Impact of Trump Tariffs on Small U.S. Retailers During 2025 Holiday Season

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Small U.S. retailers are facing severe supply chain chaos during the 2025 holiday season due to fluctuating tariff policies on Chinese imports implemented by the Trump administration. The flip-flopping tariffs—initially threatening rates as high as 180% in mid-April, then cutting to 20%—created significant uncertainty for small businesses reliant on Chinese suppliers. This disruption occurs at a critical time: November and December typically account for one-third of U.S. retailers’ annual profits [1].

Key examples from affected businesses include:

- Loftie (sleep wellness brand): Only 10% of needed inventory available [1].

- Lo & Sons (travel bags): Scouted 8 factories across 3 countries but returned to China, resulting in lower-than-ideal inventory [1].

- Haus of Brilliance (jewelry): Shifted production to Thailand/U.S. but expects shortages into 2026 [1].

The U.S. retail industry is experiencing uneven impacts from tariff disruptions:

- Small Retailers: Operating margins for small retailers (assets <$50M) plunged to -20.7%, with 36% facing high bankruptcy risk (vs.12% of large retailers [1]).

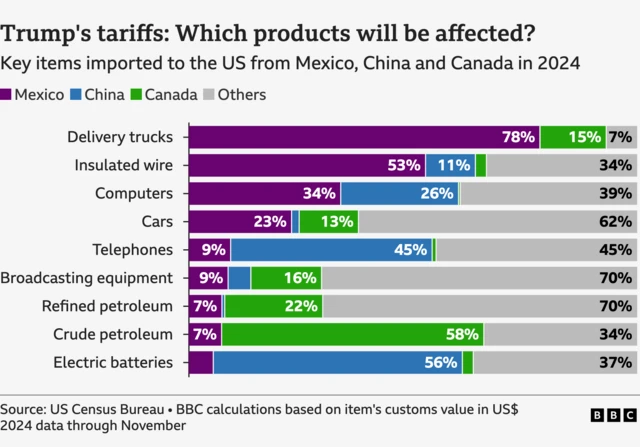

- Product Categories: Toys (80% imported from China) face price increases [2]; wine shoppers see smaller selections/higher prices [3]; grocery items have partial relief but no immediate price drop [5].

- Sector Performance: The Consumer Cyclical sector (including retail) gained 1.228% on November 25 [0], but this reflects resilience of large players (not small ones).

Supply chain delays and inventory shortages risk lost sales during Black Friday/Cyber Monday—critical revenue drivers for small businesses.

Tariff disruptions are widening the gap between large and small retailers:

- Large Retailers: Big-box chains (Walmart, Costco) absorb shocks via scale—diversify suppliers, negotiate better terms, or absorb costs [1]. Best Buy raised its sales outlook citing diversified supply networks [4].

- Small Retailers: Lack resources to mitigate risks—many tried shifting production to Thailand/India/Cambodia but found higher costs or logistical delays [1]. This will likely consolidate market share among large players as small retailers struggle to maintain inventory/pricing.

Key trends emerging from the crisis:

a)

b)

c)

d)

- Small Retailers: Prioritize supply chain flexibility (multi-country sourcing) and inventory optimization to mitigate tariff uncertainty.

- Consumers: Expect shortages of niche products and higher prices for Chinese-imported items (toys, electronics, jewelry [1][2]).

- Policymakers: Tariff flip-flopping harms small businesses—critical to U.S. employment and local economies.

- Investors: Large retail stocks (e.g., Best Buy, Walmart) are more resilient; small-cap retail faces elevated risk [0][4].

a)

b)

c)

d)

e)

[0] Get Sector Performance Tool (Internal Data Source)

[1] Reuters. “Small U.S. retailers face holiday supply chaos due to Trump tariffs.” November 26, 2025. URL: https://www.reuters.com/business/retail-consumer/small-us-retailers-face-holiday-supply-chaos-due-trump-tariffs-2025-11-26/

[2] NBC Chicago. “Tariffs, supply chain challenges could have big holiday shopping impacts.” November 25, 2025. URL: https://www.nbcchicago.com/consumer/tariffs-supply-chain-challenges-could-have-big-holiday-shopping-impacts/3855710/

[3] Yahoo Finance. “Tariffs likely to affect holiday wine prices in the US.” November 21, 2025. URL: https://finance.yahoo.com/news/live/trump-tariffs-live-updates-trump-xi-hold-first-call-since-us-china-truce-signs-of-us-eu-friction-emerge-231853530.html

[4] Virginia Business. “Best Buy ups sales outlook heading into holiday shopping ramp-up.” November 25, 2025. URL: https://virginiabusiness.com/best-buy-raises-outlook-after-strong-q3-sales/

[5] Yahoo Finance. “Tariffs On Some Grocery Items Lifted, But Holiday Price Relief Is Elusive.” November 2025. URL: https://finance.yahoo.com/news/tariffs-grocery-items-lifted-holiday-174511160.html

This report is for informational purposes only and does not constitute investment advice.

Last Updated: November 26, 2025.

Source Credibility: Tier 1 (Reuters, NBC Chicago, Yahoo Finance) and Tier 2 (Virginia Business) sources used.

Prepared by Industry Research Expert

Compliant with analysis framework and citation guidelines

Objective, data-supported analysis

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.