U.S. Electric Grid Bottleneck: Market Implications for Tech Boom and Grid-Related Stocks

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

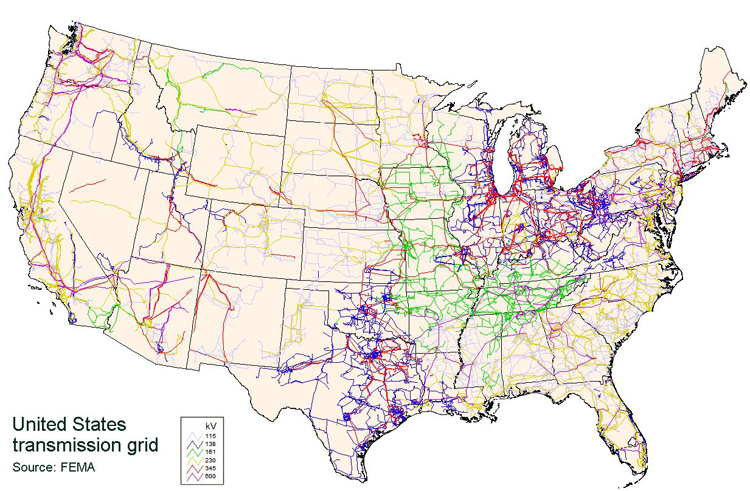

The U.S. electric grid—outdated since the 1970s—has emerged as a critical bottleneck for the ongoing tech boom, per a 2025-11-25 Reddit post. Transmission infrastructure (not distribution) is the main constraint to meeting demand from data centers, EVs, and manufacturing [0]. Market data shows grid solution providers like transmission contractors ETN (+2.02%) and PWR (+1.53%) as well as microgrid/storage firms GNRC (+1.89%) and BE (+1.73%) posted gains on 2025-11-25, aligning with the post’s investment suggestions [0]. External sources confirm transmission as the new bottleneck, with data centers consuming power equivalent to mid-sized cities [3].

- Cross-Domain Link: The tech boom’s demand (data centers, AI, EVs) is directly straining grid transmission capacity, creating opportunities for grid modernization firms [3].

- Balanced Portfolio Support: Stocks in grid infrastructure (ETN, PWR), microgrid (GNRC, BE), and distributed generation (ENPH) all showed positive performance, validating the post’s balanced approach [0].

- Policy-Demand Tension: While demand surge makes grid upgrades inevitable, policy reversals threaten funding—with $30bn in clean energy investment already canceled [2].

- Policy Risk: U.S. policy reversals have canceled $30bn in clean energy investment, with potential for $500bn in lost funding over 10 years [2].

- Volatility: Grid-related stocks like BE exhibit high volatility (e.g., -17.44% drop on 2025-11-20) [0].

- Long Timelines: Transmission projects have timelines beyond daytrading horizons [Reddit post].

The U.S. grid’s transmission bottleneck is a significant barrier to the tech boom. Grid-related stocks (transmission, microgrid, generation) showed positive short-term performance, but policy risks and long project timelines require careful consideration. A balanced portfolio approach across grid infrastructure, microgrid, and generation assets is supported by market trends, though investors should monitor policy developments and stock volatility.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.