ADP Private Job Losses Accelerate: Market Reaction and Rate Cut Expectations

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

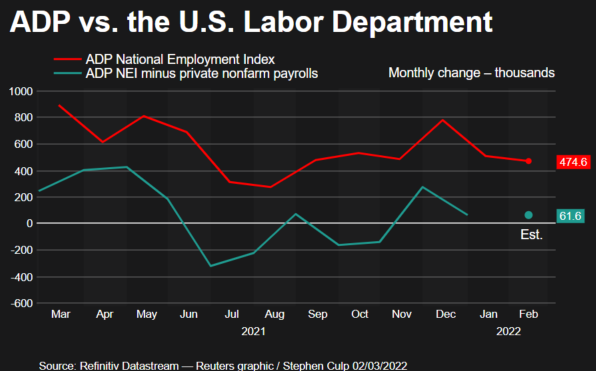

On November 25, 2025, Forbes published an article citing ADP data showing U.S. private sector job losses accelerated to over 13,500 per week in October and early November, indicating a weakening labor market [1]. Contrary to this negative signal, U.S. equity indices posted gains: S&P 500 (+0.79%), NASDAQ (+0.69%), Dow Jones (+1.10%), and Russell 2000 (+1.76%) [0]. This divergence reflects investor expectations of Federal Reserve rate cuts to stimulate the economy amid labor softness. Cyclical sectors (Industrials +1.23%, Consumer Cyclical +1.16%, Financials +1.10%) led gains, while defensive sectors (Utilities -0.95%, Real Estate -0.77%) underperformed as rate cut hopes reduced their relative appeal [2].

- Policy Over Data: Markets prioritized potential rate cuts over immediate job loss concerns, driving cyclical sector outperformance.

- Small-Cap Leadership: Russell 2000 outperformance suggests investors anticipate greater benefits for domestically focused small businesses from monetary easing.

- Sector Rotation: Defensive sectors (bond proxies) underperformed as rate cut expectations diminished their appeal relative to cyclicals.

- Rate Cut Expectation Risk: Market gains depend on Fed policy shifts; unmet hopes could reverse gains [0].

- Economic Slowdown Risk: Sustained job losses may reduce consumer spending and impact cyclical sectors long-term.

- Volatility Risk: Mismatch between investor expectations and Fed actions could increase market volatility.

- Cyclical sectors (Industrials, Consumer Cyclical) may benefit if rate cuts materialize.

- Small-cap stocks (Russell 2000) offer exposure to domestically focused businesses sensitive to policy easing.

- Event: ADP reported accelerating private job losses (13,500/week Oct-Nov 2025) [1].

- Market Data: S&P 500 (+0.79%), NASDAQ (+0.69%), Dow Jones (+1.10%), Russell 2000 (+1.76%) [0].

- Sector Performance: Cyclicals (Industrials +1.23%) led; defensives (Utilities -0.95%) lagged [2].

- Key Considerations: Monitor Fed policy signals and subsequent labor/economic indicators to validate rate cut expectations.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.