U.S. Government Shutdown Becomes Longest in History Amid Political Stalemate

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

This analysis is based on the CNBC report [1] published on November 4, 2025, which detailed the Senate’s failure to pass a short-term funding bill, extending the government shutdown to record length.

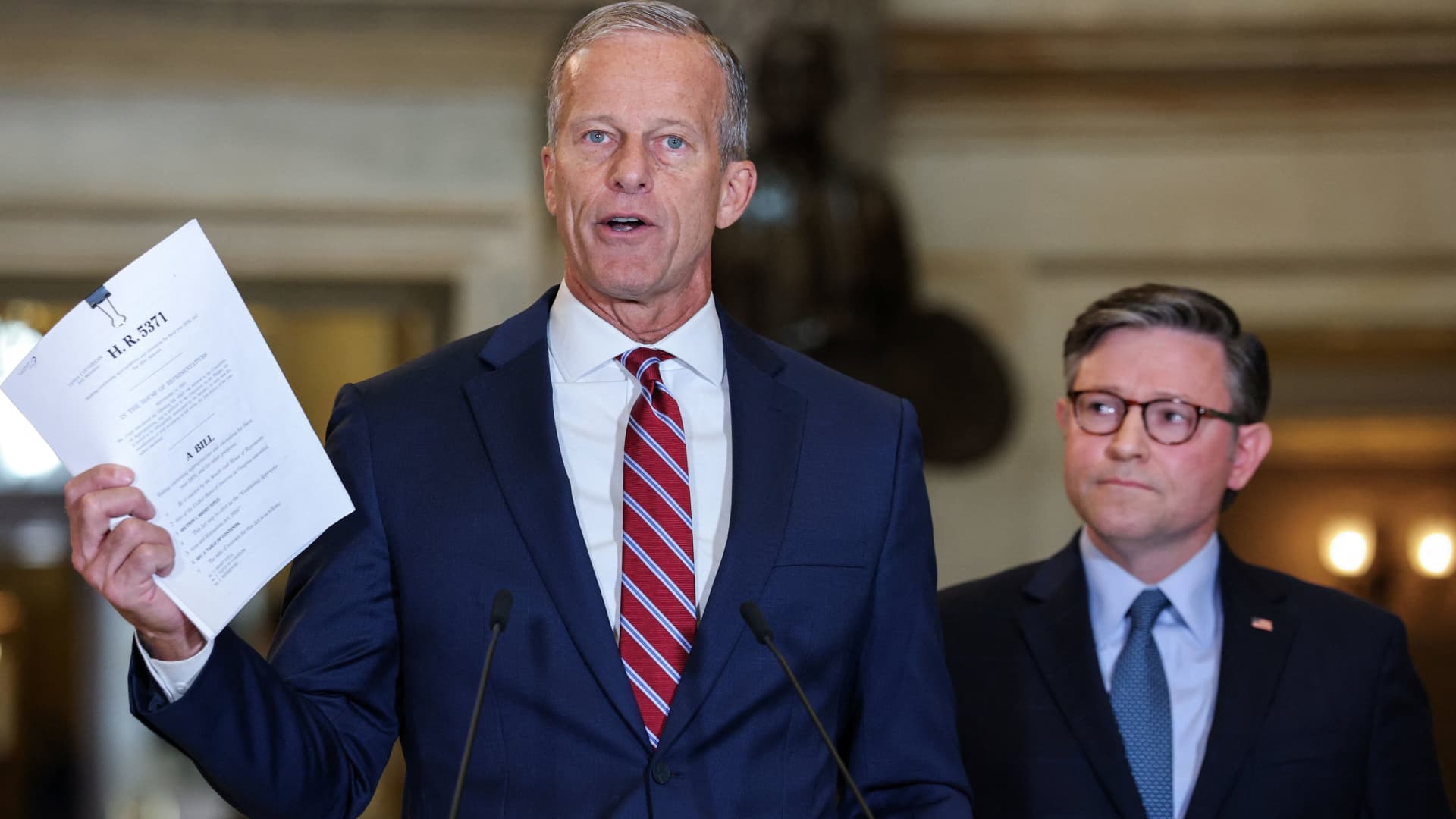

The U.S. government shutdown has officially become the longest in American history, reaching 35 days as of November 4, 2025 [1]. The Senate’s 54-44 vote fell short of the required 60-vote supermajority, marking the 14th failed attempt to pass a continuing resolution since the shutdown began on October 1, 2025 [0]. This duration now exceeds the previous record of 35 days set during President Trump’s first term in 2018-2019 [1].

The core political conflict centers on funding priorities: Republicans are pushing for temporary funding at current levels while Democrats are demanding additional healthcare spending allocations [1]. This stalemate has created a complex web of impacts across federal operations and the broader economy.

Market data [0] indicates increasing volatility as investors grapple with the uncertainty. The shutdown’s unprecedented duration is amplifying concerns about economic disruption, particularly as it affects critical government services and federal contractor operations.

- Extended Economic Disruption:Each additional day of shutdown increases cash flow risks for federal contractors and compounds economic uncertainty [1]

- Market Volatility:Financial markets are showing declines as uncertainty persists, with potential for broader market impact if shutdown continues [0]

- Social Services Crisis:SNAP benefit disruptions could affect 42 million Americans, creating both humanitarian and political pressure [1]

- Political Escalation:Trump’s threats against Republican senators could destabilize the legislative process and complicate resolution efforts [3]

- Near-Term Resolution:Both parties signaling potential deals this week could provide opportunities for market stabilization [2]

- Filibuster Reform:Republican openness to procedural changes could unlock new pathways for compromise [3]

- Sector-Specific Opportunities:Certain sectors may benefit from resolution, particularly those heavily impacted by government delays

The shutdown has reached a critical juncture at 35 days, creating unprecedented pressure on all stakeholders. The combination of political infighting, humanitarian concerns, and economic disruption suggests that resolution efforts may accelerate, though the path forward remains uncertain. Investors and stakeholders should monitor Senate negotiations closely, particularly any developments regarding filibuster rules and SNAP benefit administration. The intersection of political pressure, economic necessity, and public health concerns creates a complex environment where rapid developments could occur at any time [1][2][3].

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.