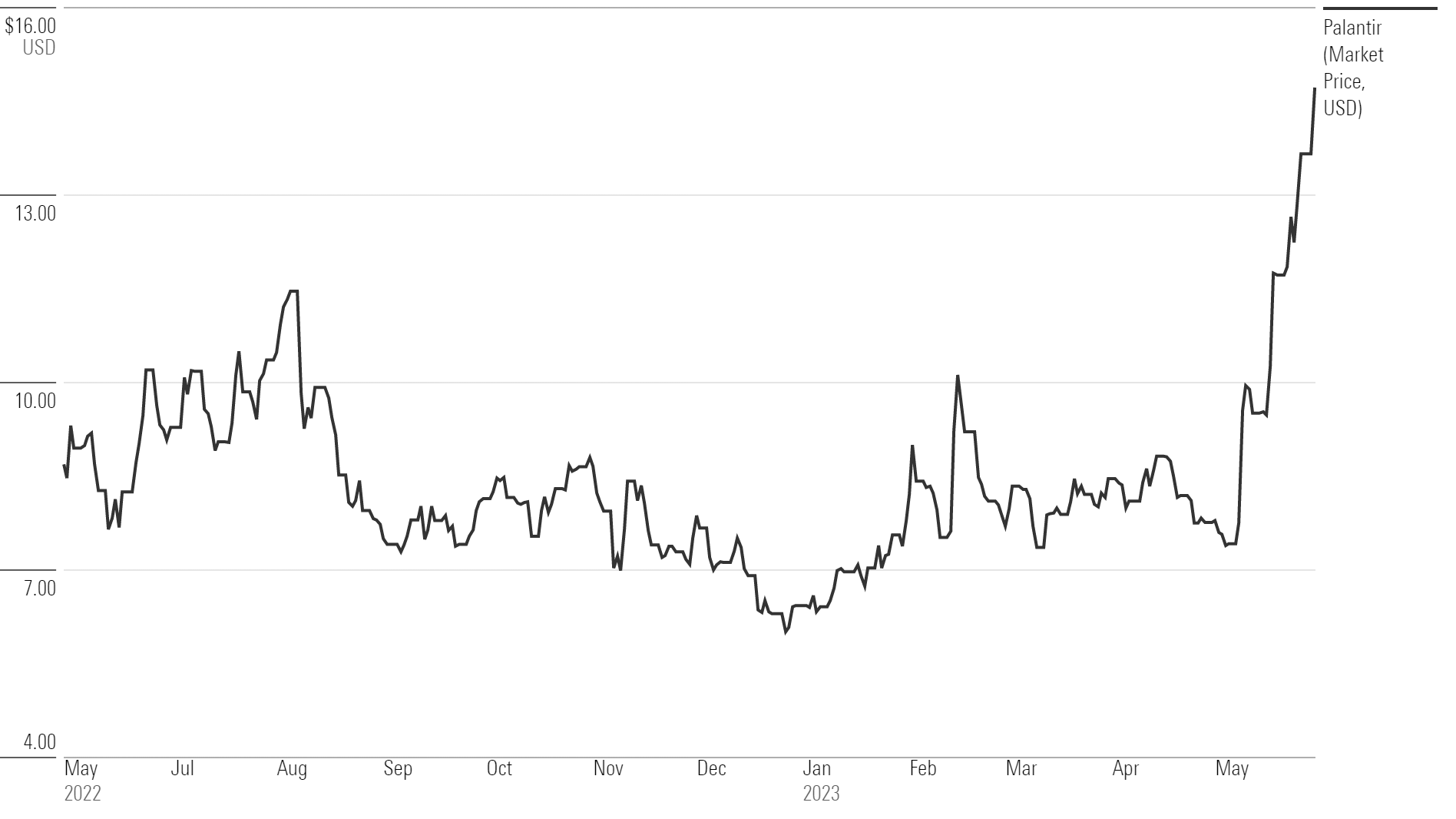

Valuation Bubble Risk: The AI-driven technology sector may be experiencing a bubble similar to the dot-com era, with companies like Palantir trading at extreme multiples (433.50 P/E) [0]. The rapid decline despite positive earnings suggests these valuations may be unsustainable.

-

Government Shutdown Impact: The ongoing U.S. government shutdown is creating uncertainty and reducing access to crucial economic data, potentially exacerbating market volatility [1]. This data vacuum makes valuation assessment more challenging and could lead to increased market inefficiency.

-

Extended Volatility Risk: Historical patterns suggest that valuation-driven corrections preceded by bank CEO warnings often lead to extended periods of volatility rather than quick recoveries.

Decision-makers should monitor several key indicators for market direction:

- Federal Reserve Communications: How Fed officials respond to market volatility in the absence of government economic data [1]

- Earnings Season Progression: Whether upcoming earnings reports justify current valuations

- Institutional Flow Patterns: Whether institutional investors are reducing exposure to high-valuation stocks

- Semiconductor Sector Performance: The SOX index’s performance as a leading indicator for broader tech sentiment

- Major indices experienced their largest decline since October 10, 2025 [1]

- Technology sector led declines with -2.3% performance [1]

- Market breadth showed 3.16-to-1 decliners-to-advancers on Nasdaq [1]

- Trading volume was below average at 19.82 billion shares [1]

- Palantir (PLTR): -7.94% to $190.74 despite beating earnings [0]

- Uber (UBER): -5.06% to $94.67 after missing profit estimates [1]

- NVIDIA (NVDA): -3.96% to $198.69 [0]

- Apple (AAPL): +0.37% to $270.04 showing relative resilience [0]

- Technology: -2.3% (worst performer) [1]

- Consumer Defensive: +0.64% (best performer) [0]

- Utilities: -0.85% [0]

- Financial Services: -0.74% [0]

The current market correction appears to be fundamentally driven by valuation concerns rather than specific company fundamentals, suggesting a broader reassessment of risk premiums across high-growth sectors. The involvement of major banking executives in warning about market corrections adds credibility to the valuation concerns and suggests this may be more than a temporary pullback.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.