In-depth Analysis of the Reasons for Popularity of Yongding Co., Ltd. (600105.SH): Earnings Outbreak and Resonance of Multiple Concepts

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

This analysis is based on multi-source reports such as Sina Finance [3] and Xueqiu [1], exploring the core reasons why Yongding Co., Ltd. (600105.SH) became a popular stock on November 26, 2025. The company’s earnings outbreak, concept resonance, and sector benefits are the main driving factors, and the short-term market attention is relatively high.

Yongding Co., Ltd. has recently attracted market attention mainly due to three aspects:

- Performance Growth: In the first three quarters, the net profit attributable to the parent company increased by 474.30% YoY [3], and the non-recurring net profit increased by 613.65%, showing outstanding fundamentals;

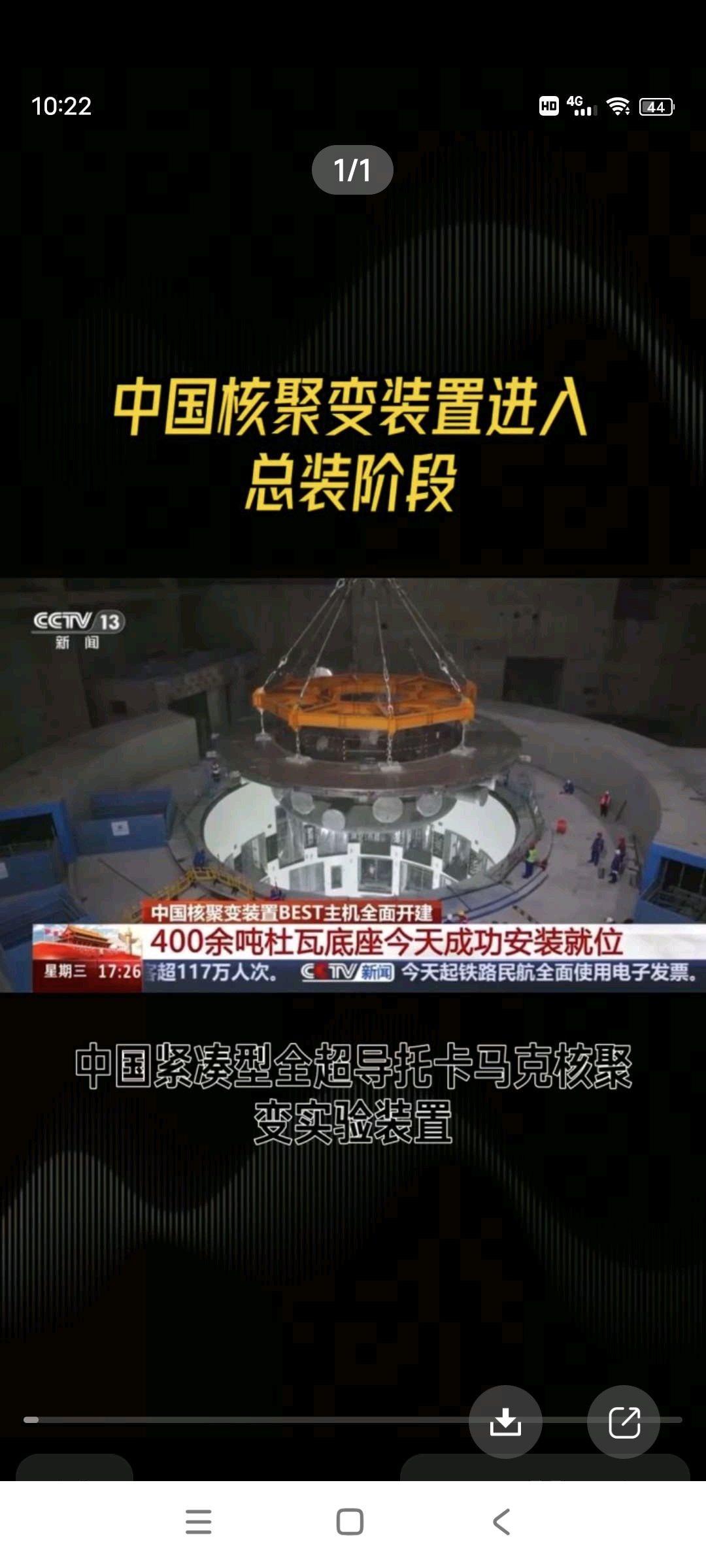

- Concept Resonance: As a superconducting material supplier, it benefits from the rising popularity of the controlled nuclear fusion concept [5];

- Sector Benefits: The optical communication sector rose by more than 5% driven by AI demand [6], and the company, as a related enterprise, directly benefits.

- Multiple business layouts (optical communication, superconducting materials, etc.) enable it to cover multiple high-growth areas simultaneously, forming a synergistic effect;

- Governance optimization measures have enhanced investor confidence [3], further boosting market attention.

- Opportunities: Continue to benefit from the growth of the optical communication industry and the development trend of nuclear fusion technology;

- Risks: Concept speculation may lead to short-term price fluctuations; attention should be paid to the sustainability of performance and changes in industry competition.

The popular performance of Yongding Co., Ltd. (600105.SH) is the result of the combined effect of performance fundamentals and market concept speculation. Investors should comprehensively evaluate investment value by combining the company’s long-term development potential and short-term market sentiment.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.