Analysis of Price Reversal Before Bullish Order Block: Community Insights & Trading Implications

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

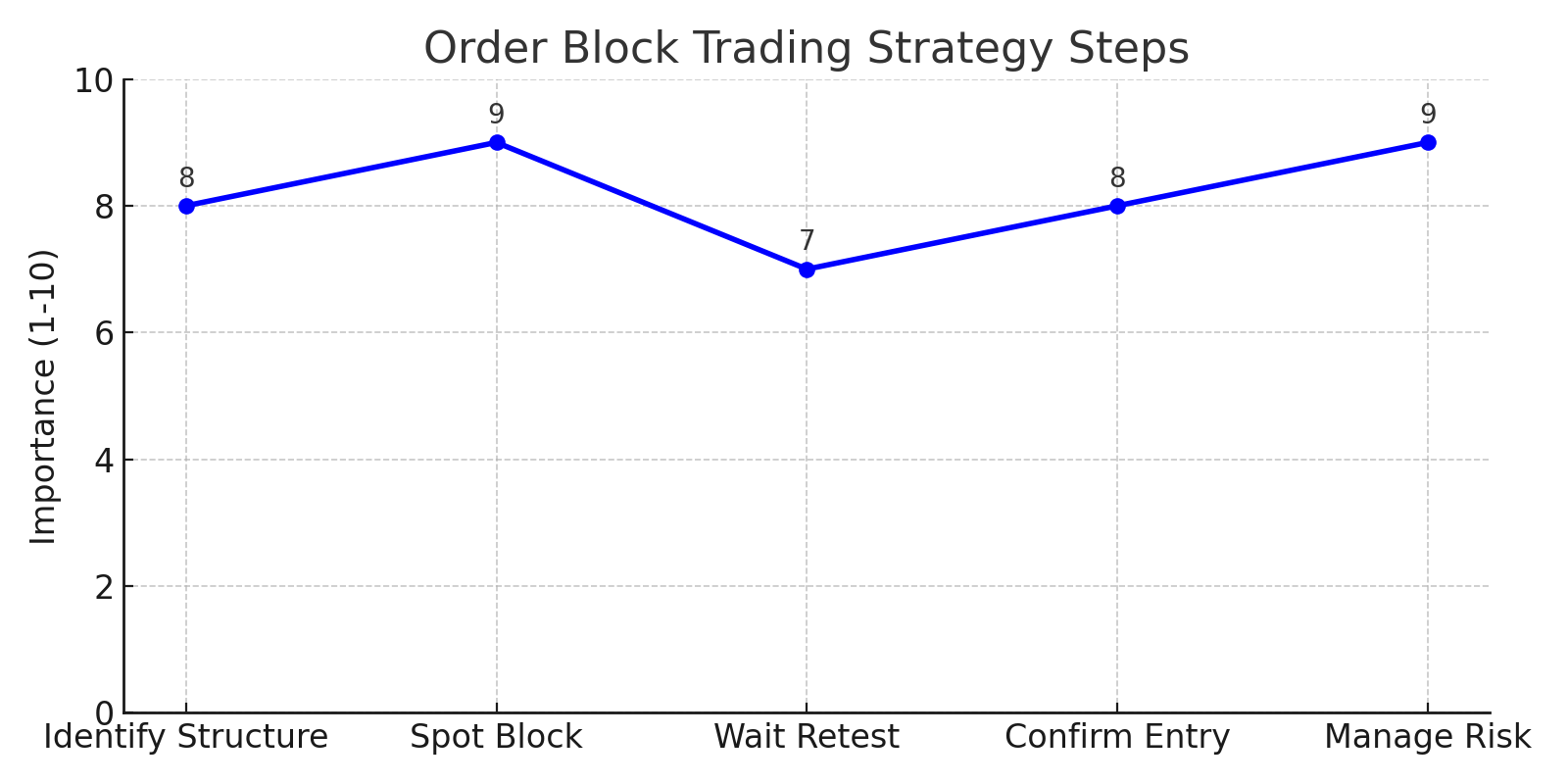

The analysis addresses a Reddit user’s query about price reversal before a marked bullish order block [1]. Community responses highlighted core themes: over-reliance on order block indicators (favoring price action instead), price reacting to stronger support levels like Point of Control (POC), and limitations of ICT concepts [1]. External research confirms these observations: valid order blocks require liquidity sweeps and alignment with market structure [2], while POC (highest volume level) acts as a stronger support/resistance zone [3][4]. Supply/demand imbalances at POC often trigger reversals before order blocks are reached [5].

- POC Priority: Volume-based support (POC) frequently overrides order blocks as a reversal trigger, given it represents the fairest price agreement between buyers and sellers [3][4].

- Order Block Validity: Invalid blocks (lacking liquidity sweeps or market structure alignment) fail to attract price action [2][7].

- Strategy Integration: Traders who combine order blocks with volume profile and price action reduce false signals [3][6].

- Community-Research Alignment: Reddit feedback on over-reliance on order blocks aligns with data-driven research on indicator limitations [1][6].

- Risks: Exclusive reliance on order blocks leads to false signals and missed reversal points [6]; subjective order block marking increases trading errors [6].

- Opportunities: Integrating volume profile (POC) into trading strategies improves entry/exit accuracy [3][4]; validating order block criteria (liquidity sweeps) enhances reliability [2].

Critical takeaways for traders:

- POC is a volume-based support/resistance level that often takes priority over order blocks [3][4].

- Valid order blocks require liquidity sweeps and alignment with market structure [2].

- Avoid over-relying on single indicators; combine order blocks with price action and volume data [6][8].

- Supply/demand imbalances at key levels drive price reversals [5].

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.