November 2025 Market Perspective: Fed Uncertainty Amid Record Highs

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

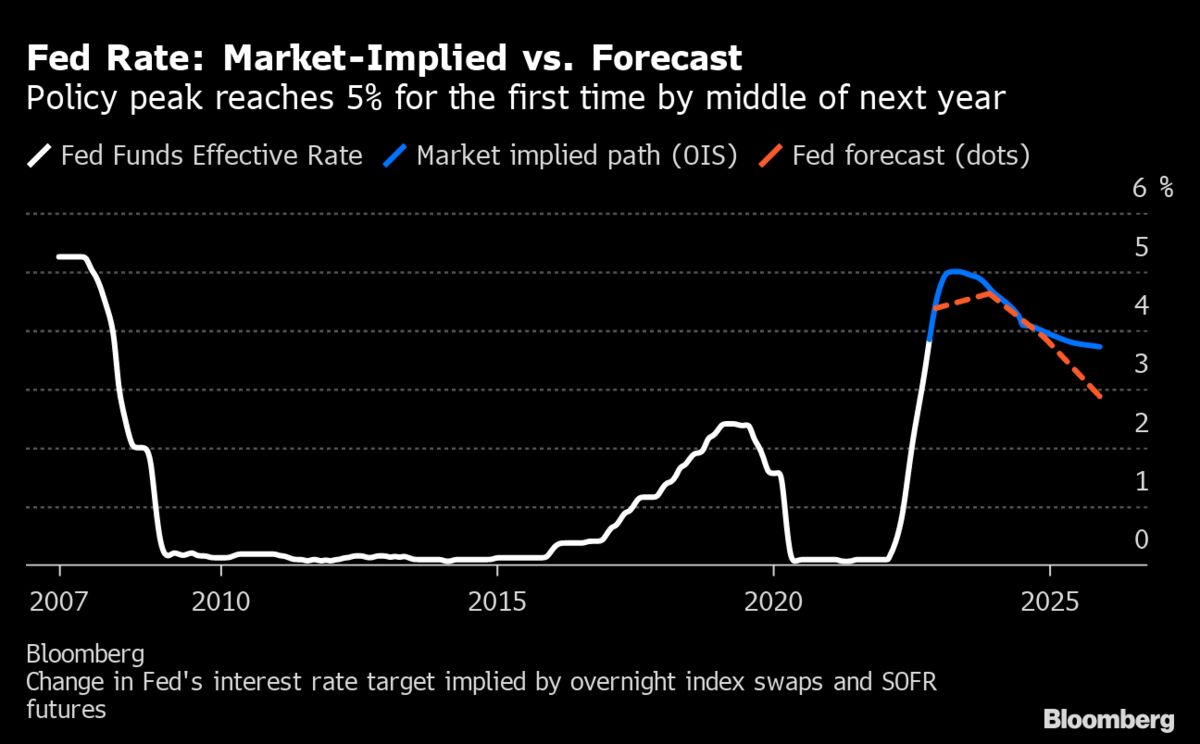

This analysis is based on the Seeking Alpha article [1] published on November 4, 2025, which reported that October 2025 brought “more treats than tricks for investors” with US equity markets reaching new all-time highs, while noting Federal Reserve Chairman Jerome Powell’s indication that a third rate cut in December was “far from certain” [1].

The Seeking Alpha article [1] paints a positive picture of October’s market performance, but current market data on November 4, 2025, reveals a contrasting reality:

- S&P 500 (SPY): Down 1.22% to $674.98, below its 52-week high of $689.70 [0]

- NASDAQ (QQQ): Down 1.88% to $620.20, significantly under its 52-week high of $637.01 [0]

- Dow Jones (DIA): Down 0.68% to $470.23, below its 52-week high of $480.39 [0]

Despite current weakness, the 30-day performance shows October’s strength:

- S&P 500: +1.54% (6669.79 → 6772.26) [0]

- NASDAQ: +3.29% (22656.02 → 23400.37) [0]

- Dow Jones: +1.44% (46368.94 → 47038.89) [0]

The article’s emphasis on Fed uncertainty aligns with broader market concerns. Reuters reporting confirms that Powell indicated a December rate cut “isn’t a foregone conclusion” following the October 29 FOMC meeting [2]. Market expectations have reduced December rate cut probabilities to roughly 2-to-1 odds [2].

The Seeking Alpha article mentions limited economic data “amid the government shutdown” [1], which Reuters confirms may put another rate cut out of reach this year due to lack of federal government data [2].

Current sector performance indicates defensive positioning:

- Gaining Sectors: Energy (+0.44%), Healthcare (+0.26%), Basic Materials (+0.16%) [0]

- Declining Sectors: Real Estate (-0.68%), Utilities (-0.58%), Industrials (-0.53%) [0]

This rotation suggests investors are repositioning for potentially more hawkish Fed policy, with growth and technology stocks (QQQ down 1.88%) underperforming defensive sectors [0].

The Russell 2000 shows notable weakness with -0.96% performance over 30 days compared to the S&P 500’s +1.54% [0], indicating risk aversion and potential concerns about economic sensitivity among smaller companies.

Trading volumes are significantly below average across major ETFs:

- SPY: 39.39M vs 72.75M average [0]

- QQQ: 36.89M vs 54.43M average [0]

This volume contraction suggests investor hesitation and uncertainty about near-term market direction.

Current volatility remains relatively contained but shows concentration:

- S&P 500: 0.80% daily volatility [0]

- NASDAQ: 1.14% (higher due to tech concentration) [0]

- Russell 2000: 1.23% (highest among major indices) [0]

The elevated small-cap volatility reinforces the risk aversion theme.

-

Fed Policy Uncertainty: Powell’s comments about December rate cuts being “far from certain” [1] may significantly impact market volatility, particularly in rate-sensitive sectors [1][2].

-

Government Shutdown Effects: The ongoing shutdown limiting economic data creates uncertainty for policy decisions, potentially leading to unexpected market reactions [2].

-

Technical Resistance: Major indices approaching all-time highs may create technical resistance and profit-taking pressure [0].

-

December FOMC Meeting (Dec 9-10): Market expectations currently price in roughly 33% probability of a rate cut [2].

-

Government Shutdown Resolution: Restoration of economic data flow will be crucial for informed Fed decision-making [2].

-

Sector Rotation Continuation: Sustained outperformance of defensive sectors vs. growth may indicate shifting market expectations [0].

-

Small-Cap Recovery: Russell 2000 performance could serve as a leading indicator of broader market risk appetite [0].

The market landscape on November 4, 2025, reflects a complex interplay between October’s strong performance gains and emerging concerns about Federal Reserve policy uncertainty. While the Seeking Alpha article [1] celebrates October’s achievement of new all-time highs, current market action suggests investors are reassessing positions amid:

- Fed Policy Uncertainty: Powell’s indication that December rate cuts are not guaranteed [1][2]

- Data Limitations: Government shutdown restricting economic information flow [1][2]

- Defensive Positioning: Sector rotation toward defensive stocks indicating risk aversion [0]

- Volume Contraction: Below-average trading volumes suggesting investor hesitation [0]

The divergence between recent historical gains and current market weakness underscores the importance of monitoring Fed policy developments and government shutdown resolution for near-term market direction.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.